MARKET STRUCTURE DICTIONARY

BY

BRIAN W. LEITE

An Insider's Guide to the Real Language of

Trading and Exchanges

Over 2700 Entries

S A written abbreviation of sell.

saddled A slang term meaning compelled to hold an undesirable position purchased at a higher price. For example, I've been saddled with this ZVZZT position for a week, and I'm starting to get a little tired of it.

safe calls only A trader's instruction to show a particular piece of natural merchandise only to potential customers who have demonstrated a capacity to trade discretely and in size. The goal is to minimize information slippage. More commonly referred to as good calls only. For example, Our XYZ situation is very large but very sensitive. Let's make safe calls only please.

sag A moderate decline in prices.

sage A speculator who is very knowledgeable about the markets and who has a reputation for making profitable commitments.

sale 1. An exchange of shares for monetary compensation. 2. A synonym for trade, as in The last sale in XYZ was at $50.75.

sales trader A hybrid position in a broker/dealer's trading department A sales trader solicits and accepts orders from customer buy side traders, routes those orders to the proper trading venue, and monitors execution quality. Acts as the primary liaison between the institutional investor's trading desk and the broker/dealer's trading desk.

salesperson See RESEARCH SALESPERSON and REGISTERED REPRESENTATIVE.

salt down stock Buy stocks as a long term investment, as in I'm too skittish on the economy to even think about salting down any stocks right now.

Salt Lake Stock and Mining Exchange A regional stock exchange founded in 1908 inSalt Lake City, Utah. Closed in 1986.

same day settlement See CASH SALE/TRADE.

San Francisco Mining Exchange A regional stock exchange founded in 1862 in San Francisco, California as the San Francisco Stock and Exchange Board. Changed its name to the San Francisco Mining Exchange in 1927. Closed in 1967.

San Francisco Stock and Bond Exchange See SAN FRANCISCO STOCK EXCHANGE.

San Francisco Stock and Exchange Board See SAN FRANCISCO MINING EXCHANGE.

San Francisco Stock Exchange A regional stock exchange founded in 1882 in San Francisco, California as the San Francisco Stock and Bond Exchange. Became known as the Big Board of the West. Changed its name to the San Francisco Stock Exchange in 1927, and merged with the Los Angeles Stock Exchange in 1957 to form the Pacific Coast Stock Exchange.

save some bullets Leave a portion of a not held order unexecuted in anticipation of more favorable prices later in the trading session. For example, It looks like XYZ wants to come in. Let's save some bullets for the close.

scale The systematic placement of portions of a larger order at stated price intervals, descending for purchases and ascending for sales. For example, Buy 50,000 XYZ on a dime scale from $25.50 to $25.10.

scale in Systematically place portions of a larger buy order at descending price intervals in order to average prices down. For example, ZVZZT, buy 100,000, try to scale it in from $25.70 to $25.50. See also BUY ON A SCALE.

scale out Systematically place portions of a larger sell order at ascending price intervals in order to average prices up. For example, XYZ, take an order to sell 50,000 with a $50.25 low, scale it out to the $50.70 level. See also SELL ON A SCALE.

scalp 1. To round trip trades quickly, frequently, and for very small profits. 2. To charge an excessive markup or markdown.

scalper 1. One who round trips trades quickly, frequently, and for very small profits. Historically, scalpers were usually exchange members who paid no commissions. 2. A dealer who charges excessive markups and markdowns.

scalping 1. To round trip trades quickly, frequently, and for very small profits. 2. Charging excessive markups or mark downs. 3. A practice in which an analyst establishes a position in a stock prior to issuing a recommendation.

Scarlet Woman of Wall Street A nickname for the Erie Railroad, which was subject to a tremendous amount of manipulation and speculation during the 1800s. See also ERIE BOARD.

scattered Describes trading interest that is dispersed among several relatively small market participants. For example, XYZ is $50 1/4-1/2, 20,000 by 5,000 Morgan and Monty on the buy side, scattered sellers.

scoop Buy aggressively within stated parameters, as in If ZVZZT gets down to the $24.75 level, scoop it.

SDBK An abbreviation of Super Display Book.

search costs The total explicit and implicit costs associated with finding a suitable counterparty with whom to trade.

seasoned issue Describes a secondary distribution of a stock for which a well established market already exists.

seasoned stock A stock with a well established reputation for quality, stability, and liquidity.

seat A membership on a physical exchange. The term originated from the earliest years of stock exchanges when members were assigned a specific chair at the prearranged call market auctions. Seats on the New York Stock Exchange were first made salable in 1868. Also called an exchange seat.

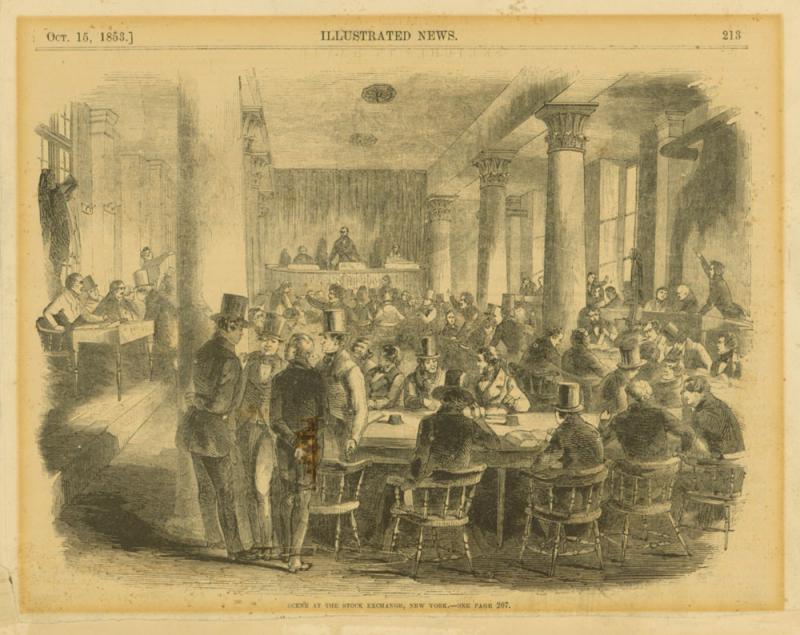

Seats at the New York Stock Exchange circa 1850 (published 1853)

Photo Credit: Museum of American Finance

SEC An abbreviation of Securities and Exchange Commission.

second market Industry jargon for the trading of New York Stock Exchange listed securities on REGIONAL STOCK EXCHANGES. See also FIRST MARKET, THIRD MARKET, and FOURTH MARKET.

second tier stock A stock of lesser perceived quality than a seasoned stock. Also known as a secondary stock.

secondary distribution/offering 1. The issuance of new shares by a company that has already had its initial public offering. 2. The sale to the public of large block of shares held by a major shareholder. See also REGISTERED SECONDARY OFFERING.

secondary listing A listing of a stock on an exchange other than its primary exchange.

secondary market The market where shares are traded following an initial public offering. The stock exchanges and the over-the-counter markets are all part of the secondary market. As opposed to the PRIMARY MARKET.

secondary precedence rules Exchange rules used to rank orders of equal primary precedence. Examples include TIME PRECEDENCE and SIZE PRECEDENCE.

secondary stock A stock of lesser perceived quality than a seasoned stock. Also known as a second tier stock.

sector 1. In general, a group of stocks that share similar characteristics. 2. More specifically, refers to the shares of companies in the same industry.

sector rotation The reallocation of assets from one sector to another, as in We're starting to see some sector rotation out of financials and into tech stocks.

secular The long term. Generally greater than ten years. For example, We saw a tremendous secular bull market in equities from 1982 to 2000.

securities Financial instruments that represent ownership of equity or debt.

Securities Act Amendments of 1975 Legislation that gave the Securities and Exchange Commission the authority to develop an integrated national market for securities.

Securities Act of 1933 The first federal law designed to regulate the securities markets in the United States. Required adequate disclosure of the facts regarding new issues sold to the public.

Securities and Exchange Commission (SEC) The primary federal regulatory agency charged with the oversight of the securities markets in the Unites States. Created by the Securities Exchange Act of 1934.

securities exchange Any formal, organized marketplace where securities are traded. Exchanges in the United States are regulated by the Securities and Exchange Commission. A securities exchange may be a physical location or an electronic trading platform. See also EXCHANGE.

Securities Exchange Act of 1934 Legislation that established the Securities and Exchange Commission. Created a series of laws to govern exchanges, the over-the-counter markets, broker/dealers, the extension of credit for securities trades, and the conduct of corporate insiders. Prohibited stock fraud and manipulation.

Securities Industry Regulatory Authority (SIRA) Prior (short lived) name of the Financial Industry Regulatory Authority (FINRA).

Securities Investor Protection Corporation (SIPC) A nonprofit insurance company established by Congress to protect the clients of bankrupt broker/dealers.

securities loan The lending of securities from one party to another primarily for use in the completion of short sales. Also called stock loan.

securities markets A general term for organized exchanges and over-the-counter markets designed to facilitate securities trading.

security A financial instrument that represents ownership of equity or debt.

security depository A centralized location in which security certificates are placed and stored. See also DEPOSITORY TRUST COMPANY (DTC).

Security Traders Association (STA) Established in 1934, the STA is the leading national professional association for buy side and sell side traders. It is essentially a compilation of various independent local affiliate associations such as the Security Traders Association of New York (STANY) and the Security Traders Association of Los Angeles (STALA).

Security Traders Association of Los Angeles (STALA) A nonprofit trade organization founded in 1936. Comprised of professional traders active in the Los Angeles, San Diego, and Arizona areas.

Security Traders Association of New York (STANY) A nonprofit trade organization founded in 1937. Comprised of professional traders active in the New York, New Jersey, and southern Connecticut areas.

seek a market Actively search for a buyer or seller of a particular stock.

SelectNet An order routing system formerly used by NASDAQ market makers and order entry firms to send orders directly to one another.

self-regulatory organization (SRO) An exchange, securities association, or clearing agency registered with the Securities and Exchange Commission. Such organizations are required to police the activities of their members. FINRA is the primary SRO for the broker/dealer community in the United States.

sell Dispose of stock in return for compensation, as in I think we should sell aggressively into this rally.

sell a bear An historic London slang term for the short sale of shares in expectation of a decline in prices. Equivalent to short of stocks.

sell at the close order An order to sell a specific quantity of stock at the official exchange closing price given a set of parameters, as in XYZ, sell 10,000 at the close. Also known as a sell on the close order. See also MARKET ON CLOSE ORDER and LIMIT ON CLOSE ORDER.

sell at the opening order An order to sell a specific quantity of stock at the official exchange opening price given a set of parameters, as in ZVZZT, sell 10,000 at the opening and then work an additional 50,000 over the day. Also known as a sell on the opening order. See also MARKET ON OPEN ORDER and LIMIT ON OPEN ORDER.

sell 'em (it) Industry lingo meaning "I agree to the bid you have proposed." For example, XYZ, I can pay $50 for 35,000 --- I'll sell 'em. See also SOLD.

sell limit order An order to dispose of a specific amount of stock at the designated price or higher. For example, ZVZZT, take an order to sell 10,000 with a $25 limit, I would.

sell off A rapid short term decline in the price of shares, as in The sell off today can be explained almost entirely by the poor jobs data.

sell on a scale Systematically place portions of a larger sell order at stated price intervals in order to average prices up. For example, XYZ, take 50,000 shares and sell it on a nickel scale from the $51 level. See also SCALE OUT.

sell on close order A MARKET ON CLOSE ORDER or LIMIT ON CLOSE ORDER to sell.

sell on open order A MARKET ON OPEN ORDER or LIMIT ON OPEN ORDER to sell.

sell on the close order An order to sell a specific quantity of stock at the official exchange closing price given a set of parameters, as in XYZ, sell 10,000 on the close. Also known as a sell at the close order. See also MARKET ON CLOSE ORDER and LIMIT ON CLOSE ORDER.

sell on the news See BUY ON THE RUMOR, SELL ON THE NEWS.

sell on the opening order An order to sell a specific quantity of stock at the official exchange opening price given a set of parameters, as in ZVZZT, sell 10,000 on the opening and then work an additional 50,000 over the day. Also known as a sell at the opening order. See also MARKET ON OPEN ORDER and LIMIT ON OPEN ORDER.

sell order An order to dispose of a specific amount of stock given a set of parameters, as in XYZ, take an order to sell 75,000 with an ultimate $50 low, not held.

sell order imbalance 1. Describes a situation in which sell orders outweigh buy orders to the extent that achieving a clearing price becomes difficult. May result in a temporary trading halt. 2. The negative difference between the amount of stock bid for and offered for the opening auction/cross or the closing auction/cross on an exchange.

sell out 1. The ENFORCED LIQUIDATION of a position or an account after a failure to meet a margin call. 2. The reselling of shares by a broker/dealer in the event that the original purchasing broker/dealer fails to pay for the shares. The original buyer is responsible for any loss incurred in the resale.

sell plus order A dynamic sell order that must be executed either on an uptick or a zero plus tick price. A relatively non-aggressive trading strategy. Also called a sell uptick order.

sell short To sell borrowed shares for the purposes of downside speculation, hedging, or market making. For example, ZVZZT, sell short 15,000 in line. The borrow is from Morgan.

sell side trader A trader who is employed by a broker/dealer firm.

sell stop limit order An order to dispose of a specific amount of stock if and only if the market price of the stock falls to the stop price stipulated on the order. Once the price is touched, the sell stop order becomes a limit order. For example, Open sell 25,000 XYZ at $45 stop limit.

sell stop order An order to dispose of a specific amount of stock if and only if the market price of the stock falls to the stop price stipulated on the order. Once the price is touched, the sell stop order becomes a market order. For example, Open sell 35,000 ZVZZT at $23 stop.

sell the book An instruction to sell every share posted at the best bid. "Book" refers to the specialist's book, where listed limit orders were historically recorded. For example, XYZ, it looks like there are 15,000 to buy at the best bid. I'd sell the book.

sell uptick order A dynamic sell order that must be executed either on an uptick or a zero plus tick price. A relatively non-aggressive trading strategy. Also called a sell plus order.

seller One who disposes of stock, or has an interest in disposing of stock, in return for compensation. For example, ZVZZT, I'm a seller up at the $26 level.

seller's market A market in which the demand for stock exceeds the supply of stock for sale, resulting in firmer prices.

sellers on balance Specialist's lingo used to indicate that there are more shares for sale on the floor than there are shares to buy at a particular point in time, generally for the market open or for the market close. For example, XYZ is paired on 50,000, 15,000 for sale.

selling climax The point at which a wave of indiscriminate selling becomes exhausted, leading to a reversal. Often signals the end of a prolonged bear market.

selling group All of the broker/dealers involved in marketing a new issue.

selling into strength Selling shares into a rising market. Often done in anticipation of a near term weakening in prices.

selling panic A severe disturbance in the financial markets caused by a sudden, widespread fear of economic and/or market collapse. Leads to indiscriminate selling and a rapid decline in stock prices.

send it in Trader to customer term meaning "I accept the terms of your proposed trade." For example, XYZ, I have 50,000 shares for sale at $25. --- Done that way. Send it in.

senior trader A highly skilled and/or well connected trader. Does not necessarily imply tenure. At a broker/dealer, the senior traders are generally more responsible for block trading, proprietary trading, and inventory management. See also TRADER, ASSISTANT TRADER, JUNIOR TRADER, and HEAD TRADER.

sensitive market A market where prices can be unduly influenced by news.

sentiment The mass psychology of the market, as in By the scope of today's decline, I'm thinking that market sentiment has turned decidedly negative.

Series 55 The examination required to be registered with FINRA as an EQUITY TRADER at a broker/dealer.

Series 63 The Uniform Securities Agent Laws examination required by individual states to be licensed as a registered representative.

Series 7 The examination required to be licensed with FINRA as a General Securities Registered Representative.

session The period of time from the official opening to the official close of trading. A regular trading session constitutes one day of trading for an organized exchange.

set back Short term selling pressure following a strong rally.

settle Complete a prearranged transaction.

settlement The transfer and delivery of securities in exchange for payment following a trade.

settlement date The date on which securities are delivered in exchange for payment. The settlement date for regular way equity trades on U.S. stock exchanges is three days following the trade date.

settlement period The period of time between the trade date and the settlement date during which the parties to a trade must remit payment or deliver shares.

settlement risk The risk that either a seller will be unable to deliver shares or a buyer will be unable to pay for shares by the settlement date. Also known as counterparty risk.

shake down the market Manipulate the market to affect lower prices.

shakeout A violent shift in market sentiment that forces many speculators to rapidly exit positions, often at a substantial loss. For example, That was one heck of a shakeout. Even some of my staunchest vanilla guys got caught up in it.

share A certificate or book entry that represents one unit of ownership of a corporation.

share broker A little used historic term for stockbroker.

share class A classification system for shares. Each class has different characteristics that are determined by the issuing company prior to the initial public offering.

share price The dollar amount at which a share of stock is quoted, traded, or otherwise valued.

share repurchase A program in which previously issued shares are purchased in the secondary market by the issuing corporation. Repurchased shares become treasury stock.

share turnover A measure of liquidity. Calculated by dividing the total number of shares traded over a specified period of time by the average number of shares outstanding during that period. The higher the number the greater the liquidity.

shareholder An owner of shares.

shearing a lamb Separating an inexperienced speculator from his capital.

sheep A speculator that is overly susceptible to suggestion.

Sheets, the An abbreviation for Pink Sheets.

shelf See BACK ON THE SHELF.

shock absorbers Industry jargon for circuit breakers.

shoestring trading Trading with only a small amount of capital.

shop 1. To inform potential customers of existing internal order flow in an effort to solicit offsetting customer orders, as in ZVZZT, you can shop 50,000 at an eighth. 2. To check with several market makers in order to ascertain the best bid and/or best ask for a particular stock, as in Give me a couple of minutes to shop for the stock, I'll be right back. 3. Industry lingo for a broker/dealer firm, as in What is your shop saying in XYZ this morning?

short 1. Selling short, as in I just shorted 50,000 XYZ at a quarter. 2. Short position, as in I'm short 50,000 XYZ at a quarter. 3. Short seller, as in I'm a short of 50,000 XYZ at a quarter.

short account The aggregate of short sales during a specified period. See also FOR THE SHORT ACCOUNT.

short against the box A short sale of a stock that is actually owned by the seller but that is unavailable for delivery. Creates offsetting long and short positions.

short and distort A method of stock manipulation in which a short seller spreads negative rumors in an attempt to affect lower prices.

short covering Repurchasing shares that had been sold short in order to close the position. For example, ZVZZT was up ten percent following earnings this morning, primarily on short covering.

short exempt A type of short sale where prints may legally be made on downticks.

short fail A trade in which the seller does not deliver securities in the designated manner at the prescribed time (usually by the settlement date).

short interest The total number of shares of a stock that have been sold short and not covered.

short interest ratio The total short interest divided by the average daily volume over a specified period of time.

short line The total number of shares short in an trading account. See PUT OUT A LINE.

short market Another term for an oversold market.

short of stocks To owe stocks in anticipation of lower prices, as in I plan to be short of stocks in front of the Fed announcement.

short position To owe shares for purposes of downside speculation, hedging, or market making, as in I may add to my XYZ short position depending on what management says on the call.

short sale The sale of borrowed shares for the purposes of downside speculation, hedging, or market making.

short sale rule A Securities and Exchange Commission rule that (when in effect) limits the execution of short sales to upticks or zero plus ticks.

short sell See SHORT SALE and SELL SHORT.

short sell against the box See SELL SHORT AGAINST THE BOX.

short seller One who sells borrowed shares, as in XYZ, I'm a short seller up at the $50.75 level.

short settlement Settlement of a trade earlier than the standard settlement date for the type of security traded. For U.S. domestic equities, short settlement would be any date earlier than T+3.

short side The side of the market preferred by traders who anticipate lower prices.

short squeeze Describes the predicament of short sellers who are compelled to cover their positions at a loss due to strong market conditions. Also known as a bear squeeze.

short stock Shares that have been sold short and not yet covered.

short tack A trader who is short of stocks for speculative purposes is said to have "taken the short tack." Also known as the bear tack.

short term A period of time from one day to approximately two months.

show (a bid/an offer) Industry jargon meaning present a trading opportunity to a customer, as in ZVZZT, why don't you show your guy 25,000 at $25.

show me buyer/seller A non-aggressive trader who would rather wait for a natural to appear than trade stock in the open market in the hopes of obtaining a more favorable price. Such a trader is more sensitive to price and market impact than to volume and immediacy.

show me stock A stock that has burned traders in the past and therefore needs to regain credibility before generating significant investor interest again. For example, I doubt that you'll get very far trying to unload that block of ZVZZT. It's become a real show me stock.

show your hand Reveal complete trading interest, as in Look, I'm not going to show my hand just because you're possibly in touch with a natural.

shut out the book To not allow public participation in a block trade on an exchange. See also SIZE OUT THE BOOK.

sick market A particularly weak market characterized by uncertainty, instability, fear, and discouragement.

sidelines A slang term for the place that an investor or trader sits and waits when he does not wish to trade in the current market. For example, I'm on the sidelines until these valuations come back to earth.

sideways Describes prices that move in a narrow range for an extended period of time. For example, Yesterday, the markets moved sideways for much of the day until good news from XYZ carried the markets higher.

significant order A order of sufficient size to materially affect the price of a stock.

significant order imbalance A situation in which orders on one side of the market so outweigh orders on the other side that achieving a clearing price becomes extremely difficult. May result in a temporary trading halt. See also ORDER IMBALANCE.

simultaneous transaction A general term for a trade in which a dealer establishes a position in order to satisfy an existing customer order. Usually a markup or markdown is added to the position price, which differentiates a simultaneous transaction from a riskless principal transaction. Also known as a riskless transaction.

SIPC An abbreviation of Securities Investor Protection Corporation.

SIRA An abbreviation of Securities Industry Regulatory Authority.

sit tight Wait, be patient. For example, Let's sit tight for a while. I think we'll see better prices heading into the close.

situation An industry term used to indicate involvement in a particular stock. Often implies significant size. For example, ZVZZT, I've got a good two way situation developing.

sixteenth One sixteenth of one dollar. Equivalent to $0.0625. Traditionally, regular priced stocks were quoted in eighths and quarters while lower priced stocks were quoted in sixteenths, as in ZVZZT is 1 3/16 - 1 1/4, 20,000 up.

size 1. The amount of stock bid for and/or offered at the inside market. In a quote, the bid size and ask size are separated by the word "by". For example, Right now, ZVZZT is $25-$25.10, 15,000 by 25,000. 2. The amount of stock involved in a trade or an indication. In an official INDICATION OF INTEREST, SMALL is less than 10,000 shares, MEDIUM is between 15,000 to 25,000 shares, and LARGE is more than 25,000 shares. More generally, GOOD SIZE is about 50,000 shares, SIZE is about 100,000 shares, GOOD SIX FIGURE SIZE is about 200,000 to 300,000 shares, and MULTIPLE SIX FIGURE SIZE is greater than 300,000 shares. 3. A nonspecific word for any very large trading situation. For example, XYZ, I'm a size buyer at the $50 level.

size out the book To SHUT OUT THE BOOK by executing a block trade on the floor of an exchange that is larger than the aggregate size of the orders held on the specialist's book at the execution price. In such a case, size precedence outweighs time precedence.

size precedence rules Exchange rules that stipulate that large (small) orders have precedence over small (large) orders.

skip day settlement Settlement of a trade one business day after the normal settlement day.

skyrocketing Rallying sharply in price, as in XYZ is skyrocketing after that unbelievably good earnings report.

slaughtered Declined severely in price due to indiscriminate selling, as in XYZ is getting slaughtered after that unbelievably bad earnings report.

SLD 1. An written abbreviation for sold. 2. As printed to the ticker tape, means sold sale. Indicates that the print is late and out of sequence.

sleep See BACK TO SLEEP.

sleeper A stock with good potential but limited current investor interest. For example, You should keep a close eye on ZVZZT. I think it may be a sleeper.

slid off Dropped in price, as in The market slid off some yesterday on fairly light volume.

slip A slight drop in price, as in The stock just slipped a little, but you're on the tape at $25.30.

slippage The difference between the expected execution price and the actual execution price. Also known as implementation shortfall.

slow market 1. A market with relatively low volumes and/or low volatility. 2. A market center in which trades are executed manually. In contrast to a FAST MARKET.

slow quote A quote that is not an AUTOMATED QUOTATION and is therefore not available for automatic execution. A slow quote may sometimes be traded through pursuant to Reg NMS. See also FAST QUOTE.

SLP An abbreviation of supplemental liquidity provider.

slug Slang for a relatively large amount of stock, as in XYZ, I'm looking to buy a slug if you happen to know where any bodies are buried.

sluggish Describes a dull market characterized by low volume, as in The market has been relatively sluggish heading into earnings season.

slump A period of weakness. Usually relatively short lived. For example, Since September was such a solid month, we may very well see a slump in October.

small An INDICATION OF INTEREST that expresses a general willingness to buy or sell 10,000 shares or less with a customer depending on the relationship with the customer, the market price, and the available liquidity. See also MEDIUM, LARGE, and SIZE.

small capitalization (cap) stock The stock of a company with a market value in the $250 million to $1 billion range.

small investor An individual investor that makes relatively small commitments.

Small Order Execution System (SOES) A computerized trading system formerly operated by NASDAQ that allowed order entry firms to automatically execute trades against NASDAQ market makers posting the best quote.

smart money Funds controlled by traders who have a reputation for making profitable commitments, as in Trust me, the smart money is all over this ZVZZT.

smart order router An algorithmic trading program that slices relatively large orders into smaller pieces and routes the individual pieces to various execution venues.

smashed Describes a market that has experienced a severe price decline due to indiscriminate selling. For example, They absolutely smashed XYZ after the CEO announced his "resignation."

snowball A situation in which a move in the market price of a stock causes stop orders to be exercised, which in turn magnifies the price move thereby causing more stop orders to be exercised.

SOES An abbreviation of Small Order Execution System.

SOES bandit A professional day trader whose trading strategy was to electronically target the stale quotes of slow moving market makers in volatile stocks through the NASDAQ Small Order Execution System.

soft dollars Payments made by institutional investors for products and services provided by broker/dealers through trading commissions rather than by cash.

soft market A market characterized by declining prices and low volume, as in For all of the allegedly "good" news out there, the market has been very soft lately.

soft spot A relatively weak sector in an otherwise strong market. For example, These tech names have really been a soft spot in the market the past few days. They can't seem to get out of their own way.

soft stop The unofficial price at which a trader believes he should exit an position. Also known as a mental stop. As opposed to a HARD STOP.

sold 1. Having disposed of a stock in exchange for compensation. For example, I think I might have sold my XYZ position a little too soon. 2. In general, industry jargon meaning "I accept the terms of your proposed trade." For example, ZVZZT, I can offer you 50,000 at $25. --- Sold. 3. More specifically, industry jargon meaning "I accept your bid." For example, ZVZZT, 3/4 for 10,000. --- Sold. Also known as sell 'em. See also TAKE ('EM).

sold out market Another term for washed out market.

sold sale A trade that is reported late and out of sequence. See also SLD.

sold to you 1. Industry jargon meaning "I accept the terms of your bid." For example, XYZ, I can pay $50 for 25,000. --- Sold to you. 2. A slang term used by traders to indicate general disapproval or lack of interest. For example, Hey, I'm getting a tofu salad for lunch. Want some? --- Sold to you bro.

solicited order An order that results from direct customer communication that was initiated by a broker/dealer. See also UNSOLICITED ORDER.

sophisticated investor An investor with enough knowledge and experience to evaluate investment opportunities on their merits.

south The direction that a stock heads as its price declines. See GOING SOUTH.

space A group of stocks that possess common properties. Also known as a universe. See also SECTOR.

SPDRs (spiders) Industry jargon for Standard & Poor's 500 Composite Price Index depository receipts.

special bid A bid presented to multiple small sellers on the floor of an exchange by a single buyer who is looking to purchase a block of stock. The aggregate of sell orders are used to satisfy the bid.

special stocks Stocks that are hard to borrow. Such stock may be described as on special.

specialist A member of a physically convened stock exchange who has been granted primary responsibility for facilitating trading in a specific stock. A specialist conducts a continuous two sided auction, acts as a broker for floor brokers, posts quotes, manages limit orders, and executes marketable orders. A specialist also acts as a dealer or market maker in his assigned stocks and as such is required by the exchange to maintain a fair and orderly market. See also DESIGNATED MARKET MAKER.

specialist block purchase and sale The purchase of a block of stock by a specialist as principal either for his own account and risk or to distribute to other floor traders.

specialist firm A firm that derives the majority of its income from specialist activities. Usually employs multiple specialists and clerks.

specialist go along Permission granted by a floor broker to a specialist that allows the specialist to participate as a principal on parity with a CAP-DI order entered by the floor broker.

specialist market A two way quote provided by a specialist in which the specialist himself is acting as principal on both sides. Usually due to a lack of public orders.

specialist unit A group of specialists who work together.

specialist's book A record maintained by a specialist that includes personal inventory, public limit orders and stop orders, and orders placed by other floor members.

specialist's clerk A floor employee of an exchange member or member firm that is charged with assisting a specialist with facilitating trading in a specific stock or group of stocks.

specified price benchmark An transaction cost estimate derived by multiplying the trade size by the difference between the benchmark price and the trade price.

speculating for differences An old London term for day trading.

speculation 1. Conducting relatively risky trading operations in the expectation of profiting from price movements. 2. Trading based on volatility and probability rather than fundamentals or benchmarks.

speculative Relatively risky.

speculative bubble A situation in which the price of an asset rises far beyond any reasonable measure of intrinsic value.

speculative investment The purchase of securities ostensibly for the interest and dividend payments but also with the definite intention of selling should there be a material price increase.

speculative trading Trading based on volatility and probability rather than fundamentals or benchmarks.

speculator One who conducts relatively risky trading operations in the expectation of profiting from price movements.

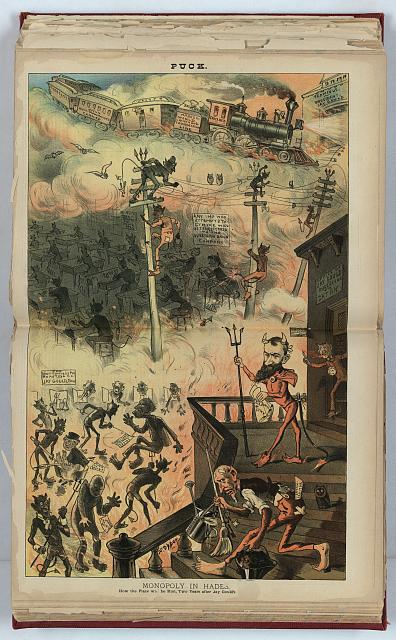

Speculators (such as Jay Gould, pictured) have not always been held in the highest regard, 1883

Photo Credit: Library of Congress

spiders (SPDRs) Industry jargon for the Standard & Poor's 500 Composite Price Index depository receipts.

spike 1. A sharp, rapid, and often temporary increase (or decrease) in prices, as in The market spiked right after the quantitative easing was announced, but then proceeded to drift lower. 2. Industry jargon for an order ticket. Derives from the practice of placing the physical ticket on a metal spike upon execution or cancellation.

spill 1. To aggressively sell a stock at the market, regardless of the effect on price. 2. To sell a stock very quickly, usually in large quantities.

split (up) An increase in the number of shares outstanding of a particular corporation with a proportional decrease in the price of the shares. Net neutral to market capitalization.

split down Another term for reverse stock split.

split order A relatively large order that has been divided into smaller pieces either to avoid seriously impacting the market price (legitimate) or to make each piece fall below a maximum automatic execution threshold (dubious or illegal).

split prints To equally divide partial executions between multiple orders that have parity. For example, ZVZZT, you want to buy 50,000? Great, but I'm already working a buyer, so you'll be splitting prints with him. See also SUBJECT TO A SPLIT.

split quotation A fractional quotation in which the smallest regular price has been cut in half (i.e. sixteenths instead of eighths).

split stock New outstanding shares created by a stock split.

Spokane Stock Exchange A regional stock exchange founded in 1897 in Spokane, Washington. Was the last mining exchange remaining in the U.S. when it finally closed in 1991.

spoken for The portion of a block trade that has been placed with natural customers. For example, Just to keep everyone up in XYZ, we have a natural seller of 500,000 shares. Right now, 350,000 are spoken for, so we're open on 150,000.

sponsored market access Access gained by non-member traders directly to the electronic trading platforms of NASDAQ market makers, the exchanges, or ECNs by using the identification of a sponsoring member firm. Sponsored traders often employ an access infrastructure that is not controlled by the sponsoring firm.

sponsorship The parties that explicitly or implicitly stand behind a particular stock. May be an underwriter, a wholesaler, or the mysterious THEY.

spoofing Entering and cancelling orders with no intent of actually executing the orders. The intent rather is to gauge market reaction and/or manipulate prices. See also LAYERING.

spooz A slang term for the S&P 500 index futures contracts.

spot news A unexpected piece of news that has a short term influence on prices.

spot secondary A secondary offering of stock that does not require any additional SEC filings. Spot secondaries are usually concluded very quickly with shares offered directly to institutional investors rather than to the public.

spread 1. The difference between the bid price and the asked price, as in Right now, XYZ is trading with a $0.15 spread. 2. The difference between the price of the same security in two different markets. See also ARBITRAGE. 3. The difference between the price of two different but related securities. See also PAIRS TRADING.

spread components See ADVERSE SELECTION SPREAD COMPONENT, TRANSACTION COST SPREAD COMPONENT, and TRANSITORY SPREAD COMPONENT.

spread trader A dealer that makes the majority of his income by purchasing shares on the bid and selling them on the offer.

spreading risk Trading in multiple issues to decrease exposure to any one particular situation.

spurt 1. A sharp, but short lived, increase in prices, as in There was a spurt following the election results, but the market quickly retraced those gains to close flat on the day. 2. A spike in volume, as in There was a spurt following the election results, but the market quickly settled back into more normal trading patterns.

squawk box A slang term for an intercom system used by broker/dealers to internally disseminate trading information. Also called a hoot-n-holler.

squeeze See LONG SQUEEZE, SHORT SQUEEZE, and CORNERING THE MARKET.

squeezed out Forced liquidation of a position due to an inability to sustain further losses.

SRO An abbreviation of self-regulatory organization.

St. Louis Stock Exchange A regional stock exchange founded in 1899 in St. Louis, Missouri. Merged with the Chicago Stock Exchange, the Cleveland Stock Exchange, and the Minneapolis/St. Paul Stock Exchange in 1949 to form the Midwest Stock Exchange.

STA An abbreviation of Security Traders Association.

stabilization 1. Pegging the price of a stock such that the market price will not fall below a given bid price. 2. Describes a period of relatively flat prices following a significant move.

stable market A market that can accommodate relatively heavy trading volume without significantly affecting prices.

stag 1. A slang term for one who round trips trades quickly, frequently, and for very small profits. 2. An historic London term for one who subscribes for shares of new issue merely to sell at a profit immediately upon the commencement of secondary trading.

stagging An historic London term for subscribing for shares of a new issue merely to sell at a profit immediately upon the commencement of secondary trading.

stagnation A period of low trading volumes.

stake The amount of a particular stock owned or owed by a trader.

STALA An abbreviation for Security Traders Association of Los Angeles.

stale bull account An historic London term for weary, anxious long holders.

stale price A relatively old price that does not necessarily reflect current conditions.

stand up A situation in which a trader will buy or sell an indicated amount of shares even if his customer falls down. For example, XYZ, I'm in touch with a large buyer. Not sure where he lives right now, but I'll stand up for 50,000 right here.

standard stocks An historic term for shares of well known companies.

standing See priority.

standing order A live order that other traders can trade against, as in I have three standing limit orders in XYZ right now at different price levels.

STANY An abbreviation for Security Traders Association of New York.

statistical arbitrage A strategy in which computers are programmed to use mathematical models to identify pricing inefficiencies and inconsistencies across many financial instruments. Often employed by firms involved in HIGH FREQUENCY TRADING. Specifically, statistical arbitrage programs place simultaneous bets that the prices of such "mispriced" securities will trend toward their historical norm by buying underpriced instruments and selling overpriced ones. See also ARBITRAGE.

stay with it Trader's lingo meaning "continue to buy (or sell) stock even if the price moves adversely." For example, ZVZZT is starting to get away from us a little bit. What do you want to do? --- Yeah, its a tough trader, just stay with it for now.

staying power The ability of a trader to maintain a position even in the face of an adverse price move. For example, Joe definitely has some staying power. I'd have dumped that stock a long time ago.

steady Describes a market characterized by low volatility.

stealth trading Trading in such a manner that other market participants are unable to ascertain trading patterns.

steam The power that drives share prices higher, as in It looks like the market is starting to run out of steam here.

steenth Industry slang for sixteenth.

step aside To allow a block trade to print without your participation even if you were entitled to participate. For example, Go ahead and do what you gotta do in ZVZZT. I'll step aside.

step in Credit received from another broker/dealer for a customer trade executed at that broker/dealer. Generally done at the request of the customer. See also STEP OUT.

step out Credit given to another broker/dealer for a customer trade that you actually executed yourself. Generally done at the request of the customer. See also STEP IN.

step up order See flash order.

stock A security that represents ownership in a corporation.

stock ahead An addendum to a nothing done report issued from the floor of an exchange to a customer with a marketable limit order on that exchange. Specifically issued when stock trades on the exchange at the customer's limit price, but the customer receives no partial executions because other orders on the floor priced at the same level have time priority. For example, Report to buy 5000 XYZ at $50.20. --- Nothing done, stock ahead at $0.20.

stock bashing A method of stock manipulation in which negative rumors are spread in an attempt to affect lower prices.

stock certificate A physical document that represents partial ownership of a corporation.

stock clearing firm See CLEARING FIRM.

stock exchange A formal, organized marketplace where corporate shares are traded. Stock exchanges in the United States are regulated by the Securities and Exchange Commission. A stock exchange may be a physical location or an electronic trading platform. See also EXCHANGE.

stock jobber An older, less used term for market maker. Originated in London.

stock jobbing 1. An older, less used term for market making. Originated in London. 2. Manipulating stocks.

stock loan The lending of securities from one party to another primarily for use in the completion of short sales. Also called securities loan.

stock market The organized trading of shares.

stock market crash An exceptional loss of value in the stock market.

stock repurchase A program in which previously issued shares are purchased in the secondary market by the issuing corporation. Repurchased shares become treasury stock.

stock split An increase in the number of shares outstanding of a particular corporation with a proportional decrease in the price of the shares. Net neutral to market capitalization.

stock symbol The ticker symbol for a stock.

stock ticker 1. An electronic device used to relay trade information from the exchanges to individual traders. Generally provides the ticker symbol along with quotes or the latest trade price and volume data. First introduced in 1867. 2. Another term for ticker symbol of a stock.

stockbroker A commission agent who buys and sells stocks on behalf of customers.

stockholder Another term for shareholder.

stop and reverse order A stop order that, if touched, instructs the broker to close the current position and open an opposite position.

stop hunting A trading strategy that involves moving the price of a stock to a price level believed to hold a large quantity of stop orders (for instance, a significant round number). If a relatively large number of stop orders are triggered, additional short term momentum can be generated. See also MOMENTUM IGNITION.

stop limit order An order to buy or sell a specific quantity of stock at a limit price (the stop limit price) if and only that stop limit price is touched. For example, Sell 25,000 XYZ at $50 stop limit.

stop limit price See STOP PRICE.

stop (loss) order An order to buy or sell a specific amount of stock at the market if and only if a certain predetermined price (the stop price) is touched. For example, Open sell 25,000 XYZ at $50 stop.

stop price 1. The action price specified in a stop (loss) order or a stop limit order. 2. The price at which a dealer stopped a customer.

stopped A situation in which a dealer guarantees a customer an execution price no worse than the stated stop price. The dealer then attempts to execute the order at a better price for the customer. This method has also been used by dealers attempting to mitigate personal risk when front ending an order or positioning a large block from a customer. Since (under certain circumstances) a stopped order does not need to be reported to the tape until the order is actually stopped out, a dealer can essentially split the order/position and more stealthily trade smaller pieces with the Street. For example, ZVZZT, you've got 100,000 for sale? I'll stop you on 25,000 at $25 to work the balance.

stopped out 1. The purchase or sale of stock executed under a stop order or a stop limit order. For example, XYZ moved lower this morning, so you got stopped out of your position. So you sold 10,000 at $49.75. 2. The actual execution and print to the tape of an order than had been stopped by a dealer. For example, ZVZZT, is trading down at $24.75 now, so you're stopped out on 25,000 at $25. If ok, I'm going to get right, then we can start working on the balance of your order.

stopped stock See stopped.

story stock A stock that requires an in depth explanation as to its merits. For example, Good luck convincing your account to buy XYZ. That is the definition of a story stock.

straddle the market Historically, a term for a hedged position.

straight cancel (can) order An instruction to completely void the unfilled portion of an existing order, as in ZVZZT, straight can the balance at a quarter, I'm going to hold off until closer to the close.

stray A relatively small order that is not necessarily representative of a customer's overall interest in the stock, as in ZVZZT, I catch a stray 4300 for sale.

Street, the An abbreviation for Wall Street. In this context, the overall community of financial firms and professionals in the United States. Includes brokers, dealers, underwriters, and institutional investors.

street broker An over-the-counter broker. Not an exchange member.

street name A method of registration that allows securities to be held in the name of a broker/dealer on behalf of a customer.

strength The extent to which buyers outnumber sellers, as in Financial industry stocks showed particular strength today even in the face of less than ideal economic data.

string A series of trades in one specific stock.

strong Describes a market in which buyers outnumber sellers, as in Utility stocks were particularly strong today as investors flocked to securities viewed as safe havens.

strong hands Patient, well capitalized investors.

structured products Customized derivatives-based financial instruments. Generally offered by banks and broker/dealers.

stub quote A nominal quote published by a market maker that is significantly away from the current inside market. Often done by a market maker who needs to comply with regulations but who does not actually want to trade in the current market.

stuckholder A slang term to describe an owner of shares that cannot be sold, as in This XYZ was just supposed to be a quick turn, but now it seems I've become a stuckholder.

style rotation The reallocation of assets from one strategy or "style" (e.g. growth, GARP, value, small cap, mid cap, large cap, etc.).to another.

subaccount From the point of view of a broker/dealer, means a customer of an institutional investor.

subject Trader's lingo meaning "conditional." As opposed to FIRM. See terms listed below as well as TREAT ME SUBJECT.

subject bid A bid from a trader that is conditional on further negotiation or customer confirmation. See also TREAT ME SUBJECT.

subject market 1. A market in which quotes are not firm but rather are conditional on confirmation or further negotiation. 2. See SUBJECT QUOTE.

subject offer An offer from a trader that is conditional on further negotiation or customer confirmation. See also TREAT ME SUBJECT.

subject quote 1. A quote that represents a dealer's approximation of price. 2. A dealer quote that requires further negotiation with interested parties before becoming firm.

subject to a (New York) can Trader's lingo meaning "conditional on the receipt of an official out from the cancellation of an order currently on the floor of the (indicated) exchange." For example, XYZ, we can put up 100,000 in Chicago subject to a New York can.

subject to a split A trader's indication to a customer that the bid or offer that he has been shown will also be shown to other potential customers who will have an opportunity to participate as well. The customer may therefore only be able participate in a portion of any resulting trade. For example, ZVZZT, I have 100,000 for sale at $25, subject to a split. --- I'd buy 100,000 at $25. --- You bought 50,000 at $25 along with one other guy. Seller and other buyer watching for now.

sub-penny pricing Trading in increments of less than one cent. It is a violation of Rule 612 of Reg NMS for a broker/dealer to quote, or accept or display limit orders, in sub-penny increments for stocks priced higher than $1. However, INTERNALIZERS and HIGH FREQUENCY TRADING programs can and often do seek to marginally improve the price of incoming marketable orders if they have detected the existence a significant limit order that can be used as downside protection.

subscriber See railbird.

sunshine trader Slang term for a trader who openly communicates his trading interest to the marketplace. Generally most successful if the trader has a reputation for being a large, honest, UNIFORMED TRADER.

super 1. N: An abbreviation of super message, as in How many supers have we sent out in the past hour? 2. V: To send a SUPER MESSAGE, as in XYZ, I just supered 100,000 at $50.

Super Display Book (SDBK) A high speed computerized order delivery and processing system developed by the New York Stock Exchange as a replacement for the SuperDOT system.

super message An electronic indication of trading interest provided by dealers to institutional investors. Specifies a precise quantity and price. For example, ZVZZT, I sent a super message offering 25,000 at $25.50 five minutes ago. I'll still make that sale. See also FIX MESSAGE.

SuperDOT Was a computerized order routing and execution system developed by the New York Stock Exchange to electronically send orders directly to the point of sale on the floor. It supplanted the original Designated Order Turnaround system (DOT) in 1984. Has since been replaced by the Super Display Book (SDBK).

SuperMontage A trading platform developed by NASDAQ in 2002 to replace SOES and SuperSOES. Subsequently replaced by the NASDAQ Market Center in 2004.

Supplemental Liquidity Provider (SLP) A market participant on the New York Stock Exchange that uses computerized algorithms to post liquidity in exchange listed stocks. SLPs receive a rebate for posting liquidity.

supply The quantity of shares for sale.

supply area Another term for resistance level.

support An increase in the demand for shares at a given price level, as in ZVZZT drifted lower for most of the day but eventually found support at the $25 level.

support level A price level at which demand from buyers tends to halt a downward price move. For example, It definitely looks like $25 is a big support level in ZVZZT. It's bounced off there several times the past few weeks.

support the market Enter buy orders primarily to halt a price decline.

supporting order A buy order entered primarily to halt a price decline.

suspended trading An indefinite trading halt in a particular stock often due to a particularly severe order imbalance.

swap A derivatives contract between two parties for the exchange of future cash flows associated with specified underlying assets.

sweep (to fill) order A type of (electronic) order that splits a relatively large order into smaller pieces in order to quickly identify and source liquidity across multiple trading venues.

sweep (the market) To take liquidity from all available sources in the market simultaneously. Basically the same as hit the bids or take the offers. See also INTERMARKET SWEEP ORDER.

swimming market A strong market.

swing A price movement, as in ZVZZT quickly swung from negative territory to positive after the analyst at Bear came out defending the name.

swing trade A type of momentum trade where a position is established and closed within a few days.

switch order A contingency order to buy (sell) one stock and simultaneously sell (buy) a different stock with a stipulated price spread.

switching Closing one position in order to open a new one. For example, I'm switching out of XYZ and in to ZVZZT. I just think the growth profile is far more attractive.

swoon A slang term for a price decline, as in The market swooned after Morgan's strategist lowered his 2011 forecast.

symbol A system of letters used by market participants to identify particular securities. Every security listed on an exchange has a unique symbol. Historically, exchange listed stocks were represented by symbols that contained three or fewer letters, while NASDAQ and over-the-counter stocks used symbols that contained four or five letters.

systematic investing (trading) A strategy in which fundamental, technical, macro, or market data points as well as trading rules and risk parameters are incorporated into models which are designed to identify and execute investment and trading opportunities based on inputted information. Portfolio manager intervention and trading discretion are therefore severely limited. As opposed to DISCRETIONARY INVESTING (TRADING).

sympathy See IN SYMPATHY.

Copyright 2016 by Brian W. Leite. All rights reserved. Reproduction of all or part of this dictionary without explicit permission is prohibited..