MARKET STRUCTURE DICTIONARY

BY

BRIAN W. LEITE

An Insider's Guide to the Real Language of

Trading and Exchanges

Over 2700 Entries

above par 1. A market price above $100 per share. For example, XYZ just moved above par for the first time in years ... $100 seemed to be a major resistance level. 2. Describes a security that is trading at a price that is higher than its PAR (or face) value.

above the market Describes an order or indication to sell (or buy) a stock at a price that is higher than the current market price. Possible examples include a sell limit order, a buy stop order, and a buy stop limit order. For example, XYZ, I've got 50,000 additional for sale, but I'm above the market for now.

absorb Describes the ability of the market to assimilate all incoming sell orders with offsetting buy orders without prices moving lower. For example, It seems lately that ZVZZT has been able to absorb everything that comes for sale. I'm betting the stock works higher from here.

absorbed Historically, described a new issue that had passed into the hands of the public. And when initial public reselling subsided, the stock was said to have become assimilated or digested.

absorption point The point at which the market is unable to bear additional selling pressure without prices moving lower.

ACATS An abbreviation for Automated Customer Account Transfer Service.

Access Rule A Securities and Exchange Commission policy established in Rule 610 of Regulation NMS that was designed to promote non-discriminatory access to quotations displayed by trading centers. Specifically, the Access Rule limits the fees that any trading center can charge for accessing quotes to no more that $0.003 per share for stocks priced greater than $1 per share.

accommodation trade A type of trade in which one trader obliges another trader by entering into an illegal non-competitive agreement with him.

account 1. A customer of an individual broker or of a broker/dealer. For example, Joe, how many accounts are you covering these days? 2. A record or statement of a customer's positions, transactions, and balances. For example, How many shares of XYZ did I book to the house account? See also OPEN AN ACCOUNT.

account and risk A term used to describe the position assumed by the customer in a stock transaction. Shares are purchased or sold short specifically for the customer's account. Therefore the customer will receive all of the gains associated with holding the position but must at the same time assume all of the risk associated with the position. For example, XYZ, buy 10,000 at $50 for the account and risk of Jack Smith.

account executive An individual stockbroker who is registered with FINRA to handle customer accounts. Also known at various times as a customer's man, a registered representative, or a reg rep.

account statement A record of a customer's positions, transactions, and balances.

accumulate To gradually (and hopefully quietly) purchase shares with the ultimate goal of assembling a substantial long position. For example, Between you and me, we're looking to accumulate a million shares of ZVZZT over the next month or so.

accumulation The process of gradually (and quietly) establishing a substantial long position. For example, Judging by the action, I’d say the stock has been under accumulation for a few months now. Opposite of DISTRIBUTION.

ACES An abbreviation for Advanced Computerized Execution System.

across the board Describes a uniform movement of prices across all stocks and/or sectors, as in Tech stocks were up across the board today, while the broader market was mixed.

ACT An abbreviation for Automated Confirmation Transaction service.

acting in concert Undertaking similar or identical trading operations as other traders in order to obtain a common goal. Based on prior arrangement.

action 1. The combination of price movement and volume, as in Judging by today's action, I bet the market moves higher tomorrow. 2. Interest and excitement generated by active trading. For example, There was a lot more action in the market today than there has been in the past few weeks. The day traders must be loving it. 3. An archaic term for corporate shares.

actionable Describes any market event or news item that fuels near term trading activity.

actionary An archaic term for a shareholder in a corporation. Also known as actionist.

actionist An archaic term for a shareholder in a corporation. Also known as actionary.

active box The collateral available to secure margin positions. "Box" refers to the location where physical securities are held by a broker/dealer for safekeeping.

active investor An investor who seeks out individual investment opportunities. An investor who consumes research and bases buy and sell decisions at least partially on fundamental analysis. Active investors are generally interested in a company's "story" rather than a narrow set of metrics. As opposed to a PASSIVE INVESTOR.

active market A market characterized by relatively high volume, good liquidity, and close bid/asked spreads.

active security A frequently traded security with readily available quotes.

activity The volume of a stock or of a market over a specific period of time. For example, There has been a lot less activity in ZVZZT today than there has been the past few days. We're having some trouble getting out of the name.

actual market See FIRM MARKET.

actual price A price at which a trade has actually been consummated. As opposed to a BID PRICE or an ASKED PRICE. For example, I see ZVZZT is $24.75 bid. Please tell me the actual price is closer to $25.

adding to a loser Increasing the size of a position as the price moves unfavorably. For example, If I buy more XYZ down here, I have a feeling I'll just be adding to a loser. I think I'm going to just dump it.

adjustment An ex post modification of the terms of an execution.

admitted to dealings Granted listing privileges on a particular exchange.

ADR An abbreviation of American depository receipt.

advance An upward movement in prices, as in Today, ZVZZT advanced two points on positive news.

Advanced Computerized Execution System (ACES) A computerized facility operated by NASDAQ that allows order entry firms to automatically route order flow directly to designated market making firms with whom they have a pre-established ACES relationship.

adventure An archaic term for the import or export of goods on speculation.

adventurer An archaic term for a merchant trader who made a business of importing and exporting goods on speculation. A distant cousin of the modern day stock speculator. Also called a merchant adventurer.

adverse selection losses An academic term for losses sustained by dealers who trade with INFORMED TRADERS.

adverse selection risk An academic term for the risk assumed by dealers when they trade with INFORMED TRADERS.

adverse selection spread component An academic term for the portion of a particular dealer's bid/asked spread that exists to protect the dealer against losses arising from trading with INFORMED TRADERS. Also known as the permanent spread component.

advertise volume Electronically disseminate trading volume information to buy side traders through various data system providers (such as AutEx). Done by broker/dealers specifically to signal involvement in particular stocks and more generally to promote their image and skillset to customers and protential customers. For example, ZVZZT, I'm going to go ahead and advertise volume, see if we can find a natural seller.

affirmative determination The responsibility assigned to broker/dealers who accept customer short sale orders to make certain that shares will be available to deliver for settlement.

affirmative obligation 1. The responsibility historically assigned to exchange specialists to maintain a fair and orderly market by entering the market as principal in the event that there is insufficient natural supply or demand to pair customer orders as agent. 2. The responsibility assigned to NASDAQ market makers to quote firm prices and to continuously make two sided markets.

after hours trading Trading that occurs in stocks listed on a given exchange after the official close of that exchange. After hours trading generally takes place between 4:00pm and 8:00pm ET. Such trading was limited historically to institutional investors, but the rise of ECNs allowed more individual investors to become involved. See also PRE-MARKET TRADING.

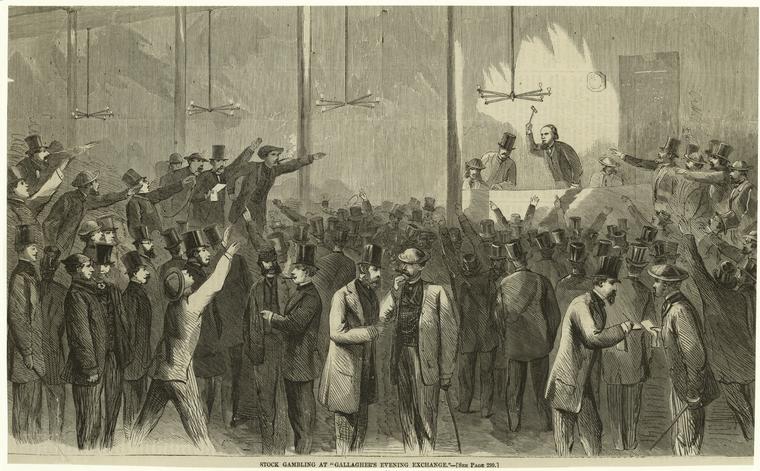

After hours trading at Gallagher's,1864

Photo Credit: New York Public Library

after market trading See AFTER HOURS TRADING.

after the bell After the close of the regular trading session. See also BELL.

aftermarket Another term for secondary market.

against the box See SELL SHORT AGAINST THE BOX.

aged fail A trade between two broker/dealers that remains unsettled thirty days after settlement date.

agency The relationship created when a principal delegates trading authority to an agent. The agent is thereby empowered to act as an intermediary on behalf of the principal.

agency cross A type of trade that can occur when single trader possesses offsetting customer buy and sell orders in a particular stock. Specifically, the trader executes the orders against each other as agent rather than trading each order separately with the Street or rather than executing each order against his trading account separately as riskless principal.

agency desk The portion of a broker/dealer's trading room dedicated to the execution of customer orders in stocks in which the firm does not act as a market maker. Often maintained as a separate entity from market making operations.

agency order An order held by a broker or a dealer that does not act as a market maker in that particular stock.

agency trade A trade in which the executing broker acts as an agent in the transaction.

agency trader A professional trader that works on an agency desk.

agent A person or a firm appointed to trade on behalf of a principal.

aggregate quotation size The sum of the sizes quoted by all market participants at a particular price level.

aggregation See DARK POOL AGGREGATOR.

aggregator See DARK POOL AGGREGATOR.

aggressive trading 1. Working an order with an emphasis on volume and immediacy rather than on market impact and price. For example, Boy that was some aggressive trading. You took the stock up a full point. 2. Making a larger than normal commitment in a particular stock. For example, I'm going to be a little more aggressive this time in ZVZZT. I think we could see a nice pop after earnings.

aggressively priced limit order A buy limit order with a relatively high price, or a sell limit order with a relatively low price. Easiest limit orders to fill or complete.

ahead See AHEAD OF ITSELF, AHEAD OF YOU, STOCK AHEAD, and TRADES AHEAD.

ahead of itself Trader's jargon meaning overbought or oversold. For example, This move in XYZ is unbelievable. The stock looks like it is really starting to get ahead of itself though.

ahead of you Trader's lingo used to indicate the status of other orders held in an exchange limit order book at the same price as your order, but entered before your order. Such orders are said to have time precedence. For example, XYZ, there are 10,000 shares ahead of you at a quarter. See also STOCK AHEAD and TRADES AHEAD.

air pocket stock A slang term for a stock whose price drops quickly, precipitously, and unexpectedly. For example, I'm out there trying to sell stock, but this thing just hit an air pocket.

ALERT A web based database developed by Omgeo LLC for the maintenance and communication of standing settlement and account instructions. Allows institutional investors and broker/dealers to share such information automatically.

alert An electronic notification of a market related event. One common alert is a notification when a stock price reaches a predetermined level.

algo An abbreviation of algorithmic trading program.

algo sniffing A strategy in which traders seek to detect an electronic trail left by a large active algorithm in order to front run the algorithm. Often employed in HIGH FREQUENCY TRADING.

algorithm A problem solving procedure that utilizes a finite list of explicit instructions to proceed from an initial state through a series of well defined successive states, and eventually to an end state.

algorithmic trading A method of trading in which computer programs generate orders automatically based on a series of parameters incorporated into advanced mathematical models. Some such programs can be used to automate the entire trading process from order creation to execution (e.g. HIGH FREQUENCY TRADING), or they can be used to divide larger orders into smaller pieces to be executed according to the rules of the specific program (e.g. TWAP, VWAP, Arrival Price, etc.). See also MACHINES, SMART ORDER ROUTER, and PROGRAM TRADING.

alive See COME ALIVE.

all buyers Trader's jargon to describe a situation in which massive demand overwhelms supply at current price levels. Usually event driven. For example, XYZ is all buyers right now. Might as well not chase it.

all clear See CLEAR A POSITION.

all in To commit all available resources to a specific trading situation. For example, I just went all in on ZVZZT. This had better work, or my next job on the Street might be sweeping it.

all or any part order An order that gives the trader discretion to execute whatever portion of the order he deems appropriate given market conditions. For example, ZVZZT, buy all or any part of 25,000 with a $25 top. See also ANY PART OF.

all or none order (AON order) An order that must be executed all at once in its entirety or not at all. If there is insufficient liquidity to execute the order during the trading day, it will be cancelled at the close of the market. For example, XYZ, sell 10,000 at $51, all or none. See also FILL OR KILL ORDER.

all over a stock To trade very aggressively. For example, Monty has been all over that stock since the opening. They must be working a size seller.

all over the place Describes a stock that is exhibiting relatively large, yet seemingly random, price swings. For example, Sorry about the execution, but this XYZ has been all over the place this morning.

all sellers Trader's jargon to describe a situation in which massive supply overwhelms demand at current price levels. Usually event driven. For example, XYZ is all sellers right now. Might as well let the dust settle.

allied member Historically, an individual who was not a member of the New York Stock Exchange but was a general partner, officer, or voting shareholder of a member firm. Such individuals could be granted access to the trading floor and allowed to conduct trading operations.

alpha A measure of actual versus expected portfolio returns given the risk level of the portfolio (as measured by BETA). Portfolio managers and buy side traders routinely claim to generate alpha.

alternative order An order that instructs the trader to execute one of two possible trades, but not both. The execution of either one of the trades automatically cancels the other. Also known as a one cancels the other order or an either/or order.

alternative trading system (ATS) A general term for any non-exchange electronic trading venue that has been approved by the Securities and Exchange Commission. Examples include ELECTRONIC COMMUNICATIONS NETWORKS (ECNS), CROSSING NETWORKS, and DARK POOLS. See also FOURTH MARKET.

American depository receipt (ADR) A certificate issued by a U.S. bank that represents a specific number of shares of a foreign stock. ADRs are dollar denominated and tradable on U.S. exchanges. See also FOREIGN ORDINARY SHARES.

American Mining and Stock Exchange An exchange founded in New York City in 1876 as the American Mining Stock Board. Merged with the New York Mining Stock Exchange in 1877.

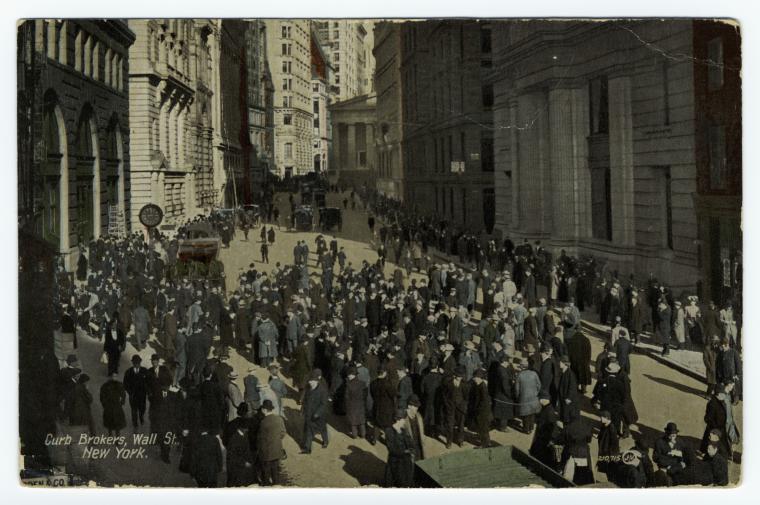

American Stock Exchange (Amex) Currently known as NYSE MKT. A stock exchange located in New York. It was officially organized into an indoor exchange called the New York Curb Market in 1921. However, CURBSTONE BROKERS had organized as an informal exchange in the streets of lower Manhattan since at least the early 1800s. When the curbstone brokers finally moved indoors, they retained the use of hand signals and designed the specialist posts to resemble outdoor lampposts. In 1953, the exchange changed its name to the American Stock Exchange. While the Amex never rivaled the New York Stock Exchange in terms of volume, quality of listings, or prestige, it was known for innovation. After an unsuccessful merger with NASDAQ in 1998, the Amex was acquired by the New York Stock Exchange in 2008 and renamed NYSE Amex (and subsequently NYSE MKT). All trading activity subsequently moved to NYSE facilities, and the American Stock Exchange trading floor was closed.

Curb brokers, Wall St. New York circa 1908

Photo Credit: From the Collections of the Museum of the City of New York

Amex An abbreviation for American Stock Exchange.

analyst, market structure An analyst that focuses on the manner in which exchange mechanisms (both formal and informal), trading rules, transaction costs, and market risks affect the price formation process.

analyst, trading desk An analyst at a broker/dealer that reports directly to the sales and trading department instead of the research department. Such an analyst does not officially publish research.

ankle biter A slang term for a corporation with a market value of less than $500 million. For example, If the stock continues to get hammered, ZVZZT may end up an ankle biter.

announcement effect The impact that a press release or a report has on the financial markets. The term is most often used to describe traders' reaction to official changes in monetary policy. First movers may be headline-reading algos.

annunciators Large boards installed at the New York Stock Exchange in 1881. Used a numbering system that allowed floor clerks to request the presence of roaming floor brokers from their booth.

anonymity What many large investors and traders seek, but few attain. Market participants are often able to ascertain the nature of natural order flow, to its detriment.

anonymous trading Trading that does not reveal the actual identity of the parties involved in a trade to other market participants.

anticipated holding period The period of time a trader expects to maintain his position in a stock.

any part of A trading term meaning "I am willing to trade an amount of stock less than my stated bid (offer) size." For example, ZVZZT, I can pay $25 for any part of 50,000. See also ALL OR ANY PART ORDER.

any part of order See ALL OR ANY PART ORDER.

AON order An abbreviation for all or none order.

AP An abbreviation of authorized participant.

appetite A desire to own stocks. For example, ZVZZT, I'm catching a seller. Do you have an appetite at these levels?

applied mathematics The application of the theory and practice of mathematics to fields outside of the traditional realm of pure mathematics. ALGORITHMIC TRADING makes extensive use of applied mathematics.

appointment See TRADES BY APPOINTMENT.

arbitrage 1) The simultaneous purchase and sale of identical (or very similar) securities in different markets at different prices. Pure arbitrage produces a riskless profit. 2) The simultaneous purchase and sale of correlated securities that have diverged from their normal relations. When prices return to their normal relations, they have converged and the arbitrageur has profited. See also PAIRS TRADING, LATENCY ARBITRAGE, and STATISTICAL ARBITRAGE.

arbitrage trading program (ATP) A computer program designed to generate and execute orders in a large basket of stocks while simultaneously taking the opposite position in the stock index futures market. Theoretically takes advantage of a difference in market values between two essentially identical portfolios. See also PROGRAM TRADING.

arbitrageur An INFORMED TRADER who seeks to profit by identifying assets that are mispriced relative to each other.

arbitragist Another term for arbitrageur.

arbs An abbreviation for arbitrageurs.

Arca See Archipelago (Arca).

Archipelago (Arca) Currently known as NYSE Arca. An electronic securities exchange owned and operated by the New York Stock Exchange. It was originally developed in 1996 as an electronic communications network and acquired in 2006 by the New York Stock Exchange. Many EXCHANGE TRADED FUNDS (ETFs) are listed on NYSE Arca.

Arizona Stock Exchange A single price electronic call market that anonymously matched institutional buy and sell orders. Originally founded in 1990 as Wunsch Auction Systems, the exchange changed its name to the Arizona Stock Exchange in 1992 and ultimately closed in 2001.

arms race Describes the continuous and massive investment in technology required to remain competitive trading in modern high speed electronic markets.

around us Another term for away from us. For example, This ZVZZT is completely trading around us. I'm going to have to get creative on this one.

arrival price The midpoint of the bid/asked spread at the time of order entry. Often used as a trading benchmark.

arrival price strategy An algorithmic trading strategy that attempts to balance market impact, volatility, volume, spread, time, and return. The strategy uses the arrival price as the benchmark. Such programs generally attempt to trade a large portion of the order relatively quickly around the arrival price to reduce exposure, and then work the balance more slowly to reduce cost.

ask A market quote that stipulates the lowest price that sellers are willing to accept for a stock (the asked price), as well as the total amount of stock that is offered at that price (the ask size). The ask is quoted as "quantity at price," as in 100,000 @ $25.20. See also OFFER.

ask size The total amount of stock that is offered for sale at the asked price. See also ASK.

asked price The lowest firm price that sellers are willing to accept for a round lot of stock. Also called the asking price or the offer price. See also ASK.

asking See ASKING PRICE, JUST ME ASKING and WHO'S ASKING.

asking price The lowest firm price that sellers are willing to accept for a round lot of stock. Also called the asked price or the offer price. See also ASK.

aspirin count theory The theory that aspirin sales are inversely related to stock prices.

asset allocation An investment or trading strategy whereby funds are divided and shifted between various classes of assets rather than into individual securities. Typical vehicles employed by asset allocators navigating the equity markets include index funds, exchange traded funds (ETFs), and various futures, options, and swaps on indexes.

assets under management (AUM) The total value of the assets managed by a particular institutional investor.

assimilation The absorption of the shares of a new issue by the public.

assistant trader A junior trader who trades under the direct supervision of a more senior trader. In a team trading environment at a broker/dealer, assistant traders are often responsible for the execution of routine order flow, while senior traders focus more on block trading, proprietary trading, and inventory management. See also TRADER, JUNIOR TRADER, SENIOR TRADER, and HEAD TRADER.

associate member An individual or firm that possesses certain rights of exchange membership but does not actually own a seat.

asymmetrically informed traders An academic term to describe a situation in which some traders are better informed than other traders. Leads to ADVERSE SELECTION RISK and potentially wider bid/asked spreads.

at (@) Refers to the offer price in a quote, as in ZVZZT is $25.10 bid, offered at $25.20 or more simply $25.10 @ $0.20 or $25.10-$0.20. Offers are quoted as "quantity at price," as in 100,000 @ $25.20 while bids are quoted as "price for quantity." Historically, the symbol “@” separated bid and asked prices on ticker tape machines (XYZ 50@1-8). See also FOR, B, and BY.

at a discount At less than face value or below par. See also PAR.

at a loss At less than cost, as in I did sell my XYZ position at a loss, but it certainly could have been much worse.

at a premium Above face value or above par. See also PAR.

at par 1. At $100. For example, XYZ if finally trading at par. Hopefully it can move back up to the $110 level now. 2. At face value. See also PAR.

at the bell Trader's lingo meaning "at the open" or "at the close" of the regular trading session of an exchange. For example, It looks like 750,000 XYZ traded on the floor right at the bell. Let me find out what's going on. See also BELL.

at the close order An order to buy or sell a specific quantity of stock at the official exchange closing price given a set of parameters. For example, ZVZZT, buy 25,000 at the close, use a $24.90 top. Also known as an on the close order. See also MARKET ON CLOSE ORDER and LIMIT ON CLOSE ORDER.

at the figure Industry term meaning "at the nearest whole dollar." For example, If it ever gets there, I'd sell 25,000 ZVZZT at the figure. Also known as at the full. See also BIG FIGURE.

at the full Industry term meaning "at the nearest whole dollar." For example, XYZ, how much do you have for sale up at the full right now? Also known as at the figure. See also BIG FIGURE.

at the market Trader's lingo for market order, as in Day around buy 50,000 XYZ at the market cans a quarter.

at the opening order An order to buy or sell a specific quantity of stock at the official exchange opening price given a set of parameters. For example, XYZ, sell 10,000 at the opening. Also known as an on the opening order. See also MARKET ON OPEN ORDER and LIMIT ON OPEN ORDER.

at the quote limit order A buy order with a limit price that is equal to the best bid, or a sell order with a limit price that is equal to the best ask at the time of entry.

at ... or better A term used to stipulate that the limit price on a buy order is higher than the current market price, or the limit price on a sell order is lower than the current market price. Usually implies a desire to trade fairly aggressively to the limit, but also an expectation of the receipt of more favorable partial executions than the limit price in the process. For example, It looks like ZVZZT is offered at $25.30 right now. I'd buy 25,000 at $25.40 or better. See also TOP and LOW.

ATP An abbreviation of arbitrage trading program.

ATS An abbreviation of alternative trading system.

auction market A market in which buyers and sellers freely interact to discover the best available prices given a set of formalized rules. Such markets are generally order driven (as opposed to quote driven) and often employ auctioneers known as specialists (or designated market makers). The most prominent example of an auction market would be the New York Stock Exchange. In contrast to a DEALER MARKET. See also DOUBLE AUCTION MARKET.

auctioneers, the In the early years of securities trading in New York, the nascent market was controlled by a small group of brokers who conducted private auctions. After the financial collapse of 1792, these auctions came under increasing criticism. The Buttonwood Agreement was in part drafted to create an alternative to the discredited auctions.

AUM An abbreviation of assets under management.

Aunt Millie A slang term for an unsophisticated trader. For example, Aunt Millie over here just ripped the stock twenty cents to buy 700 shares. Nice work.

AutEx A leading electronic platform owned by Thomson Reuters that allows dealers to signal buy side traders of their interest in and ability to conduct block trades in individual stocks. The primary tools offered are INDICATION OF INTEREST (IOI), SUPER MESSAGE (SUPER), and ADVERTISE VOLUME.

authorized participants Large financial institutions chosen by an ETF SPONSOR to create and redeem ETF units.

authorized shares The maximum number of shares that may be issued by a particular corporation.

Automated Confirmation Transaction service (ACT) A computerized platform that electronically facilitates the post execution steps of price and volume reporting, comparison, and clearing for trades reported to the FINRA/NASDAQ TRADE REPORTING FACILITY (TRF) or the Over-the-Counter TRADE REPORTING FACILITY (TRF).

Automated Customer Account Transfer Service (ACATS) A system developed by the National Securities Clearing Corporation (NSCC) to facilitate the transfer of customer accounts from one broker/dealer to another.

automated market making A form of HIGH FREQUENCY TRADING in which computers are programmed to generate orders that post short term quotes to the market. The goal is to generate liquidity rebates (see REBATE TRADING) as well as capture a portion of the bid/asked spread, if possible. Relies on ultralow latency to conduct high speed, high turnover computerized trading operations. Also known as electronic market making.

automated order entry system A general term for any exchange sponsored computerized order routing and execution system.

automated quotation A quote that is available for immediate and automatic execution in an AUTOMATED TRADING CENTER. May not normally be traded through pursuant to Reg NMS. See also FAST QUOTE and SLOW QUOTE.

Automated Quotation System See NASDAQ.

automated trading A method of trading in which orders are generated by computer programs and automatically routed to the appropriate trading venue for execution. See ALGORITHMIC TRADING, PROGRAM TRADING, and HIGH FREQUENCY TRADING.

automated trading center A general term for any trading venue that has implemented systems capable of providing AUTOMATED QUOTATIONS as well as generating automatic quote updates.

automatic execution system A general term for any computer based trading platform that allows traders to automatically execute trades directly against posted orders and quotes. In contrast to an ORDER ROUTING SYSTEM.

autotrading An abbreviation of automated trading.

average daily float The average daily number of shares outstanding and tradable over a particular time period.

average daily volume The average number of shares traded per day over a particular time period.

average down To purchase additional shares as the price of a stock decreases, utilizing a fixed amount of capital, in order to reduce the average cost of the entire position. For example, I've bought half of my position already, now I'm going to try to average down some.

average up 1. To purchase additional shares as the price of a stock increases, utilizing a fixed amount of capital, in order keep the average cost of the entire position below the current market price. For example, We got some good prices earlier, but I need to stay involved. So let's keep picking away ZVZZT, I can average up a bit. 2. To sell shares at increasingly higher prices in order to improve the overall average price of an execution. For example, XYZ, I'd lose 25,000 in line, and then let’s try to average up some on the balance.

away See AWAY (FROM ME), AWAY FROM THE MARKET, AWAY FROM US, AWAY FROM YOU, BID AWAY, OFFERED AWAY, and TRADING AWAY (FROM US).

away (from me) Describes a quote, market, or trade that does not originate from the dealer making the statement. For example, It looks like ZVZZT is offered at $25.20 away from me. I'm $0.30 best right now.

away from the market Describes a limit order that is not IN LINE with current market prices. Also known as behind the market.

away from us Describes trading that occurs in venues (such as certain dark pools) that are not available to an execution trader holding a marketable customer order. The statement is often made when the customer order is not being executed in a timely manner because a relatively large percentage of the overall volume in the stock is trading in such unavailable venues. For example, Sorry about the ZVVZT execution, or lack thereof, but it looks like stock is trading away from us in size in Liquidnet.

away from you See OUTSIDE OF YOU.

ax, the Trader's slang for he most active and informed dealer in a given stock. For example, ZVZZT, another million trades at Morgan. That guy is really the ax in this name.

Copyright 2016 by Brian W. Leite. All rights reserved. Reproduction of all or part of this dictionary without explicit permission is prohibited..