MARKET STRUCTURE DICTIONARY

BY

BRIAN W. LEITE

An Insider's Guide to the Real Language of

Trading and Exchanges

Over 2700 Entries

each way Describes the commission (or commission equivalent) generated by a trader who is able to pair off natural customer buy and sell orders internally.

ease off Describes a slow decline in prices, as in It looks like the market may ease off in front of the holidays.

easy to borrow list A list of stocks that are readily available to short sellers.

eating stock Describes the action of a dealer who has been compelled to assume position risk that he would not otherwise assume in order to facilitate a customer trade. For example, I just front ended 250,000 ZVZZT from a vanilla guy. I'm glad we’ve locked in his order, but I bet I'm going to have to eat that stock.

echo bubble A rally that sometimes follows the deflation of a bubble, which itself may become another (smaller) bubble.

ECN An abbreviation of electronic communications network.

econometric transaction cost estimation The pre-trade use of statistical methods to estimate transaction costs.

EDGA Exchange See DIRECT EDGE.

EDGX Exchange See DIRECT EDGE.

effective spread A transaction cost estimate that uses the quotation midpoint at the time of the trade as the benchmark. The effective spread essentially equals twice the LIQUIDITY PREMIUM.

efficient market A theoretical market where prices reflect fair value at any given time. An efficient market would produce highly informative prices.

eighth One eighth of one dollar. Equivalent to $0.125. Traditionally, stocks were quoted and traded in eighths and quarters, as in "$50 1/8-1/4". See also BIT.

eighthed A derogatory term used to describe a situation in which one trader undercuts or outbids another trader by an eighth of a dollar. For example, ZVZZT, I've been sitting here on the bid buying stock for ten minutes, and now some guy just eighthed me on Instinet. See also PENNIED and TEENIED.

either way Dealer jargon used to indicate that a quoted size is good on the bid side as well as the offer side, as in ZVZZT, I'm $25.10-$0.20, 100,000 either way. Also known as UP.

either/or order See ALTERNATIVE ORDER.

elect To convert a conditional order (such as a stop order or a stop limit order) into a market/limit order.

electing sale The market transaction that causes a conditional order (such as a stop order or a stop limit order) to convert into a live market/limit order. Generally the first trade that takes place at the stipulated price (or better).

electronic communications network (ECN) A general term for a computer based ALTERNATIVE TRADING SYSTEM that allows principals to trade anonymously and directly with each other, thereby bypassing traditional middlemen such as market makers, floor brokers, and specialists. ECNs allow participants to seek liquidity within the ECN itself as well as to directly access the market. ECNs do not seek to trade all flow internally as would a crossing network.

electronic exchange A general term for any computer based stock exchange that allows members to trade anonymously and directly with each other, thereby bypassing traditional middleman such as market makers, floor brokers, and specialists.

electronic market making A form of HIGH FREQUENCY TRADING in which computers are programmed to generate orders that post short term quotes to the market. The goal is to generate liquidity rebates (see REBATE TRADING) as well as capture a portion of the bid/asked spread, if possible. Relies on ultralow latency to conduct high speed, high turnover computerized trading operations. Also known as automated market making.

electronic order routing system A general term for any computer system that is designed to electronically forward orders to the appropriate trading venue.

electronic proprietary trading A method of trading in which computers are programmed to generate proprietary orders. See HIGH FREQUENCY TRADING and PROGRAM TRADING.

electronic trading A general term for any method of trading that utilizes computer systems to match buyers and sellers.

elephant Industry slang for a large institutional investor, as in I just bagged the elephant.

EMS An abbreviation for execution management system.

end of day order See DAY ORDER.

enforced liquidation The forced closure of a position due to a failure to maintain sufficient equity in a margin account.

engrossing the market A archaic term for trading in such large quantities that a trader effectively controls the market.

episodic volatility An academic term for large price swings that occur in a short time period.

equilibrium spread An academic term for a bid/asked spread that ensures traders are indifferent between using a limit order and a market order. If the spread is too wide, all traders will wish to use limit orders. If the spread is too narrow, all traders will wish to use market orders. In either case, theoretically no one will trade.

equities Financial instruments that represent partial ownership in a corporation. See COMMON STOCK and PREFERRED STOCK.

equities trader A professional trader of common or preferred stock. Refers to both buy side and sell side traders. Also known as equity trader.

equity Ownership interest in a corporation. See COMMON STOCK and PREFERRED STOCK.

equity market A general term for the organized trading of shares. Also known as a stock market.

equity securities Financial instruments that represents partial ownership in a corporation. See COMMON STOCK and PREFERRED STOCK.

equity trader 1. A professional trader of common or preferred stock. Refers to both buy side and sell side traders. Also known as equities trader. 2. See SERIES 55.

Erie Board The more commonly used moniker for the National Stock Exchange. Was an exchange founded in New York City in 1869 originally to trade the shares of Erie Railroad (affectionately known as Scarlet Woman of Wall Street). Erie, led by Cornelius Vanderbilt and Daniel Drew, had refused to register its shares with the major exchanges. Shares had subsequently been delisted. Drew and Vanderbilt encouraged the formation of a new market which would have less stringent requirements. This market succeeded for a short time but ultimately collapsed when Vanderbilt lost interest and Erie finally agreed to register its shares.

erratic market A market characterized by rapid and irregular movements in price. For example, Yet again we've got an erratic market following a Fed announcement. It never fails.

erroneous trade A trade made in error. See also CLEARLY ERRONEOUS TRADE.

error See ERRONEOUS TRADE.

error account A house account maintained by most broker/dealers into which any erroneous trade made by the firm's personnel is booked.

ETF An abbreviation of exchange traded fund.

ETF arbitrage 1) Authorized Participants (APs) are contracted by ETF Sponsors to create and redeem ETF creation units. If for whatever reason, the price of an ETF's shares rises above the value of the underlying securities, an AP may buy enough of the underlying securities to create a creation unit, exchange those underlying shares for a creation unit (containing ETF shares), and sell the ETF shares in the open market. The opposite if true as well. If the price of an ETF falls below the value of the underlying securities, an AP may buy enough ETF shares to form a creation unit, redeem the underlying shares from the ETF sponsor (i.e. exchange the creation unit for underlying shares), and sell those shares in the open market. In either case, the spread between the purchase price and sale price of the ETF shares and the underlying shares represents an arbitrage profit. 2) Traders can take advantage of mispricings between ETFs and their underlying securities by selling the relatively overpriced ETF/basket and buying the relatively underpriced basket/ETF.

ETF Sponsor A company or financial institution that creates and administers EXCHANGE TRADED FUNDS. See also ETF arbitrage.

Euronext A pan European stock exchange headquartered in New York City and operated out of Paris, France. Euronext was formed in 2000 by the merger of the Amsterdam Stock Exchange, the Brussels Stock Exchange, and the Paris Bourse. Since then, the London International Financial Futures and Options Exchange (LIFFE) and the Bolsa de Valores de Lisboa e Porto have joined with Euronext. In 2006, Euronext merged with the New York Stock Exchange to form NYSE Euronext. Spun off from the NYSE in 2014.

evasive trading strategies Strategies employed by large traders to avoid exposing information to other traders who might use it to the disadvantage of the large trader. See also DEFENSIVE TRADING STRATEGIES.

even Describes a trader who has bought and sold the same amount of the same stock on the same day.

even lot The exchange determined standardized number of shares in a single trading unit. Usually 100 shares. Also known as a board lot, a full lot, a regular lot, or a round lot.

even up 1. To buy or sell enough stock to offset an existing position. See also CLOSE A POSITION. 2. To realize a profit in order to offset a loss. 3. Describes a situation in which buyers and sellers are about equally divided.

event-driven strategy (corporate) An investment strategy in which securities are targeted because of actual or anticipated atypical corporate actions. Such actions could include bankruptcy, emergence from bankruptcy, mergers, acquisitions, divestitures, and stock repurchases.

Evening Exchange See NEW YORK EVENING EXCHANGE.

evening exchanges In 1862, an unofficial evening exchange was formed at the Fifth Avenue Hotel in New York City. Over the next few years, unofficial evening exchanges (as well as an evening curbstone crowd) began to proliferate in the area around Fifth Avenue and Broadway, 23rd and 24th Street. The evening exchanges eventually closed after facing strong opposition from the New York Stock Exchange and the Open Board. Also see NEW YORK EVENING EXCHANGE.

ex dividend Without dividend. Describes a trade in which the buyer is no longer eligible to receive a previously declared dividend. As opposed to CUM DIVIDEND.

exchange An organized marketplace where financial instruments are traded. An exchange may be a physical location or an electronic platform. See also STOCK EXCHANGE.

Exchange, The Industry lingo for the New York Stock Exchange. Also known as the Big Board.

Exchange Alley See 'CHANGE ALLEY.

exchange broker A synonym for floor broker.

exchange distribution A block trade on the floor of an exchange that is actually comprised of multiple buy and sell orders which have been combined and then crossed as a single transaction.

exchange market maker A member of an exchange registered as a specialist or a market maker. See DESIGNATED MARKET MAKER and REGISTERED COMPETITIVE MARKET MAKER.

exchange member firm/house See MEMBER FIRM.

exchange seat A membership on a physical exchange. The term originated from the earliest years of stock exchanges when members were assigned chairs at prearranged call market auctions.

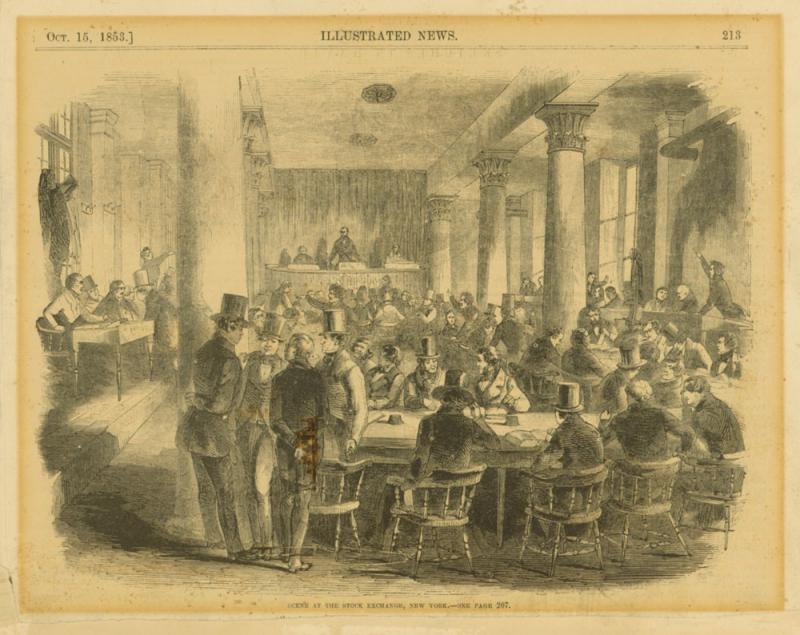

Seats at the New York Stock Exchange circa 1850

Photo Credit: Museum of American Finance

exchange traded fund (ETF) An investment fund whose shares can be traded like a stock. ETF SPONSORS essentially bundle together the stocks that form an index, contract with AUTHORIZED PARTICIPANTS to receive underlying shares, then issue creation units in return that contain tens of thousands of ETF shares which in turn can be traded on an exchange. Only authorized participants (generally, large broker/ dealers) may trade with the ETF sponsor directly, creating and redeeming creation units in the process (see ETF ARBITRAGE). ETF shares should theoretically track the index closely, but the ultimate price is decided through the interaction of buyers and sellers of the ETF in the marketplace. See also ETF ARBITRAGE, and PASSIVE INVESTMENT.

exchange traded stock A stock that is approved to trade on a physically convened stock exchange such as the New York Stock Exchange. Does not refer stocks listed on the NASDAQ. See also LISTED STOCK.

execute To fill a buy order or complete a sell order. For example, ZVZZT, I'm going to go ahead and execute the balance of your order at $25.10. Let me know if you have any more to do.

executed at the quote Describes an order that was executed at the NBBO at the time of entry.

executed outside of the quote Describes an order that was executed at a price that was inferior to the NBBO at the time of entry.

executed with price improvement Describes an order that was executed within the NBBO at the time of entry.

execution A fill on a buy order or the completion of a sell order. For example, XYZ, I just got a verbal report from the floor, so an official execution should be coming your way shortly. See also PARTIAL EXECUTION.

execution management system (EMS) A general term for any computer based platform that facilitates and manages the execution of securities orders. An EMS will generally offer a trade blotter, connectivity to multiple execution destinations, and real time market data.

execution price uncertainty An academic term for the risk that a market order will be executed at a price that is inferior to the expected price.

execution system A general term for any computer based trading platform that allows traders to electronically execute trades with other traders.

execution uncertainty An academic term for the risk that a limit order will fail to be executed.

executions An abbreviation of partial executions.

exhaust price The point at which a speculative position must be liquidated to meet a margin call.

exit To close a position, as in If I can exit this position anywhere in the vicinity of even, I'm out.

exit strategy The methods employed by a trader to close a position. For example, John, you and the rest of the shorts are really starting to get squeezed in this one. I trust you have an exit strategy… .

expand Trading jargon used to indicate that a stated size may reflect only a portion of the entire trading interest. For example, XYZ, take 50,000 to buy not held, may expand.

explicit transaction costs Accounting costs. Includes commissions, markups or markdowns, fees paid to market centers, and taxes. May also include the costs associated with maintaining a trading operation.

ex post regret An academic term for the risk that a trader may end up regretting his decision to trade.

expunge To permanently remove any electronic trace of an advertisement of volume or an indication of interest. Differs from a CANCEL INDICATION which remains in the historical records. For example, Expunge our last IOI in ZVZZT. We don't need some fast guy coming in here thinking he can run us over with this news out.

Extended Blue Room In 1988, the Blue Room at the New York Stock Exchange was expanded to create the Extended Blue Room. The Room was closed in 2007 but subsequently reopened to trade NYSE Alternext options.

extended trading Trading that occurs in NASDAQ and exchange listed securities on alternative trading systems and electronic exchanges outside of the regular trading session. PRE-MARKET TRADING usually runs from 4am to 9:30am ET, and AFTER HOURS TRADING usually runs from 4pm to 8:00pm ET.

Copyright 2016 by Brian W. Leite. All rights reserved. Reproduction of all or part of this dictionary without explicit permission is prohibited..