MARKET STRUCTURE DICTIONARY

BY

BRIAN W. LEITE

An Insider's Guide to the Real Language of

Trading and Exchanges

Over 2700 Entries

P & L An abbreviation of profit and loss statement.

P & S Department An abbreviation of purchase and sales department.

P Coast A slang term for the Pacific Stock Exchange.

PA An abbreviation of personal account.

Pacific Coast Stock Exchange See Pacific Stock Exchange.

Pacific Stock Exchange A regional stock exchange created in 1957 by the merger of the Los Angeles Stock Exchange and the San Francisco Stock Exchange. Originally named the Pacific Coast Stock Exchange, it was unique in that maintained separate trading floors in Los Angeles and San Francisco. In 1973, it was renamed the Pacific Stock Exchange, and in 1976 it began trading options. The Los Angeles equity trading floor was closed in 2001 followed by the San Francisco floor in 2002. Acquired by Archipelago in 2005.

package dealer A dealer that makes markets for entire portfolios rather than for individual stocks.

package trading market A market in which dealers make firm quotes for entire portfolios rather than for individual stocks. Also known as a basket market, a firm bid/offer market, or a portfolio trading market.

packet A London term for block.

pad Describes a specific group of stocks in which a particular trader makes a market as well as the positions maintained in those stocks. For example, Go ahead and add ZVZZT to my pad. See also LIST.

painting the tape 1. A manipulative practice in which a trader or group of traders actively trade a stock amongst themselves to create the illusion of heavy volume. 2. Breaking a large order into multiple small orders primarily to have more individual trades appear on the ticker tape. Both are used to attract other traders into the market.

paired (on) A situation in which offsetting natural buy and sell orders are matched with each other. Often used in a look from the floor of an exchange for an opening or closing auction/cross in a particular stock. For example, Right now, XYZ is paired on 100,000 for the close.

pairing off Settling trades by netting cash positions instead of delivering securities. An illegal practice used by brokerage firms engaged in a stock manipulation conspiracy.

pairoff To repurchase shares immediately after selling them in order to lower the book value of a position.

pairs trading 1. In general, the simultaneous purchase of one financial instruent and sale of another. 2. More specifically, an arbitrage strategy used to exploit perceived mispricings of relative valuation differentials between two correlated financial instruments. The relatively cheap instrument is purchased while the relatively expensive instrument is sold. The trade is profitable when prices converge. See also RELATIVE VALUE ARBITRAGE.

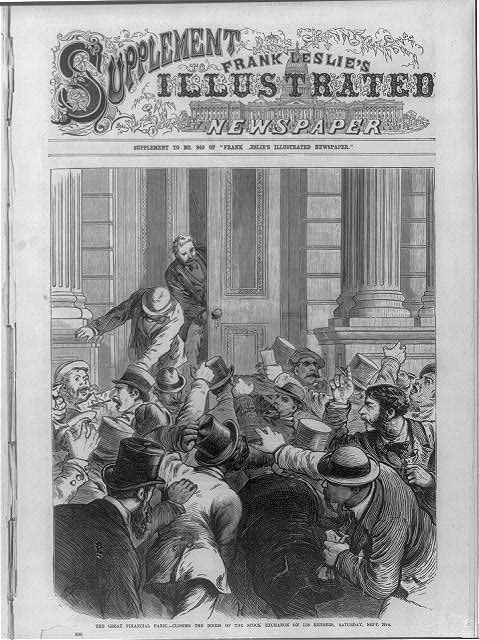

panic A severe disturbance in the financial markets caused by a sudden, widespread fear of economic and/or market collapse. Leads to indiscriminant selling and a rapid decline in stock prices.

Panic of 1873 - Closing the doors of the exchange on members

Photo Credit: Library of Congress

panic buying An substantial increase in the number and aggressiveness of buyers as the price of a stock increases.

panic selling A substantial increase in the number and aggressiveness of sellers as the price of a stock decreases.

paper profit/loss Industry jargon for an unrealized profit/loss.

paper trading A slang term for mock trading.

par 1. A market price of $100. 2. The face value of a security assigned by the issuer. Historically, often $100 for equities, but now usually a nominal amount.

par value The face value of a security assigned by the issuer. Historically, often $100 for equities, but now usually a nominal amount.

parasitic trader A trader who anticipates or uncovers natural order flow, and profits by exploiting other market participants. Parasitic traders seek to expose (or use exposed) information to create trading tactics to profit at the expense of exposed traders. Examples include FRONT RUNNING, MANIPULATION, MOMENTUM IGNITION, rumormongering, and squeezing. See also GAMING.

parity 1. In general, having equal value or standing. 2. More specifically, a situation in which multiple orders in an exchange floor crowd have equal standing with none having priority. Such orders become matched orders for execution.

parking 1. Placing funds into safe, short term investments while waiting for suitable longer term investment opportunities. 2. Concealing ownership of shares by placing them with a nominal holder.

partial An abbreviation of partial execution. For example, ZVZZT, I've got a partial for you. You bought an additional 5,000 at $25.30 for a total on the day of 20,000 at $25.25. Working 25,000 additional with an ultimate $25.50 top.

partial delivery Delivery of fewer shares than the contracted amount.

partial execution A report of an execution for a quantity that is less than the full amount of the order.

partial fill Often used as another term for PARTIAL EXECUTION. More appropriately, a partial execution of a buy order.

partial report A report of an execution for a quantity that is less than the full amount of the order.

participate 1. In general, means to be involved in a trade. 2. More specifically, a customer instruction to be a portion of the trading volume, but not all of the volume. For example, ZVZZT, just participate lightly at these levels. See MARKET ORDER/PARTICIPATE. 3. Even more specifically, another term for go along. A customer request for equal participation in a situation where the execution trader possesses more than one order of equal price priority. For example, You're already got another buyer of ZVZZT? Ok, I'll participate with the other guy.

participate but do not initiate 1. Specifically, an instruction to be involved in trading activity but to not initiate trading at a new price level. 2. More generally, an instruction to be involved in trading activity but to not be so aggressive as to impact the market price.

pass the book Transfer responsibility of overnight positions from one trading desk to another trading desk in a different time zone in order to facilitate twenty four hour trading for a particular firm.

passive investor An investor who buys and sells shares with an aim to achieve a diversified portfolio, Passive managers generally seek to replicate an index or other basket of securities. Day-to-day buy and sell decisions are therefore more a function of fund flows than of stock selection. See also INDEXING, EXCHANGE TRADED FUNDS (ETFS), and MODEL-DRIVEN TRADING.

passive liquidity supplier A trader who posts bids and offers in the marketplace. Passive liquidity suppliers generally hope to profit by trading with impatient traders who take liquidity. Profits may be derived from capturing spreads or trading for exchange rebates.

passive trader A patient trader who tends to post bids and offers in the marketplace rather than take liquidity. While passive traders may theoretically achieve favorable prices and minimize transaction costs, they are susceptible to front running and other parasitic trading tactics.

passive market making Market making under a set of restrictions that allows the broker/dealer to act as an underwriter in a follow-on offering as well as continue to purchase shares in the secondary market.

pattern day trader A designation applied by the Securities and Exchange Commission to any individual trader who round trips a stock on the same day at least four times in a five day period. Additionally, such trades must make up at least 6% of trading activity during that time period.

pawned stock A London term to describe shares pledged as collateral for a loan.

pay A synonym for bid, as in ZVZZT, I can pay $25 for 50,000, subject to a split.

payment for order flow The practice of providing compensation to an order entry firm in return for routing order flow to a specific market maker.

pegged order An order that contains a limit price that fluctuates with a predetermined variable. Common examples would be a buy order pegged to the best bid or a sell order pegged to the best ask.

pegged stock A stock that appears to attract support at a particular price level. For example, ZVZZT is pegged at $25. It looks like somebody is scooping everything that comes for sale there.

penalty box A slang term for the location of stocks that trade at a relatively low valuation, as in I'm betting XYZ stays in the penalty box until they get their management issues worked out.

pending order An order that has been submitted by a customer but has not yet been acknowledged by the broker/dealer to whom it was sent.

pennied A derogatory term used to describe a situation in which one trader undercuts or outbids another trader by penny or two. For example, ZVZZT, I'm getting pennied by some guy on Arca. Time to move and groove.

penny jumping A dubious practice in which one trader buys or sells stock in front of a large limit order held by another trader using the limit order as downside protection. Also known as quote matching.

penny stock In general, describes a stock priced under $5 per share that is not listed on a national securities exchange. Often highly speculative. See also OTC MARKETS GROUP, OTC BULLETIN BOARD, and GREY MARKET.

percentage order An order that stipulates a volume target as a percentage of overall volume in the stock. For example, ZVZZT, buy 50,000 with an ultimate $0.50 top, be a quarter of the volume.

perfectly hedged positions A theoretical portfolio in which future changes in the market prices of the individual components no longer have an impact on the profit and loss of the overall portfolio.

permanent spread component An academic term for the portion of a particular dealer's bid/asked spread that exists to protect the dealer against losses due to trading with INFORMED TRADERS. Also known as the adverse selection spread component.

personal account An account controlled by a professional trader in which he trades his own money. Also known as a PA.

Philadelphia Board of Brokers See PHILADELPHIA STOCK EXCHANGE.

Philadelphia Stock Exchange The Philadelphia Board of Brokers was the first stock exchange established in the United States. It was founded in 1790 and originally located in the Merchants' Coffee House and Place of Exchange (City Tavern). The Board of Brokers remained the most significant stock exchange in the U.S. from the time of its founding until the canal mania that followed the War of 1812 (when the New York markets achieved primacy). In 1875, the organization changed its name to the Philadelphia Stock Exchange. Merged with the Baltimore Stock Exchange in 1949, the Washington Stock Exchange in 1954, and the Pittsburgh Stock Exchange in 1969. Was acquired by NASDAQ in 2007 and renamed the NASDAQ OMX PHLX.

PHLX An abbreviation of Philadelphia Stock Exchange.

physically convened market Any market where trades are arranged on a trading floor.

pick away Buy stock slowly and methodically, as in ZVZZT, I know the volume is light, but you can keep picking away.

picture 1. In particular, details provided by a specialist regarding recent trading activity, the current market, and indicated interest. For example, XYZ is $50 1/4 - 3/8, 10k by 20k, Bear on the buy side, Morgan and Monty on the sell side. Also called a look. 2. More generally, industry jargon for any description of market conditions provided by a broker/dealer, as in ZVZZT, I've got a good two way picture right now. 3. Industry lingo for a dealer's quote, as in ZVZZT, what's your picture right now?

piece A large BLOCK of stock. For example, ZVZZT, we're about to go up on a piece. Let me know if anyone needs protection.

piggybacking A situation in which a broker mimics a trade made by a customer in the hope that the customer possesses superior information.

piker A slang term for a trader with limited resources.

piking A slang term for trading in small quantities.

pinging A GAMING strategy employed by predatory algorithms in which small orders are sent into dark pools in an attempt to discover large hidden orders. The goal is to identify such orders and manipulate prices accordingly.

Pink OTC Markets An inter-dealer electronic quotation and trading system in the over-the-counter securities market. Now known as OTC Markets Group. See also NATIONAL QUOTATION BUREAU.

Pink Sheets 1. Originally, a daily subscription service published (and printed on pink paper) by the National Quotation Bureau. The Pinks systematically organized and distributed wholesale stock quotes and indications from market makers in the Eastern U.S. section of the over-the-counter market. See also YELLOW SHEETS and WHITE SHEETS. 2. Today, the Pink Sheets have evolved into OTC PINK, an electronic marketplace operated by OTC Markets Group to trade the more speculative over-the-counter securities.

Pinks An abbreviation for Pink Sheets.

pit A ring shaped area of an exchange trading floor designated for open outcry commodities, futures, or options trading.

pit trader An exchange based commodities, futures, or options trader that trades for his own proprietary account. A commodities trading version of FLOOR TRADER. Also known as a local.

Pittsburgh Stock Exchange A regional exchange established in 1894 in Pittsburgh, Pennsylvania. Merged with the Philadelphia Stock Exchange in 1969.

pivotal stock A stock that is considered the leader of its group.

PK Historically, a written suffix to indicate an over-the-counter security quoted on the Pink Sheets.

place stock The process of marketing and distributing stock. Usually applies to a large block trade or a new issue sold to institutional investors.

place to show Refers to a specific customer who a trader believes may potentially have interest in participating in a block trade due to prior activity or indications of interest. For example, ZVZZT, we've got 500,000 for sale on the desk? I've got a good place to show it.

(plain) vanilla account Industry jargon for an institutional investor who is basing his trading activities primarily on company fundamentals. Usually refers to a large mutual fund. For example, I have a guy asking for a market in ZVZZT. Don't worry, it's a plain vanilla account. As opposed to a FAST GUY.

player An active trader.

playing the market 1. A general term for investing, as in I've been playing the market for twenty years. 2. More specifically, refers to amateur speculation, as in I wouldn't listen too closely to Jim, he's just playing the market.

plug 1. Dealer jargon meaning "fill the competitor's bid (or offer) in its entirety." For example, ZVZZT, three quarters for 50k, Morgan. --- Plug 'em on the 50k. Somewhat more aggressive than FADE. 2. See PULL THE PLUG.

plunge A sudden, precipitous drop in price, as in The market plunged after the unexpectedly negative jobs report.

plunger Industry lingo for a speculator who trades heavily and according to his own rules. Usually implies relatively large commitments and sizable risk. In his youth, legendary speculator Jesse Livermore was known as the Boy Plunger.

plus tick 1. A price that is higher than the price of the previous trade. 2. A bid that is higher than the previous best bid. Also called uptick.

plus tick rule A Securities and Exchange Commission regulation that, when in effect, stipulates short sales are only allowed on an uptick or a zero plus tick. Also called the uptick rule.

plus tick seller Another term for short seller, as in XYZ, I'm a plus tick seller of 20,000.

PM An abbreviation of portfolio manager.

point 1. For stocks, equals $1, as in XYZ is up three points today. 2. Industry lingo for alleged "inside information" given by one trader to another.

pointer One who provides tips.

pool Historically, a combination of speculators organized under an individual manager for the purposes of stock manipulation. The first pool in the United States was organized in 1791 in an attempt to manipulate the shares of the Bank of the United States.

pool operator Historically, a professional trader employed by a pool to manipulate a stock.

poop An historic slang term for inside information.

poop and scoop A form of stock manipulation in which a group of operators spread false rumors about a company in an attempt to drive the share price lower. If the efforts are successful, shares can be purchased at bargain prices.

pop An increase in prices, as in I bet the market gets a pop tomorrow morning with all of the economic data coming out.

portfolio A grouping of investments held by a single entity.

portfolio manager A market professional who controls the allocation of assets for a particular portfolio of an institutional investor.

portfolio trading market A market in which dealers make firm quotes for entire portfolios rather than for individual stocks. Also known as a basket market, a firm bid/offer market, or a package trading market.

POSIT The Portfolio System for Institutional Trading is a widely used crossing network created in 1987 by the Investment Technology Group (ITG).

position 1. The amount of a particular stock owned (a LONG POSITION) or owed (a SHORT POSITION), as in My total short position in XYZ is 100,000 shares. 2. To buy or sell securities in order to establish a net long or a net short position, as in I've positioned 100,000 shares already, 400,000 more to come. Also known as take a position or build a position.

position building The process of establishing a long or short position over a period of time.

position sheet A list of net positions maintained by a dealer. Usually includes a list of the individual trades that created the positions as well. See also BLOTTER and PAD.

position trader A professional trader that holds positions overnight or longer. Positions may result from block positioning activities or from speculative positioning activities. Market makers and upstairs listed traders often take on the role of position trader as well.

positioning The process of a dealer establishing a position generally in the hope of locating a natural customer.

positive obligation See affirmative obligation.

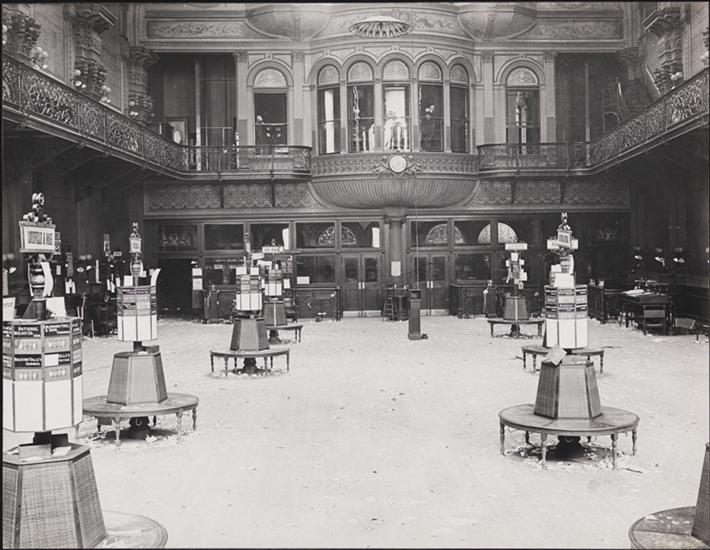

post 1. A physical structure on the floor of a stock exchange where the CROWD gathers around a specialist to trade in a particular stock. 2. To enter information in an account.

Posts at the New York Stock Exchange

Interior New York Stock Exchange circa 1908

Photo Credit: Museum of the City of New York

post a quote Present a quote in a particular stock to other participants in the market.

post liquidity Enter a limit order on an exchange or in an alternative trading system that is not immediately marketable.

post trade transaction cost analysis See TRANSACTION COST ANALYSIS.

pot The portion of a new issue that is set aside by the lead underwriter to place with institutional investors. Also known as the institutional pot.

pot is clean Industry jargon used when pot stock has been completely placed with institutional investors.

PPY An abbreviation of Priority, Parity, Yielding.

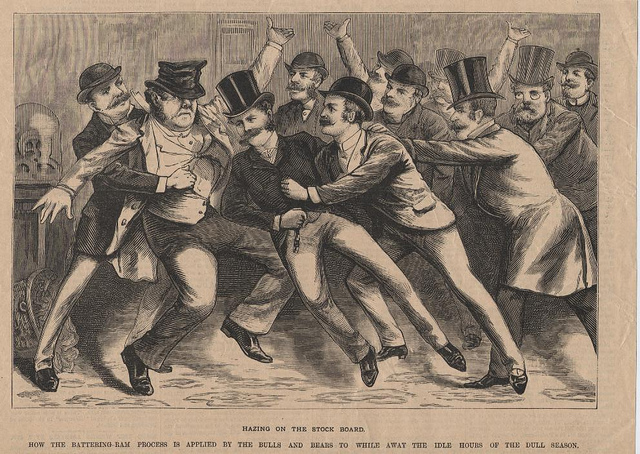

pranks An endless variety of pranks have been played by traders on other traders (particularly rookie traders) for generations. Pranks have become deeply ingrained in the trading culture. For one example, see BEECHER TOOL AND DIE.

Hazing at the New York Stock Exchange, 1884

Photo Credit: Museum of American Finance

prearranged trading The (usually illegal) practice between two traders in which the terms of a trade are determined at one point in time, but the trade is not officially executed until a later time.

precedence rules The set of rules established by each stock exchange to prioritize the importance of the various characteristics of an order. Common rules involve price, time, and size. For example, the highest bid and lowest offer usually have the highest precedence, and customer orders have historically had precedence over member orders.

preditory algorithms Computerized trading systems designed to profit from the exploitation of natural order flow. See also GAMING and PARASITIC TRADERS.

preferencing A situation in which an order entry firm selects a particular dealer to execute a order whether or not that dealer is currently posting the best quote. The order entry firms will often receive a payment for order flow. Both firms remain obligated to fulfill best execution requirements.

preferred stock An equity security that holds an ownership claim on corporate assets, has priority over common stock on earnings and assets, generally pays a fixed dividend which is paid before any common stock dividend, but does not usually carry any voting rights.

pre-market trading Trading that occurs in stocks listed on a given exchange before the official opening of that exchange. Pre-market trading generally takes place between 4:00am and 9:30am ET. Such trading was historically limited to institutional investors, but the rise of ECNs has allowed more individual investors to become involved. See also AFTER HOURS TRADING.

premium 1. The difference between the original offering price of a new issue and the price at which it trades in the secondary market. 2. The amount paid in excess of the par value. 3. Describes a superior stock.

pre-open trading See PRE-MARKET TRADING.

pre-opening indication The range of potential opening prices for a stock as provided by a specialist, as in Right now, XYZ is looking $50-$52.

pre-routing order The technically correct term for flash order.

pressure Forces acting to move prices lower, as in The market came under pressure after several prominent companies failed to meet their whisper numbers.

pre-trade analytics An analysis of historical and current price and volume data for the purposes of determining the best venue for and timing of order placement and trade execution.

pre-trade benchmark A price against which trade execution performance is measured. Occurs before or at the time that the decision to trade is made.

previous close The closing price of a stock during the prior trading session.

price The dollar amount at which a share of stock is quoted, traded, or otherwise valued.

price change The difference between the current price and the previous day's closing price.

price clustering The tendency of traders to enter orders at "significant" price levels. For example, more orders are entered in whole dollar amounts than in fractions, and more orders are entered at a numbers such as $25 or $50 than at numbers such as $26 or $49.

price concession The premium that large buyers must sometimes pay or the discount that large sellers must sometimes offer to attract a counterparty.

price continuity A situation in which price gaps between trades in a particular stock are relatively small. Generally due to a high volume of transactions.

price convergence Arbitrageurs can profit when the market prices of correlated but mispriced financial instruments return (converge) to their normal relationships.

price discovery The process of establishing the price of a security through the interaction of buyers and sellers in a market.

price discrimination Describes a situation in which market participants may be disinclined to trade with a large trader because they fear more size will follow.

price gap A situation in which the price of a particular trade in a given stock is significantly different than the price of the previous trade in that stock.

price give A willingness to be flexible on price.

price impact costs The costs associated with the order execution process. Also known as market impact costs.

price improvement A situation in which the actual execution price is better than the best quoted price at the time of order entry.

price limit The highest (lowest) price a trader is willing to pay for (sell) stock, as in Sell 50,000 XYZ with a $25.20 (price) limit.

price momentum The perceived impetus behind a price movement.

price of admission Industry jargon for the initial losses that will likely be incurred with an attempt to become a dominant market maker in a particular stock. Such costs are primarily derived from making very large and aggressive markets to attract customer flow as well as from overtrading to generate volume. For example, There is a decent chance that we get killed on this super. Oh well, I guess that's just the price of admission.

price priority rules Exchange rules that stipulate that buy orders with the highest limit price or sell orders with the lowest limit price take precedence over orders with inferior limit prices. See also PRIORITY.

price range The difference between the highest trade price and the lowest trade price of a stock over a specific period of time, as in Today, XYZ traded in a $0.50 price range.

price risk The perceived risk that the price of a stock will move adversely.

price taker A trader who trades primarily by responding to the quotes of others. A relatively non-aggressive trader.

price tension A market phenomenon that derives from buyers seeking the lowest price and sellers seeking the highest price. All things being equal, the greater the tension, the wider the spread.

price transparency The level of accessibility that traders have to prices.

price uncertainty The perceived risk that the price of a stock will change.

priced in the stock Describes information that cannot be used to forecast future price changes, as in I understand why you're negative on XYZ, but I personally think all of the bad news is already priced in the stock.

pricey Describes a bid or an offer that is far away from the current market price, as in As long as your guy continues to be this pricey, I doubt well be able to get a trade on.

primary distribution The sale of a new issue.

primary exchange The main exchange on which a particular stock is listed. Stocks trading on their primary exchange are sometimes described as trading in the FIRST MARKET.

primary market The market for new issues. See also SECONDARY MARKET.

primary offering The sale of a new issue.

primary order precedence rule The order precedence rule that supersedes all others on a particular exchange. Often a PRICE PRIORITY RULE.

primary spread determinants The main factors that determine whether spreads will be wide or narrow. Includes information asymmetries between market participants, volatility, and utilitarian trading interest.

prime brokerage Services offered by larger brokerage firms to smaller institutional investors and hedge funds. Such services include trade execution, settlement, lending, financing, custody, cash management, and risk management.

principal 1. The main party to a trade. The person who is trading for his own account and risk. 2. A dealer who is trading from a proprietary account.

principal trade A transaction in which a dealer is trading from a proprietary account.

print 1. To execute a trade and record it to the ticker tape, as in ZVZZT, print 25,000 at $25.50. 2. An execution of a trade, as evidenced by the trade appearing on the ticker tape. For example, XYZ, a print of 100,000 just went up at $50.50. I'll try to get you done there. 3. A synonym for earnings report, as in We are buyers of XYZ into the print.

print, opening A synonym for opening trade.

priority rules The set of rules established by each stock exchange to prioritize the importance of the various characteristics of an order. Common rules involve price, time, and size. For example, the first bid or first offer usually has priority, and larger orders have sometimes had priority over smaller orders.

Priority, Parity, Yielding (PPY) A term for the priority rules of the New York Stock Exchange.

private wire house See WIRE HOUSE.

proactive trader A trader who articulates trading interest himself rather than simply responding to opportunities presented by others.

proceeds The amount received from the sale of stock before any deductions for commissions or other costs.

producer An individual at a broker/dealer directly responsible for generating revenue.

production Revenue derived from commissions or trading profits.

professional speculation Speculation by individuals who are particularly adept at it and/or who make a regular business of it.

professional speculator An individual who is particularly adept at and/or who makes a regular business of speculation.

professional trader An individual who makes a regular business of trading. Market makers, specialists, upstairs traders, floor traders, agency traders, institutional traders, and (sometimes) pattern day traders are all professional traders.

profile buyer/seller A dealer who presents himself as either a buyer or seller without possessing a customer order. Such a trader is willing to commit capital in order to attract a natural customer.

profit 1. The positive difference between the current market price of a stock and its initial cost. 2. The amount made on a particular trade.

profit and loss statement A summary that details the net income derived from trading activities.

profit center A division of an organization that is responsible for generating its own profits. The trading desk at a broker/dealer is usually viewed as a profit center.

profit taking 1. Specifically, a temporary decline in stock prices following a sharp rise. Usually due to selling pressure coming from short term traders. For example, It looks like the fast guys may be taking some profits in ZVZZT. I wouldn't get overly concerned though. 2. More generally, a term used to explain any inexplicable decline in stock prices following a rise. For example, The Dow was down today on profit taking.

program trading 1. In general, an operation in which computers generate and execute orders simultaneously in a large basket of stocks (usually fifteen or more). Often used to arbitrage price discrepancies between related securities. 2. More specifically, program trading is often employed to arbitrage between baskets of stocks and their corresponding options and/or futures contracts. Thus, it theoretically takes advantage of a difference in market values between essentially identical portfolios. See also ARBITRAGE TRADING PROGRAM.

prop shop Industry jargon for a broker/dealer that derives the majority of its income from proprietary trading activities.

prop trader An abbreviation of proprietary trader.

proprietary order An order that originates from a dealer's proprietary trading account rather than from a customer.

proprietary trader A professional trader who derives the majority of his income from proprietary trading activities.

proprietary trading Professional trading as principal with the primary goal of creating gains rather than generating commissions.

proprietary trading account An account used by a professional trader to conduct principal trading activities, often in an attempt to create trading gains.

protected quote A quote that is displayed by an AUTOMATED TRADING CENTER. May not be normally traded through pursuant to Reg NMS. See also FAST QUOTE.

protection An assurance made by a trader to look after the best interests of a customer. Examples: 1. Trader assures customer of reasonable participation in overall volume. See also NOT HELD ORDER. 2. Trader assures customer that if stock trades away at a particularly favorable price, the customer will trade stock at that price as well. 3. Trader assures customer of the opportunity to participate on an internal block trade. See also CLEAN YOUR SKIRTS. 4. Trader assures customer that at least a portion of an order will be executed at a certain price or better. See also STOPPED. 5. Trader places customer order (or portion of an order) on the floor of an exchange in order to guarantee participation in trading on that exchange. See also FLOOR PROTECTION.

protective stop A stop limit order or stop (loss) order used to protect gains or limit losses.

proximity hosting Locating a data center very close to an exchange in order to provide high frequency trading firms with a suitable environment in which to install high speed data processing equipment. This gives high frequency trading firms the ability to reduce latency and gain a small but meaningful timing advantage over other market participants.

pseudo-informed traders Traders who believe themselves to be informed, but in fact are trading on old information that has already been assimilated into market prices.

public, the A general term for the universe of small non-professional individual investors. See also MAIN STREET.

public book A list of public (non-member) limit orders held by an exchange specialist.

public company A company that has issued shares through a public offering which currently trade freely in an organized marketplace.

public distribution The sale of new securities to the public. See also PRIMARY MARKET.

public equity The equity capital invested in a public corporation.

public float The portion of a corporation's shares held by the public. Equals the total shares outstanding minus shares held by officers, directors, or owners of 10% or more. Often referred to as simply the float.

public offering The sale of new shares to the public by a company. Usually offered through an underwriting by an investment bank. See also PRIMARY MARKET.

public offering price The price at which a new issue is offered to the public.

public order precedence rules Exchange rules that stipulate that public orders take precedence over member orders.

public ownership See PUBLIC FLOAT.

Public Stock Board See Open Board of Stock Brokers.

Public Stock Exchange See Open Board of Stock Brokers.

public trader One who trades stocks but is not a professional trader or member of an exchange.

publicly held Describes the shares of a public company.

publicly traded Describes a company that has issued shares through a public offering that currently trade in an organized marketplace. See also SECONDARY MARKET.

puke A slang term for selling a position quickly and without particular regard to price. Usually implies a losing position. For example, This XYZ position is killing me. Just puke it out.

pull To lower a bid price, raise an offer price, or cancel an order entirely, as in I'm going to pull the balance of my ZVZZT order until after the FOMC announcement.

pullback A short term reversal in a longer term uptrend, as in I think this pullback is a great opportunity to buy stocks on the cheap.

pulled the plug Describes a market that is selling off sharply. For example, Who pulled the plug on the market this morning? It looks like its going to zero.

pulling in their horns A slang term that means closing (or hedging) a portion of a long position to guard against lower prices. For example, It looks like the fast guys are pulling in their horns some in front of the numbers.

pump and dump A method of stock manipulation in which unsubstantiated claims are made about the future prospects of a company in order to allow the manipulators to sell stock at inflated prices.

punter A synonym for speculator. Used mostly in London.

pup A slang term for a low priced, inactive stock.

purchase Another word for buy.

purchase and sales department (P&S department) The portion of the back office charged with trade confirmation and reconciliation.

pure play A term to describe a company engaged primarily in one line of business.

put (a trade) on 1) Execute a trade. Often implies a block trade. For example, ZVZZT, let's go ahead and put on 50,000 at $25.50. 2) Initiate a position. May be a relatively complex position such as an arbitrage play.

put (a trade) up Execute a trade (often a block trade), as evidenced by the trade printing on the ticker tape. For example, XYZ, put 'em up at $50 1/2.

put option A derivative financial instrument that represents the right, but not the obligation, to sell an underlying asset at a fixed price for a set period of time.

put on an arbitrage Assume an arbitrage position in two or more securities.

put out a line Establish a substantial short position, usually over a period of time. For example, The market seems to finally be showing some real weakness. I think the time is ripe for me to put out a line. Opposite of TAKE ON A LINE.

put pants on it Industry jargon meaning open up. For example, You think your guy's got some XYZ to buy? If you put pants on it, maybe we can write a ticket.

Px A written abbreviation for price.

pyramiding Using paper profits in a stock to increase the size of the position.

Copyright 2016 by Brian W. Leite. All rights reserved. Reproduction of all or part of this dictionary without explicit permission is prohibited..