MARKET STRUCTURE DICTIONARY

BY

BRIAN W. LEITE

An Insider's Guide to the Real Language of

Trading and Exchanges

Over 2700 Entries

cabinet stock An exchange listed stock with a low average daily volume.

CAES An abbreviation of Computer Assisted Execution System.

cage The department of a broker/dealer that handles physical securities.

call 1. An expressed opinion, as in What's your call in XYZ today? 2. Communication with customers. For example, ZVZZT, we've got a nice two way situation developing here. Make your calls. See also GOOD CALL, GOOD CALLS ONLY, and TAKES A CALL.

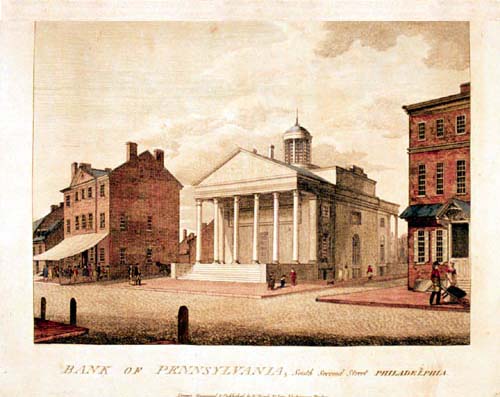

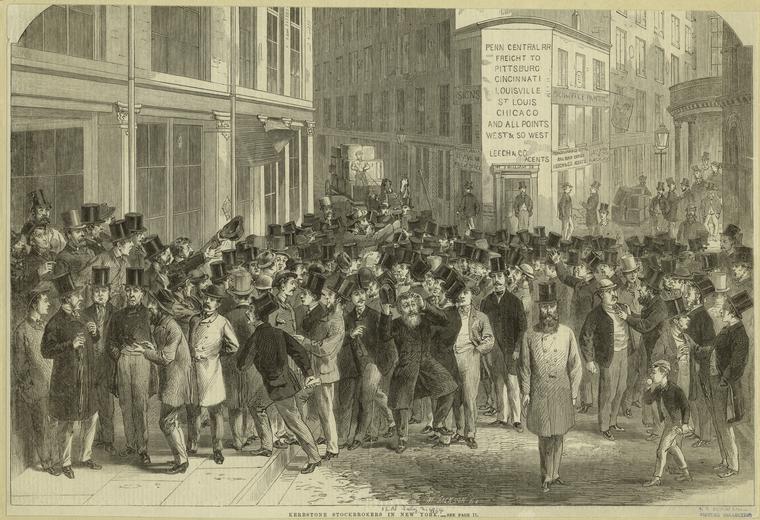

call market A market where traders trade at a specified time. All stocks may be called simultaneously, or each stock may be called individually in rotation. As opposed to CONTINUOUS MARKET. The New York Stock Exchange originally operated as a call market but switched primarily to continuous trading following its merger with the Open Board of Stock Brokers in 1870. The NYSE call market was phased out completely by 1882.

New York Stock Exchange call market in session,1857

Photo Credit: New York Public Library

call option A derivative financial instrument that represents the right, but not the obligation, to buy an underlying asset at a fixed price for a set period of time.

campaign A systematic and sustained effort by a group of market operators to either move stock prices higher (see BULL CAMPAIGN) or lower (see BEAR CAMPAIGN).

can the order An abbreviation for cancel order. For example, ZVZZT, it looks like we missed the $25 kind. Just can the order for now.

canal mania Following the War of 1812, canal building and operation became glamour industries. As capital poured into canal companies, interest in canal stock trading increased dramatically. As canal mania increased, New York overtook Philadelphia as the financial capital of the United States. The canal boom lasted until the late 1820s, when railroads captured the speculative imagination.

cancel former order (CFO) A verbal instruction to cancel and replace an unfilled order with a new order that contains some alteration to the original order (normally a change in price). For example, XYZ, buy 25,000 at $50.25 CFO $50.

cancel indication To void an electronic INDICATION OF INTEREST or SUPER MESSAGE. For example, ZVZZT, cancel our last super at $25, there's no way I make that sale now. See also EXPUNGE.

cancel order An order to void or countermand a previous unfilled order. See also CANCEL FORMER ORDER (CFO), CANCEL/REPLACE ORDER, CANCEL TO REDUCE ORDER, and STRAIGHT CANCEL ORDER.

cancel to reduce order An electronic instruction to reduce the quantity of an existing order. Since this does not modify any other parameters, the order will not lose standing in the limit order book.

cancel/replace order The electronic version of CANCEL FORMER ORDER.

cancellation A notice sent to a customer from a broker/dealer that voids an erroneously generated trade confirmation.

cans An abbreviation for cancel former order, as in ZVZZT, buy 50,000 at $25.25, cans $25.

can't compete Dealer's expression meaning "unable to match another trader's quote." For example, ZVZZT, you're seeing 100,000 at $25 away? Sorry, I can't compete there. I'm at $25.10.

CAP-DI order An abbreviation for convert and parity - destabilize and immediate order.

CAP order An abbreviation for convert and parity order.

capital commitment/facilitation The placement of financial resources at risk by a dealer in order to facilitate the execution of a customer order. See also use the balance sheet.

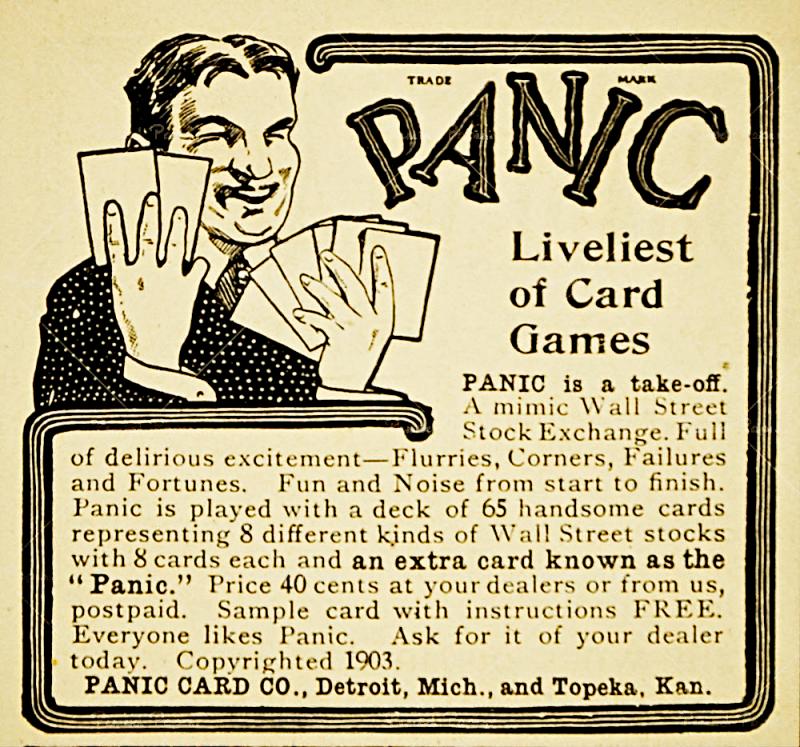

capitulation Panic selling induced by traders basically giving up on stocks. For example, Do you think yesterday's action was really a capitulation? I'm not sure the sellers were aggressive enough.

capping an order Forwarding all or any part of a customer order to a specialist as a convert and parity order.

care See IF YOU CARE.

carry The cost of financing a particular position.

carry stocks Own stocks in anticipation of higher prices, as in I'm going to carry stocks at least through the end of the year.

carry up stock Aggressively bid for stock at successively higher prices. For example, I'll bet that after Morgan cleans up that ZVZZT seller in the machines, he starts to carry up the stock. Opposite of TAKE STOCK DOWN.

carte blanche order A slang term for an order that conveys unlimited authority to the execution trader. See also NOT HELD ORDER.

cash account A brokerage account used to settle trades in cash rather than with credit.

cash equity trading desk The trading department of a broker/dealer responsible for executing customer equity order flow and maintaining equity inventories. The broker/dealer may act as agent or as dealer in such transactions.

cash sale/trade A trade that settles on the same day as the trade date.

cashier The department of a broker/dealer that arranges the delivery and settlement of securities trades.

catch Trader's lingo meaning "receive an order." For example, XYZ, I catch 50,000 for sale, I would lose them all at a half.

catching a bid Increasing rapidly in price. For example, The market is really catching a bid. It looks like we're headed higher into the close.

cats and dogs A slang term for highly speculative stocks with short or questionable histories. For example, This is one heck of a bull market. Everything is going up, even the cats and dogs.

caveat emptor Latin for "Let the buyer beware."

caveat subscriptor Latin for "Let the seller beware."

caveat venditor Latin for "Let the seller beware."

CBOE Stock Exchange An electronic stock exchange operated by the Chicago Board Options Exchange. Established in 2007.

CCG An abbreviation of Common Customer Gateway.

Cede & Company The nominee name for the Depository Trust Corporation (DTC). Legend holds that Cede was the name of a clerk at DTC. According to this legend, when DTC first began to hold securities in street name, its filing system required a name for the shareholder of record. Not knowing what name to use, Cede used his own name. In actuality, Cede is an abbreviation of Central Depository.

central limit order book (CLOB) A centralized database proposed by the Securities and Exchange Commission that would aggregate all limit orders regardless of venue of origination.

Central Registration Depository (CRD) A licensing and registration database maintained by FINRA that contains the records of registered broker/dealers and registered representatives.

CFO An abbreviation for cancel former order, as in Day around sell 35,000 XYZ at $50.25 CFO $50.30.

change 1. The difference between the current price and the previous day's closing price. An abbreviation of price change. 2. As 'change, an abbreviation of exchange.

'Change Alley A maze of small streets in London where merchant traders congregated to trade stocks and commodities. Primary years of operation as an unofficial stock exchange were 1698-1773.

The South Sea Bubble, a Scene in 'Change Alley in 1720 by Edward Ward

chasing eighths and quarters Historically, a trader's slang term used to describe the occupation of a scalper.

chasing the market Describes the efforts of a trader attempting to use limit orders (but subsequently breaking price) in a rapidly moving market. Often leads to an unfavorable execution. For example, My guy chased the market all day yesterday in ZVZZT and ended up getting plugged at the top.

cheap stock A stock that is trading below its expected price given the company's fundamentals, as in With Monty out hammering ZVZZT, I might end up being able to buy some cheap stock by the end of the day.

check the holders A request from a market maker or execution trader to the firm's sales traders to identify (and contact) the current owners of a particular stock. Usually follows a notification of trading interest. For example, ZVZZT, I'm a natural buyer of 250,000 in line. Check the holders.

checking 1. Approaching a particular dealer to ascertain his trading interest. For example, I'm getting checked in ZVZZT by a large Boston account as we speak. 2. Searching among various market makers to find the best bid and/or offer. For certain OTC equities, an agency trader might need to call several market makers asking, "How's ZVZZT?" or "What's ZVZZT?"

Chicago Stock Exchange A regional stock exchange located in Chicago, Illinois. It was founded in 1882, and merged with the St. Louis, Cleveland, and Minneapolis/St. Paul stock exchanges in 1949 to form the Midwest Stock Exchange. The Midwest Stock Exchange was renamed the Chicago Stock Exchange in 1993. Today, the exchange operates as an automated trading platform primarily trading NYSE and NASDAQ stocks.

Chicago Stock Exchange,1894

Photo Credit: Cornell University Library

Chinese market Historically, a slang term for a quote published by a NASDAQ market maker which was priced in an odd eighth (1/8, 3/8, 5/8, 7/8).

chip away Trader's lingo meaning work a not held order slowly but steadily. For example, XYZ, just chip away up here, but if it starts to come in, you can be more aggressive.

choice market See LOCKED MARKET.

choppy market A market characterized by relatively large price swings but limited net price movement. For example, If the market gets any more choppy, our plain vanilla guys are going to end up on the sidelines.

chunky Describes a stock witnessing an unusual level of block trading activity. For example, Today might be a good day to relieve yourself of that XYZ "investment." It's trading pretty chunky.

churn 'em and burn 'em A slang term for churning.

churning Excessive trading by a broker in a customer's account for the sole purpose of generating commissions.

Cincinnati Stock Exchange See National Stock Exchange, Chicago.

circuit breakers Industry lingo for the trading restrictions implemented by various exchanges in the event of a serious market break. Includes trading halts and program trading restrictions.

circular trading See WASH SALE.

City Tavern An opulent tavern established in Philadelphia, Pennsylvania in 1773. After the Revolutionary War, the Tavern replaced the London Coffee House as the premier meeting place for Philadelphia's merchant traders. Changed its name to the Merchants' Coffee House and Place of Exchange in 1789 to better reflect that fact. Became the first residence of the Philadelphia Board of Brokers (the precursor to the Philadelphia Stock Exchange) after that organizations' founding in 1790. Demolished in 1854.

City Tavern (with the awning)

Engraving by William Birch, 1800

City, the London's financial district. England's version of the term Wall Street.

class See SHARE CLASS.

clean Describes a block trade in which the natural buy orders/interest and the natural sell orders/interest pair off exactly. The dealer therefore does not need to position any stock in inventory to complete the trade, nor does he have any stock available if further buy or sell interest should arise. For example, We just trade 100,000 XYZ at $25, come out clean. See also BETTER BUYER and BETTER SELLER.

clean up 1. A trade that leaves the seller with a zero net position. Often represents the last piece of a larger block. For example, XYZ, I'd buy 50,000 shares from your seller on a clean up. 2. To leave a seller with no remaining position, as in ZVZZT, I've got 100,000 left for sale at $25, cleans up the seller. 3. To purchase all of the remaining supply of stock available at the current price level. For example, ZVZZT, it looks like we cleaned up a seller at the $25.25 level. The stock is starting to move higher. 4. To realize a substantial profit, as in I really cleaned up on that XYZ trade. 5. See CLEAN UP THE BOOK.

clean up the book Historically, described a situation in which a trader wished to print a block trade on the floor of an exchange outside of the current quote, but was therefore required to incorporate all standing orders priced better than the block trade price into the block trade itself.

clean your skirts Trader's slang for the unwritten obligation of a dealer who is in the midst of arranging a (block) trade to contact any customer to whom he might have a prior obligation with regards to that particular stock. For example, We're about to go up on 750,000 ZVZZT at a quarter. Last chance ... has everybody in the room cleaned their skirts?

clear See CLEARING.

clear a position To eliminate a position by buying or selling enough stock to bring the position to zero. For example, Just clear that small ZVZZT position. I don't want to see it sitting on my pad anymore.

clearance See CLEARING.

clearing The confirmation and settlement of a trade between two broker/dealers. See also SETTLEMENT.

clearing broker An exchange member that acts as an intermediary between customers and clearing firms.

clearing corporation/firm An organization that handles confirmation, delivery, and settlement of trades between broker/dealers. See also DEPOSITORY TRUST AND CLEARING CORPORATION.

clearing fee A fee charged by clearing firms to clear trades.

clearly erroneous trade A trade that is both made in error and executed at a price that is inconsistent with current and recent historical trading patterns. Such trades are eligible to be busted or adjusted by the exchange on which they took place.

clerk See FLOOR CLERK and SPECIALIST'S CLERK.

Cleveland Stock Exchange A regional stock exchange founded in 1900 in Cleveland, Ohio. Merged with the Chicago Stock Exchange, the St. Louis Stock Exchange, and the Minneapolis/St. Paul Exchange in 1949 to form the Midwest Stock Exchange.

climax The point at which a trend becomes exhausted, often leading to a reversal. See also BUYING CLIMAX and SELLING CLIMAX.

clique An informal combination of market operators formed for the purposes of stock manipulation.

CLOB An abbreviation of central limit order book.

close 1. An abbreviation for closing price, as in What was yesterday's close in ZVZZT? 2. The end of the regular trading session, as in ZVZZT, sell 25,000, just spread it to the close. 3. See CLOSE MARKET.

close a position To eliminate a position. To bring a particular commitment to zero. For example, Once I close this XYZ position, I doubt I'll even look at the stock again for the rest of the year.

close market A market with a relatively narrow bid/asked spread. Usually characterized by high volume and a large number of participants. Opposite of WIDE MARKET.

closed book market A market that does not display limit orders.

closed out Describes a position that has been involuntarily liquidated by a broker/dealer due to the failure of a customer to meet a margin call.

closed trade A completed trade. Implies that the position in a stock has been brought to zero.

closet indexer An active investor who seeks to essentially replicate the returns of a particular index without replicating the index exactly.

closing auction The price discovery method employed by designated market makers on the New York Stock Exchange to determine the official closing price for each stock. The final print is usually a BATCHED TRADE.

closing bell Traditionally on a stock exchange, a bell is rung to signal the end of the regular trading session.

closing cross 1. The final trade of the regular trading session for each NASDAQ stock. Establishes the official closing price. Usually a BATCHED TRADE. 2. The BATCHED TRADE for a particular stock that occurs in any crossing network at the official primary exchange closing price. For example, Why don't you try to sell 10,000 ZVZZT in the closing cross, see if we have any luck.

closing look A look from a specialist or a market maker that provides details regarding the supply and demand situation developing for the closing auction/cross in a particular stock. For example, XYZ, get me a good closing look please. I may have something to do.

closing price The price of the final trade of a particular stock during the regular trading session on an exchange. For example, Yesterday the closing price in ZVZZT was $25, down $0.50 on the day.

closing quote The final bid and asked prices of a particular stock at the end of the regular trading session on an exchange. For example, Yesterday, the closing quote in ZVZZT was $24.90-$25.10.

clustering The tendency of traders to enter orders at round number price levels. For example, more orders are entered in whole dollar amounts than in fractions, and more orders are entered at numbers such as $25 or $50 than at numbers such as $26 or $49.

CNBC The Consumer News and Business Channel is a television channel established in 1989. It is owned by NBC Universal and concentrates on financial and business news. Many trading rooms have at least one television set turned to CNBC.

CNS An abbreviation for continuous net settlement.

Coal Hole Slang term for the hot and poorly lit room located at 23 William Street in Manhattan where some members of the New York Stock and Exchange Board and gold traders from the curbstone market established a short lived exchange in 1862. This was during the Civil War, and gold trading had been banned by the Big Board early in 1862.

color Industry jargon for trading information and commentary. For example, It looks like you've been active in XYZ today. Could I get a little color?

Colorado Springs Mining Exchange A regional stock exchange founded in 1894 in Colorado Springs, Colorado. Closed in 1966.

combination order See ALTERNATIVE ORDER.

come, to Trader's jargon meaning "remaining to be bought." For instance, XYZ, you've bought 15,000 so far at $25, 10,000 to come.

come alive Trader's jargon meaning "have trading interest". For example, XYZ, I come alive at the $50 level.

come out 1. Dealer's jargon used to indicate a position or additional trading interest following the execution of a block trade, as in ZVZZT, we trade 100,000 at $25, come out a better buyer. 2. Industry slang for the opening of the regular trading session, as in It looks like we're going to be particularly strong on the come out this morning.

comes at Trading jargon used to indicate the price in a firm dealer offering, as in XYZ, if you care, 100,000 comes at $25. See also AT.

coming in/off Industry lingo meaning "declining in price". For example, This stock is really coming off hard. Look out below.

commission A fee charged by a broker to execute a trade as agent. Usually based on the number of shares and/or the total dollar amount of the trade. See also COMMISSION EQUIVALENT.

commission broker See COMMISSION HOUSE BROKER.

commission equivalent A fee charged by a dealer to execute a trade as principal. May not be charged in addition to a markup or markdown. Usually based on the number of shares and/or the total dollar amount of the trade. See also COMMISSION.

commission house A firm that executes trades exclusively as agent.

commission house broker A FLOOR BROKER who is an employee of an exchange member firm and who executes trades for that particular firm and its customers exclusively. Also known as a house broker. See also TWO DOLLAR BROKER.

commission recapture agreement An arrangement between an institutional investor and an execution broker/dealer to return a portion of total commissions paid.

commission sharing agreement (CSA) An arrangement between an institutional investor and an execution broker/dealer to pass along a stipulated portion of the commissions generated to various third parties. Consolidates trading counterparties for the institutional investor, yet still allows them to direct commission dollars to the appropriate parties.

commission trader See BROKER.

commit capital To place financial resources at risk in order to facilitate the execution of a customer order. For instance, Look, we're certainly willing to commit capital as long as you're willing to broaden the scope of our trading relationship. See also USE THE BALANCE SHEET.

commitment 1. The total position held in a stock, as in I have made a rather large commitment in XYZ. This had better work. 2. An obligation.

Common Customer Gateway (CCG) An electronic order delivery system developed by the New York Stock Exchange in 2007. Provides customer connectivity to the NYSE matching engine, the Super Display Book, floor brokers, designated market makers, and supplemental liquidity providers.

common stock Securities that represent equity ownership in a corporation.

comparison An abbreviation for comparison ticket.

comparison ticket A (pre-settlement) correspondence between two broker/dealers that details the terms of a particular trade.

competition A synonym for competitor.

complete 1. Specifically, to execute a sell order in its entirety, as in ZVZZT, you sold 10,000 additional at $25 to complete. 2. More generally (but less precisely), to execute any order in its entirety. See also FILL.

completion An executed sell order. For example, XYZ, I just got an official completion from the DMM. You sold your balance at a half. Some traders may use this term (less appropriately) when referring to a buy order as well. See also FILL.

composite quotation service See CONSOLIDATED QUOTATION SYSTEM.

composite tape A reporting service that includes all of the trades in a stock on each of the exchanges. See also TICKER TAPE.

Computer Assisted Execution System (CAES) An automated order routing and execution system developed by NASDAQ that allowed market makers to trade listed stocks directly with specialists on an exchange floor through the Intermarket Trading System (ITS).

Computer to Computer Interface (CTCI) A high speed communications interface between NASDAQ member firms and the NASDAQ trading platform.

concealed trader A trader who wishes to trade but who does not want to expose his orders to the public.

concession See PRICE CONCESSION.

conditional order An order that specifies particular market conditions which must be met for the order to be considered live and executable.

confirm An abbreviation for confirmation.

confirm an order To acknowledge the existence and corroborate the details of an order. An order is not usually considered officially received by the executing trader unless it has also been confirmed.

confirm me out Following a cancellation, a request from the customer for an official statement that the balance of the order has indeed been cancelled. Once a customer receives a firm "out," he has no further obligation to the order.

confirmation A written (electronic) statement delivered to a customer that details the terms of a trade. Usually issued immediately following an execution.

consolidated last sale The execution price of the most recent trade in a particular stock on any exchange.

consolidated limit order book A theoretical system that would be designed to aggregate all limit orders (regardless of venue of origination) into a centralized database. See also CENTRAL LIMIT ORDER BOOK (CLOB).

consolidated market A market in which all traders trade at the same place. In contrast to a FRAGMENTED MARKET.

Consolidated Quotation System (CQS) An electronic system developed in 1978 that collects, processes, and disseminates quote information for securities listed on any national securities exchange other than NASDAQ. Data is collected from the New York Stock Exchange, the American Stock Exchange (NYSE MKT), NASDAQ, regional exchanges, electronic exchanges, and third market firms.

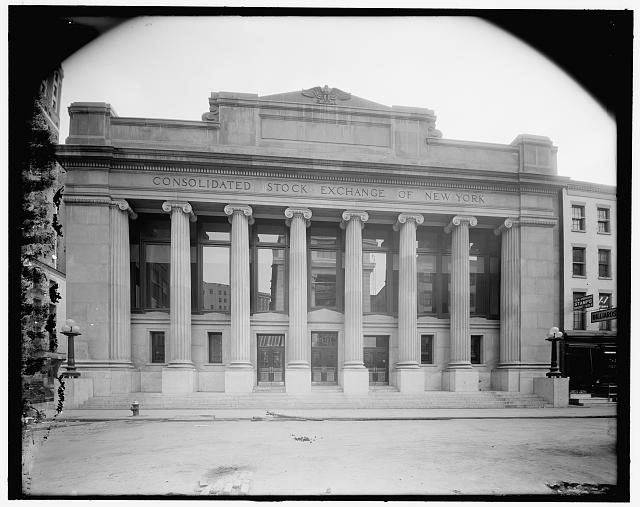

Consolidated Stock and Petroleum Exchange An exchange founded in 1885 as the result of a merger between the New York Petroleum Exchange and Stock Board and the New York Mining Stock and National Petroleum Exchange. For years, it competed effectively against the New York Stock Exchange by attracting small speculators and odd lotters. Eventually, the exchange became plagued by scandal and mismanagement. In 1927, it simply faded away, not even bothering to formally announce its closure. Also known as the Little Board.

Consolidated Stock Exchange, between 1905 and 1920

Photo Credit: Library of Congress

Consolidated Tape Association (CTA) Oversees the collection and dissemination of real time trade and quote information for securities listed on any national securities exchange other than NASDAQ. Maintains the CONSOLIDATED QUOTATION SYSTEM (CQS) and the CONSOLIDATED TAPE SYSTEM (CTS). See also NETWORK A and NETWORK B.

Consolidated Tape System (CTS) An integrated electronic reporting system of price and volume data for trades in New York Stock Exchange and American Stock Exchange (NYSE MKT) listed securities. Data is collected from the New York Stock Exchange, the American Stock Exchange (NYSE MKT), NASDAQ, regional exchanges, electronic exchanges, and third market firms.

contingency order An order that can be executed only if certain predetermined conditions are met.

contingent order 1. An order that requires the simultaneous execution of two or more trades. 2. An order whose price/execution relies on the price/execution of another security.

continuous market A market where trading is allowed any time that the market is open. As opposed to a CALL MARKET. The New York Stock Exchange adopted a continuous market format in 1870 following its merger with the Open Board of Stock Brokers.

continuous net settlement (CNS) An automated book entry system run by the Depository Trust and Clearing Corporation that centralizes the settlement of compared trades. Regardless of volume traded, CNS nets each broker/dealer's daily obligation to one net long or short position per security.

continuous trading A type of trading in which traders are allowed to arrange trades any time the market is open. See also CONTINUOUS MARKET.

contra broker The broker/dealer firm on the opposite side of a particular trade.

contract broker A FLOOR BROKER who executes trades for other exchange members. See also TWO DOLLAR BROKER.

contrarian A speculator who operates in opposition to prevailing wisdom, as in Sometimes it can be awfully lonely being a lifelong contrarian, but it is rarely dull.

conversation Trader's lingo meaning "negotiation." For instance, ZVZZT, why don't you bid your seller a half for 25,000 just to start a conversation.

convert and parity - destabilize and immediate order (CAP-DI order) A more versatile version of the convert and parity (CAP) order. Under a CAP-DI order, the specialist was allowed to convert all or part of the order to a limit order priced at a destabilizing tick.

convert and parity order (CAP order) Was a type of away from the market order entered by floor brokers to be worked by specialists. A CAP order instructed the specialist to participate with volume within the parameters of the order when the market price reached the electing price on the order. Specifically, the 'convert' portion allowed the specialist to convert the all or part of the order to a limit order priced at a stabilizing tick even if the market did not trade at the electing price. The 'parity' portion allowed the specialist to trade for his own proprietary account on parity with the CAP order. It also indicated that the CAP order was on parity with other CAP orders at the same price.

core liquidity provider A firm that regularly facilitates trading in a specific stock. Often an underwriter or a market maker that holds a sizable position in the stock.

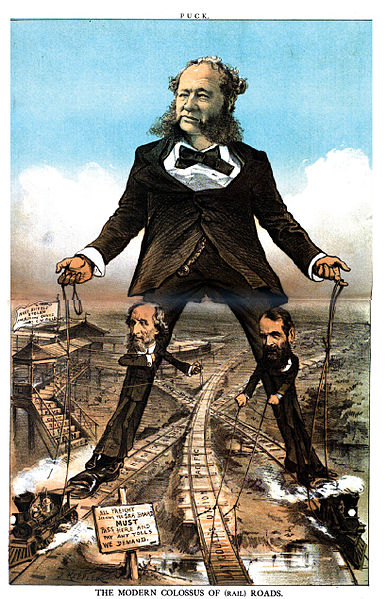

corner Establish enough control over the float of available shares of a company to be able to manipulate the price. For instance, It looks like the Commodore's corner of XYZ is nearly complete. The bears are really starting to dance.

Cornelius Vanderbilt, master of the railroad corner, 1879

Photo Credit: Wikimedia Commons

cornering the market Attempting to establish enough control over the float of available shares of a company to be able to manipulate the price. For instance, While the Commodore thought that he was in the final stages of cornering the market in XYZ, corporate insiders with a printing press and a plan to water the stock knew otherwise.

corporate repurchase The act of a corporation buying its own stock in the secondary market. See also BUYBACK.

correction A reversal in the overall price trend of a stock of at least 10%. Usually refers to a down move. For example, If this correction isn't reversed soon, we may end up in a real bear market.

correlation The strength of the relationship between between the price of financial instruments. Correlated prices tend to rise and fall together. Correlation may be the result of similar underlying fundamentals or from similar trading profiles. For trading strategies that exploit correlations, see ARBITRAGE, PAIRS TRADING, and STATISTICAL ARBITRAGE.

Corre's Hotel A hotel located in lower Manhattan where twenty four leading merchant traders met in March of 1792 in an attempt to bring some order to the chaotic securities market in New York. The result of these meetings was the Buttonwood Agreement.

correspondent A financial institution that performs services for other financial institutions in markets where the former has direct access but the latter does not.

cost of carry The total costs associated with holding a particular position.

costs me Dealer's lingo to indicate the net price that must be paid to a natural seller in order to reoffer the stock to a natural buyer. This price excludes any potential markup to the buyer. For example, ZVZZT, I'm catching a seller ...100,000 costs me $25. You can offer it to your buyer at an eighth. See also I GET.

countermand Cancel an order.

counterparty The entity on the other side of a particular trade.

counterparty risk 1) The risk that either a seller will be unable to deliver shares or a buyer will be unable to pay for shares by the settlement date. Also known as settlement risk. 2) The risk that one of the parties to an over-the-counter trade (such as an equity swap) will be unable to meet the terms of the contract.

countryman A old slang term for an inexperienced and unsophisticated trader.

cover Repurchase shares that had been sold short. For example, It looks like the market wants to move higher. Let's cover ZVZZT before it starts to become painful.

covered position A position that has been hedged.

cowboy A trader who makes oversized commitments. For example, I could be a cowboy like Jim is if I had access to Morgan's balance sheet like Jim does.

CQS An abbreviation of Consolidated Quotation System.

crash An exceptional loss of market value.

Crash of 1929 See Wall Street Crash of 1929.

Crash of 1987 See Black Monday (1987).

craze An overwhelming desire to buy stocks. For example, I've seen more than one craze like this before. They never end well.

CRD An abbreviation of Central Registration Depository.

cream skimming Historically, referred to the selective filling of the most potentially lucrative orders by specialists as principal. Less desirable orderswere instead placed in the specialist's book. Now, term would more aptly apply to INTERNALIZERS.

creation unit The minimum size of a block of shares of an EXCHANGE TRADED FUND (ETF). Bought from or sold to fund sponsors by authorized participants at net asset value. See also ETF ARBITRAGE.

cross A type of trade in which a single trader possesses offsetting buy and sell orders from different customers. The trader executes each order simultaneously internally rather than by buying one from and selling the other to the Street. A cross might be executed as principal (see RISKLESS PRINCIPAL TRANSACTION) or as agent (see AGENCY CROSS). For example, ZVZZT, we just crossed 150,000 at $25.10, come out in touch with two ways.

crossed market A situation in which the best bid for a stock is higher than the best ask. See also LOCKED MARKET.

crossed trade 1. An upstairs cross in an exchange listed stock that is not recorded on an exchange. Formerly prohibited for exchange members. 2. A type of trade in which one trader executes MATCHING ORDERS from the same institutional customer, but for different sub accounts. This is one case in which matching orders is legal.

crossing network A general term for any ALTERNATIVE TRADING SYSTEM that anonymously matches and buy and sell orders for its members internally. Might either conduct electronic call market block trades or seek to electronically match and flag indications of trading interest. See also DARK POOL.

crossing price The price at which a crossing network matches and executes internal buy and sell orders.

crossing session A specific predetermined period of time in which a crossing network attempts to match and execute buy and sell orders.

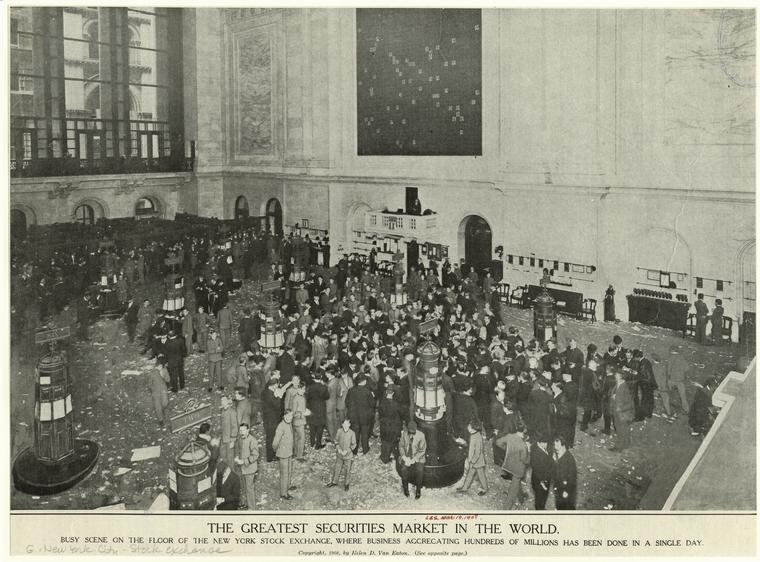

crowd 1. In general, the aggregate population of traders on the floor of a stock exchange. Includes specialists (DMMs), floor brokers, and floor traders. For example, The crowd seems especially active today. 2. More specifically, the group of floor brokers and floor traders that gathers around an individual specialist's post. For example, I'm surprised the XYZ crowd isn't larger this morning given the news that hit the tape pre-opening.

The crowd gathers, New York Stock Exchange,1908

Photo Credit: New York Public Library

CSA An abbreviation for commission sharing agreement.

CTA An abbreviation of Consolidated Tape Association.

CTCI An abbreviation for Computer to Computer Interface.

CTS An abbreviation of Consolidated Tape System.

cuffing Trader's lingo for providing a fictitious floor look to a customer. For example, I checked with another broker, so I know you were cuffing that last XYZ look. I understand you're busy, but don't ever do that again.

cult stock A slang term for a stock with great speculative interest regardless of the soundness of company fundamentals.

cum dividend With dividend. Describes a trade in which the buyer is eligible to receive a previously declared dividend. As opposed to EX DIVIDEND.

Curb Stock and Bond Market A short lived attempt by Thomas Cook to organize the few curbstone brokers who refused (or could not afford) to move indoors when the New York Curb Market opened in 1921.

curb trading A general term for any trading activity that occurs outside of an exchange and its regulatory structure. Originally referred to the trading of the curbstone brokers.

Curb, the Industry slang for the American Stock Exchange. See also CURBSTONE BROKERS.

curbs An abbreviation for trading curbs.

curbs in Trading curbs are in effect.

curbs out Trading curbs are no longer in effect.

curbstone brokers "Members" of the unofficial exchange loosely organized in the streets of lower Manhattan by the early 1800s. Primarily traded issues ignored by the indoor exchanges. Practiced continuous trading long before the New York Stock Exchange adopted the system. Known for using street lampposts as trading posts and for wearing colorful clothing in order to be easily recognizable by their order clerks (usually located in the offices directly above the trading action). In 1921, the curbstone brokers finally moved indoors, officially forming the New York Curb Exchange. Also known as the Outside Board. See also AMERICAN STOCK EXCHANGE.

Curbsone brokers,1864

Photo Credit: New York Public Library

cushion theory The theory that a relatively large short position in a stock will eventually create upward price pressure due to short covering.

CUSIP number An identification number or code assigned to every stock and registered bond by the Committee on Uniform Securities Identification Procedures.

custodian (bank) A financial institution that settles trades and holds money, assets, and securities on behalf of clients. The four largest custodian banks are BNY Mellon, State Street, JPMorgan Chase, and Citigroup.

customer A person or entity who engages the services of a broker/dealer.

customers' man An historic term for registered representative.

cutting a loss Closing an unprofitable position before it becomes even more unprofitable, as in I'm thinking about cutting my losses in this stock and just puking it.

CXL A written abbreviation of cancel.

Copyright 2016 by Brian W. Leite. All rights reserved. Reproduction of all or part of this dictionary without explicit permission is prohibited..