MARKET STRUCTURE DICTIONARY

BY

BRIAN W. LEITE

An Insider's Guide to the Real Language of

Trading and Exchanges

Over 2700 Entries

N.G. Basically stands for "not good." Applies to many aspects of the securities business. For instance, a bad delivery, a cancelled trade, and stolen shares may all be labeled N.G.

naked access The provision of DIRECT MARKET ACCESS to a customer without maintaining a system of risk management controls and supervisory procedures to limit financial exposure and ensure regulatory compliance. Illegal under SEC Rule 15c3-5.

naked position A slang term for a position that has not been hedged.

naked short sale A short sale in which shares have not been borrowed or located.

name Industry jargon for security. For example, As of today, I have fifty names on my pad.

name a price To create a specific bid and/or offer at the request of a customer. Also known as make a market or make a price.

names later report A report from the floor of an exchange that provides the quantity and price but does not provide the name of the contra broker. The name of the contra broker will be given later.

nano capitalization (cap) stock The stock of a small public corporation with a market value under $50 million.

narrow market A market with few traders, low liquidity, wide spreads, and high volatility.

narrow the spread Enter a quote the causes the difference between the bid price and the asked price of a stock to decrease.

NASD An abbreviation for National Association of Securities Dealers.

NASD Regulation See FINANCIAL INDUSTRY REGULATORY AUTHORITY (FINRA).

NASDAQ Originally, an abbreviation of National Association of Securities Dealers Automated Quotation System. Now, usually an abbreviation of NASDAQ Stock Market.

NASDAQ Capital Market An electronic marketplace established by NASDAQ specifically to trade the issues of smaller companies that do not qualify for inclusion in the NASDAQ Global Market or the NASDAQ Global Select Market. Until September of 2005, it was known as the NASDAQ SmallCap Market.

NASDAQ Global Market An electronic marketplace established in 2006 specifically to trade those NASDAQ issues that do not meet the listing requirements for the NASDAQ Global Select Market but exceed those for the NASDAQ Capital Market. Prior to 2006, such stocks were listed on the NASDAQ National Market (NMS). See also NASDAQ GLOBAL SELECT MARKET.

NASDAQ Global Select Market An electronic marketplace established in 2006 specifically to trade those NASDAQ issues that meet the absolute highest listing standards. Prior to 2006, such stocks were listed on the NASDAQ National Market (NMS). See also NASDAQ GLOBAL MARKET.

NASDAQ InterMarket An electronic marketplace that allowed NASDAQ market participants to quote and trade exchange listed securities through the Computer Assisted Execution System (CAES) and the Intermarket Trading System (ITS). It was essentially NASDAQ's version of the THIRD MARKET.

NASDAQ Level 1 A subscription service offered by NASDAQ that provides real time quotes for the NBBO in NASDAQ and OTC Bulletin Board stocks.

NASDAQ Level 2 A subscription service offered by NASDAQ that supplies all NASDAQ Level 1 data as well as provides the real time top of file position data for every NASDAQ market participant in NASDAQ, NYSE, Amex, and regional exchange stocks. Also provides order entry firms with the ability to enter and execute trades in all NASDAQ automated systems.

NASDAQ Level 3 Historically, the basic trading platform available to NASDAQ market makers. Comprised of both the information available to Level 2 quote subscribers as well as quoting, trading, and reporting functionality. Now part of the NASDAQ Market Center.

NASDAQ Market Center A trading platform developed by NASDAQ and implemented in 2004 that incorporates all of NASDAQ's quoting and trading functionality into one system.

NASDAQ market maker A dealer who maintains firm two way quotes in NASDAQ securities and stands ready to trade at his quoted prices. A NASDAQ market maker may also facilitate the execution of customer orders either as principal, as riskless principal, or as agent.

NASDAQ National Market System (NMS) An electronic marketplace established by NASDAQ specifically to trade the issues of the largest firms listed on NASDAQ. Possessed the strictest listing and trade reporting requirements of the NASDAQ platforms. In 2006, the National Market was divided into the NASDAQ Global Market and NASDAQ Global Select Market.

NASDAQ NMS An abbreviation of NASDAQ National Market System.

NASDAQ OMX BX See BOSTON STOCK EXCHANGE.

NASDAQ OMX PHLX See PHILADELPHIA STOCK EXCHANGE.

NASDAQ OpenView See NASDAQ LEVEL 2.

NASDAQ order entry firm A member firm that enters orders into the NASDAQ system for execution by other market participants. A non-market maker.

NASDAQ SmallCap Market Former name of the NASDAQ Capital Market.

NASDAQ Stock Market The premier electronic national securities exchange. The National Association of Securities Dealers Automated Quotation System was established in 1971 by the NASD in an effort to provide more visibility into an over-the-counter market that had long relied on a telephone network and Pink Sheet listings. NASDAQ operated originally as an automated inter-dealer quotation system for over-the-counter securities and ultimately became a market technology innovator. Successfully merged the liquidity benefits of an established dealer market with the visibility benefits of electronic quoting. Developed the Small Order Execution System (SOES) in response to Black Monday (1987). Became the primary listing venue for technology firms in the 1980s and 1990s. Acquired the INET ECN in 2005 and integrated its functionality into that of the NASDAQ Market Center. Officially became a national securities exchange in 2006.

NASDAQ TotalView A subscription service offered by NASDAQ that provides the full order book depth for all NASDAQ market participants. Also disseminates the net order imbalance indicator for opening and closing crosses. Services NASDAQ, NYSE, and Amex stocks.

NASDAQ trader A sell side trader who specializes in trading NASDAQ securities. See also NASDAQ MARKET MAKER.

NASDAQ Workstation An electronic quoting and trading platform developed by NASDAQ to provide market data information, market making and order entry capability, and trade reporting services to traders at NASDAQ member firms.

National Association of Securities Dealers (NASD) An association of over-the-counter broker/dealers created in 1939 in order to establish legal and ethical standards of conduct for its members similar to those that existed for members of physical stock exchanges. See also NASDAQ STOCK MARKET.

National Association of Securities Dealers Automated Quotation System (NASDAQ) See NASDAQ STOCK MARKET.

national best bid and offer (NBBO) The best bid and best offer available for a given stock at any particular time. Distilled from the competing quotes and orders of all market participants.

National Market System (NMS) 1. See NASDAQ NATIONAL MARKET SYSTEM (NMS). 2. See REGULATION NMS.

National Petroleum Exchange A minor New York City securities exchange. Merged with the Mining Stock Exchange in 1883.

National Quotation Bureau (NQB) The original publisher of the Pink Sheets, the White Sheets, and the Yellow Sheets. The NQB was organized in 1913 through the merger of two smaller quote services, one founded in 1904 by Roger Babson and the other founded in 1911 by Arthur Elliot. Prior to 1904, the custom of over-the-counter broker/dealers was to advertise quotes and inventory in financial publications and in the financial pages of daily newspapers, or simply to distribute circulars. The NQB was therefore the first company to systematically organize and publish securities quotes in the over-the-counter market. Now known as OTC Markets Group.

National Securities Clearing Corporation (NSCC) A company established in 1976 that provides clearing, settlement, risk management, central counterparty services, and a guarantee of completion for virtually all broker-to-broker equity trades. NSCC also nets trades and payments among its participants. Currently a subsidiary of the Depository Trust and Clearing Corporation (DTCC).

national securities exchange A term used to identify any U.S. exchange officially registered with the Securities and Exchange Commission.

National Stock Exchange 1. See NATIONAL STOCK EXCHANGE, CHICAGO. 2. The name of an exchange that operated briefly in 1869 in New York City. See ERIE BOARD. 3. The name of an exchange that operated in New York City from 1962 to 1974.

National Stock Exchange, Chicago An electronic stock exchange based in Chicago, Illinois. Originally founded in Cincinnati, Ohio in 1885 as a physically convened exchange called the Cincinnati Stock Exchange. In 1976, the Cincinnati Stock Exchange closed its trading floor and became an all electronic stock exchange. The exchange moved its headquarters to Chicago in 1995 and changed its name to the National Stock Exchange in 2003.

natural In general, industry jargon that basically means "customer." More specifically, the term is often used to describe an indication or a quote provided by a sell side trader that is based on an actual customer order and not merely on proprietary trading interest. For example, XYZ, I'm a natural seller of 100,000 in line. Good calls only on this one please.

natural corner A CORNER in a stock that is not the result of manipulation.

NBBO An abbreviation for national best bid and offer.

near term Another phrase for short term.

near the quote limit order A buy order with a limit price that is below the best bid by $0.10 or less or a sell order with a limit price that is higher than the best ask by $0.10 or less.

need the tick A trader's term meaning "my sell order is, in fact, a customer short sale." Derived from regulations requiring short sales to be executed only on upticks or zero plus ticks. For example, XYZ, I have 25,000 to travel, I need the tick.

negative obligation Historically, a New York Stock Exchange mandate that forbade specialists from trading stock from their proprietary account when they held customer buy and sell orders that paired off naturally.

negotiated commission A commission rate that is subject to bargaining between the customer and the broker/dealer. In contrast to FIXED COMMISSIONS. See also MAY DAY.

negotiated market A market in which the terms of each trade are negotiated between the buyer and seller. Often, at least one side of the trade is a dealer. The over-the-counter stock market has traditionally operated as a negotiated market.

negotiation 1. In general, arranging the terms of a any trade. 2. More specifically, industry jargon for the process of arranging a trade between a dealer and at least one customer. For example, XYZ, we're in negotiations on 100,000. If you need protection, let me know now.

Nervous Nellie A slang term for a trader who is very uncomfortable with holding positions. For example, Jeez Jim, you dumped ZVZZT already? When did you become such a Nervous Nellie?

net 1. Another word for profit, as in I made $20,000 net on the XYZ trade. 2. Indicates a price that includes any commission, commission equivalent, markup, or markdown. For example, ZVZZT, you can offer your guy 35,000 at $25 net. See also NET TO YOU.

net buyers Describes a situation where liquidity demanders wish to buy more stock than than they wish to sell.

net capital requirement rule An industry term for Securities and Exchange Commission Rule 15c3-1 that stipulates the minimum capital required to be held by a broker/dealer.

net change The difference in the closing price between one time period and the previous time period. Usually from day to day.

net long Describes a trader with total long commitments that exceed his total short commitments.

net position The difference between a trader's total long and total short positions. See also NET LONG and NET SHORT.

net sellers Describes a situation where liquidity demanders wish to sell more stock than than they wish to buy.

net settlement See CONTINUOUS NET SETTLEMENT.

net short Describes a trader with total short commitments that exceed his total long commitments.

net to you Industry jargon used to indicate that a quote or a trade includes any commission, commission equivalent, markup, or markdown. Represents the actual price to the customer. For example, ZVZZT, I can offer 50,000 at $25 1/2 net to you.

net trade A trade in which the commission, commission equivalent, markup, or markdown is built into the execution price. See also NET TO YOU.

Network A The reporting service of the CONSOLODATED TAPE ASSOCIATION that covers New York Stock Exchange listed securities. Also known as Tape A. See also NETWORK B.

Network B The reporting service of the CONSOLODATED TAPE ASSOCIATION that covers securities listed on any national securities exchange other than the New York Stock Exchange or the NASDAQ. Also known as Tape B. See also NETWORK A.

neutral Neither bullish nor bearish. For example, I'm neutral on the name. I think it’s going to be dead money until they get their management issues worked out.

New Board of Stock Brokers A stock exchange organized in New York City by a group of curbstone brokers around 1834. By early 1837, the New Board had more members and higher volume than the New York Stock and Exchange Board. However, it closed as a result of the Panic of 1837. It reformed in 1845 and again saw a measure of success, but again faded away around 1848. Also known as the Bourse.

new high Describes the price of a market or of a stock as it trades through the previous high point of a specified period of time. Usually implies a one year time horizon. For example, ZVZZT broke out to new highs following an unexpected positive earnings pre-announcement.

new issue A security that is offered to the public for the first time.

new issues market The niche in the overall market in which new issues are first sold to the public. Also called the primary market.

New Orleans Stock Exchange A regional stock exchange located in New Orleans, Louisiana. Merged with the Midwest Stock Exchange in 1959.

New Room The fifth trading room added to the floor of the New York Stock Exchange. Located at 30 Broad Street. It was closed in February 2007.

New York Curb Exchange The original name of the American Stock Exchange.

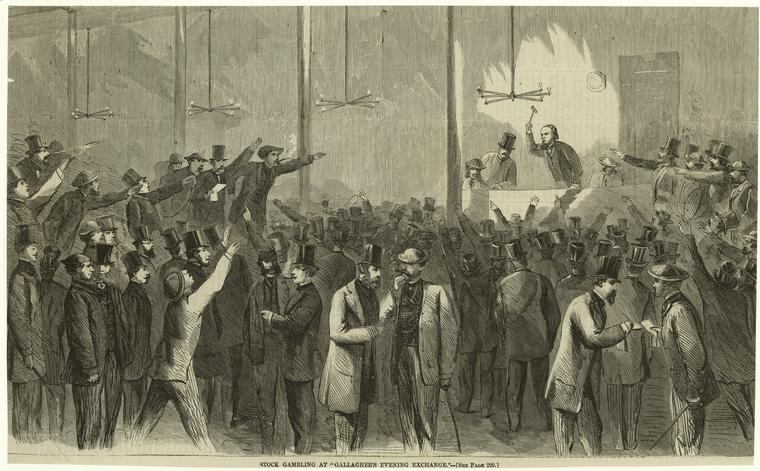

New York Evening Exchange In April of 1865, a curbstone broker named R.H. Gallagher erected a building on the corner of 24th Street and Fifth Avenue that he called the New York Evening Exchange. It could hold one thousand traders, and was, at that time, the only building in New York designed primarily for stock trading. While the Evening Exchange was very successful initially, opposition from the New York Stock Exchange and the Open Board of Stock Brokers forced the Evening Exchange to close its doors in relatively short order. See also EVENING EXCHANGES.

Gallagher's New York Evening Exchange, 1864

Photo Credit: New York Public Library

New York Mining and Stock Board A short lived stock exchange organized in New York City in 1875. Disreputable business practices led to its closure in 1876.

New York Mining Exchange A stock exchange organized in New York City in 1864 by interests associated with the New York Stock Exchange. After the end of the Civil War, the Big Board withdrew its sponsorship. Merged with the New York Petroleum Stock Board in 1866 to form the Petroleum and Mining Board.

New York Mining Stock and National Petroleum Exchange A securities exchange formed in New York City in 1883 by the merger of the New York Mining Stock Exchange and the National Petroleum Exchange. Merged with the Petroleum and Stock Board in 1885 to form the Consolidated Stock and Petroleum Exchange.

New York Mining Stock Exchange A stock exchange organized in New York City in 1877 by interests associated with the New York Stock Exchange. Created in response to the success of the rival American Mining and Stock Exchange. Merged with the National Petroleum Exchange in 1883 to form the New York Mining Stock and National Petroleum Exchange.

New York Petroleum and Stock Board A securities exchange established in New York City in 1877. Merged with the New York Mining Stock and National Petroleum Exchange in 1885 to form the Consolidated Stock and Petroleum Exchange.

New York Petroleum Stock Board A securities exchange organized in New York City by interests associated with the Open Board of Stock Brokers in 1865. Created as a rival to the New York Mining Exchange which was operated by interests associated with the New York Stock Exchange. After the end of the Civil War, the Open Board withdrew its sponsorship. Merged with its rival New York Mining Exchange in 1866 to form the Petroleum and Mining Board.

New York Quotation Company A subsidiary of the New York Stock Exchange organized in 1889 to provide stock ticker services to subscribers.

New York Stock and Exchange Board The official name of the New York Stock Exchange from the date of its formal organization in 1817 until the date of its name change in 1863.

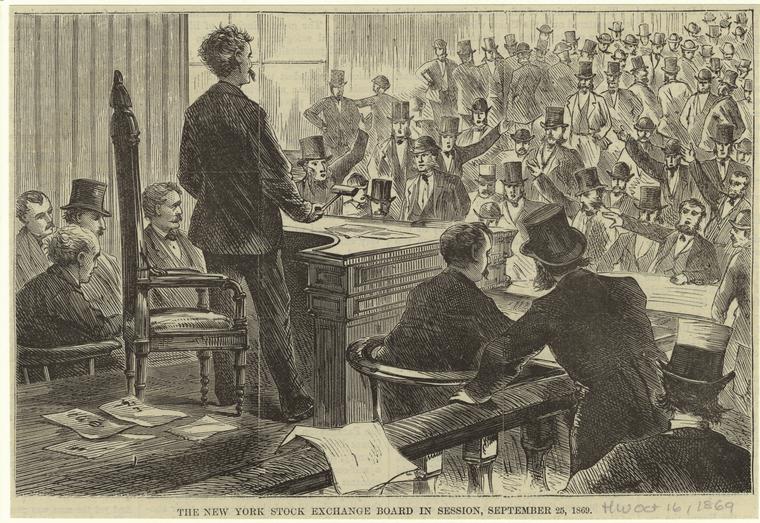

New York Stock and Exchange Board, 1869

Photo Credit: New York Public Library

New York Stock Exchange The NYSE is the world's preeminent stock exchange ... The Big Board. The New York Stock Exchange traces its roots to 1792, when a group of prominent merchant traders met in lower Manhattan to sign the Buttonwood Agreement. These brokers subsequently helped to establish the Tontine Coffee House. In 1817, the Tontine brokers adopted their first constitution and officially organized the New York Stock and Exchange Board. In 1863, the name was changed to the New York Stock Exchange. Originally designed as a call market, the Exchange adopted continuous trading after its merger with the rival Open Board of Stock Brokers in 1869 and developed the specialist system in the early 1870s. The current main building and trading floor were constructed in 1903 with various supplemental trading floors and offices added over the years. Merged with Euronext in 2007 to become NYSE Euronext. Acquired by the Intercontinental Exchange in 2013. Euronext spun out in 2014. While the New York Stock Exchange had some formidable rivals over the years, none ever successfully supplanted the Big Board... that is, until it was ultimately purchased by a derivatives exchange.

Trading Floor, New York Stock Exchange, circa 1915

Photo Credit: Museum of the City of New York

New York Stock Exchange Clearing House A organization founded in 1892 to centralize and expedite the broker-to-broker transfer of securities.

New York Tontine Coffee House Company A company created by signers of the Buttonwood Agreement and other prominent New York merchants in 1792 in order to build a new coffee house/ merchants’ exchange building and create a more permanent trading venue. The company sold 203 shares to 157 investors at $200 per share. Each shareholder selected a nominee, usually a young son or a daughter. As long as the nominee lived, the shareholder received dividends and a share of any profits. When the nominee died, the shareholder forfeited his interest in the Company. When the number of nominees was reduced to seven, the Company was to be dissolved with the remaining shareholders to receive an equal division of the assets. The Company survived until November 18, 1870, the date of the death of the eighth remaining nominee. See also TONTINE COFFEE HOUSE.

news out A "heads up" traditionally given as a courtesy by knowledgeable OTC market makers to their potentially unaware counterparts during the process of sweeping a stock. For example, ZVZZT, $25 1/4 for 10,000, news out.

news ticker See BROAD TAPE.

news trader An INFORMED TRADER who searches for, collects, and trades on new information that he believes will alter fundamental value and therefore have a material impact on market price. May subscribe to MACHINE READABLE NEWS services for tactical implementation.

next day settlement Settling a trade on the day after the trade date.

NH A written abbreviation for not held.

nicknames Stocks are often known by nicknames in the trading community. For example, Microsoft (MSFT) is often called "'Soft", McDonald's (MCD) is known as "Burgers" on the floor of the New York Stock Exchange, and Corning (GLW) has been called "Glow Worm" and "Glass Works."

Nifty Fifty A slang term popular in the 1970s for the fifty stocks most favored by institutional investors.

NMS An abbreviation of National Market System.

no AutEx Trader's jargon meaning "do not advertise trading interest (in a particular stock) on AutEx." While the term refers specifically to the AutEx system, it also more generally forbids any broad electronic broadcasting of interest. The assumption is that advertising interest might cause an adverse price move. For example, XYZ, let's buy 50,000 with an ultimate $50.25 top. No AutEx on this one. See also NO SHOP.

no bid A term used to indicate that there are currently no buyers for a stock at any price. As opposed to NONE OFFERED.

no book A situation in which there is little to no natural interest in buying or selling a stock.

no brainer A trade that will obviously be profitable. For example, Would you just close your eyes and buy some ZVZZT please? This trade is a no brainer.

no can An instruction that a new order does not supersede any previous order in the same stock. Any and all previously entered orders in the stock remain effective. I really need to get some stock in, so let's get a little more aggressive. Buy 10,000 XYZ at the market, no can.

no limit order Another term for market order.

no market A term used to indicate that there are currently no buyers and no sellers in a stock. Often means that the shares are worthless. May sometimes indicate that shares are privately held. See also NO QUOTE.

no near bid A term used to indicate that the current best bid is far below the last sale price.

no near offer A term used to indicate that the current best offer is far above the last sale price.

no par value stock A stock that is issued with no official PAR VALUE indicated by the issuing corporation..

no quote A situation in which no market maker is currently providing a quote in a particular over-the-counter stock. See also NO MARKET.

no shop Trader's jargon meaning do not tell any other market participants about a customer's interest in a particular stock, as in ZVZZT, we're a buyer of 100,000, no shop on this one please. See also NO AUTEX.

noise Random short term price movements that do not provide meaningful insight into underlying market supply and demand.

noise trader A trader who does not base his market activity on fundamental values. One example would be a MOMENTUM TRADER.

nominal capital The aggregate par value of issued shares.

nominal quotation A quote provided by a market maker strictly for valuation purposes. It is an approximation of price, not a firm quote. Therefore the market maker is under no obligation to trade. Usually identified by prefixes such as FYI (for your information) or FVO (for valuation only).

nominal value Another term for par value.

non-clearing member An exchange member that is not able to clear their own trades and must therefore hire a clearing member firm (or firms) to provide clearing services.

non-compete clause A provision contained in some industry employment contracts that prohibits the employee from working at a competing firm for a specified period of time following the termination of employment.

non-directed order Any order other than specifically a DIRECTED ORDER.

non-displayed order An order residing in an alternative trading system that is available for execution but is not visible to other market participants. Also called a hidden (size) order.

non-linear hedge A hedging vehicle with payoffs that are not necessarily proportional to changes in market price of the underlying assets (non-linear). Examples include options, certain exotic derivatives, and bonds with embedded options. As opposed to a LINEAR HEDGE.

non-marketable security A security that does not trade in an active secondary market.

non-member firm A broker/dealer that does not hold a membership on a particular exchange. Historically, such firms either needed to execute listed trades on the exchange through a member firm, trade on a regional exchange where they possessed a membership, or trade in the third market.

nonpublic information Corporate information that is not known by the general public. See also MATERIAL NONPUBLIC INFORMATION.

non-regular way settlement Settlement under any terms other than REGULAR WAY.

none offered A term used to indicate that no stock is currently being offered for sale at any price. As opposed to NO BID.

normal trading unit See round lot.

normal way settlement Another term for regular way settlement.

not a delivery See BAD DELIVERY.

not a name with us Trader's jargon basically meaning "I do not have trading interest in that particular stock." If the trader is a dealer, it indicates that he does not make a market in the security. If the trader represents an institutional investor, it indicates that he has closed his position and has no further interest, that his position is full and he has no interest for the time being, or that he has no interest whatsoever in the stock. For example, Thanks for showing me the ZVZZT flow, but it's not a name with us.

not afraid to own ‘em A customer instruction to work an order fairly aggressively. For example, ZVZZT, I’m not afraid to own ‘em. Take it to my limit if you have to.

not held order 1. A customer order that gives the trader fairly wide discretion as to how, when, and at what price to execute the order. The trader will not automatically be held responsible for a failure to participate in any particular print. Most orders from institutional customers default to not held. 2. Sometimes used as a synonym for work. For example, XYZ, buy 50,000 shares not held. It's a tough trader.

nothing done 1. A standard industry term for "neither executed nor partially executed." For example, XYZ, nothing done on your 25,000 to buy at $50.25. The stock is catching a bid. 2. Trader's slang for "no interest." For example, Hey, my wife is having a tea party during the Super Bowl. You guys have any interest? --- Yeah, take a nothing done on that.

now to the bell A term used to stipulate that a not held order should be worked by the trader from the time entered until the market close. May also indicate that the order should be a TIME WEIGHTED AVERAGE PRICE ORDER (TWAP ORDER) or a VOLUME WEIGHTED AVERAGE PRICE ORDER (VWAP ORDER). For example, ZVZZT, take 75,000 for sale now to the bell. Target the VWAP.

NSCC An abbreviation for the National Securities Clearing Corporation.

numbers only Another term for nominal quotation.

nut The amount of money that a trader must make in order to break even, as in My monthly nut to trade here is about $15,000.

NYSE An abbreviation of New York Stock Exchange.

NYSE Alternext The name given to the American Stock Exchange following its merger with the New York Stock Exchange.

NYSE Amex See American Stock Exchange.

NYSE Arca See Archipelago.

NYSE Euronext See New York Stock Exchange.

NYSE MarkeTrac An electronic market data and order ratio information system developed by the New York Stock Exchange.

NYSE MatchPoint An electronic portfolio based order matching system developed by the New York Stock Exchange.

NYSE MKT See American Stock Exchange.

NYSE OpenBook An electronic system that provides a real time view of the limit order book for each stock listed on the New York Stock Exchange.

Copyright 2016 by Brian W. Leite. All rights reserved. Reproduction of all or part of this dictionary without explicit permission is prohibited..