MARKET STRUCTURE DICTIONARY

BY

BRIAN W. LEITE

An Insider's Guide to the Real Language of

Trading and Exchanges

Over 2700 Entries

F stock A slang term for foreign ordinary shares. See also Y STOCK.

face value Another term for par value.

facilitate To provide services and/or capital to customers in order to expedite the trading process. For example, Need I remind you gentlemen that our job is to facilitate trades for our customers, not gamble on earnings reports?

fade 1. Dealer jargon meaning "fill the competitor's bid (or offer) in its entirety." For example, ZVZZT, three quarters for 50k, Morgan. --- Fade Morgan on the fifty. Slightly less aggressive than PLUG. 2. See FADE THE MARKET.

fade the market To trade contrary to the prevailing trend. For example, There is quite a love fest for equities these days. I'm afraid I'm going to have to fade the market on this one.

fail A trade in which the seller does not deliver securities (SHORT FAIL) or the buyer does not deliver funds (LONG FAIL) in the designated manner at the prescribed time (usually settlement date).

fail position See FAIL.

fail to deliver A situation in which a seller does not deliver securities to the buyer in the designated manner at the prescribed time (usually settlement date). Also known as a short fail.

fail to receive A situation in which a buyer does not receive securities from the seller. Often the result of a short fail.

fall down 1. Specifically, trader's jargon for an inability to complete a trade as proposed. Sometimes due to circumstances outside of the trader's control. A customer may cancel an order unexpectedly or market conditions may change quickly. For example, XYZ, I need to check with my customer, but I think I can still buy 50,000 in line. Give me a little room to fall down though. 2. More generally, to fail to fulfill any obligation. For example, Jack fell down on the lunch print again? How much are we paying that kid anyway?

fall out of bed A slang term meaning decline very rapidly in price. For example, Of all the luck … the minute I cover my ZVZZT short, the thing falls out of bed.

falling knife A slang term for a stock that is experiencing a very rapid decline in price. For example, Joe, I'd be careful buying too much XYZ here … it looks like you might be catching a falling knife.

false market A market that has been manipulated through the spread of inaccurate information.

fancy stock An archaic term for a high priced and/or volatile stock that is subject to extensive manipulation.

fast guy (trader) Industry lingo for a trader who is basing his trading decisions on very short term probabilities rather than on longer term fundamentals. For example, Fast guy on the wire asking about your ZVZZT indication … watch your wallet. In contrast to a PLAIN VANILLA ACCOUNT. Given current market structure, a fast trader is more likely to be model-driven algo than a human.

fast market 1. Specifically, describes the condition of a stock that is experiencing such overwhelming volume that it causes a delay in quote updating and trade reporting. 2. More generally, defines any market that is experiencing abnormally high volatility on heavy volume. 3. A market center that is capable of producing AUTOMATED QUOTATIONS and therefore of providing automatic executions. As opposed to a SLOW MARKET. See also AUTOMATED TRADING CENTER.

fast quote A quote that is available for immediate and automatic execution. An AUTOMATED QUOTATION. A fast quote may not normally be traded through pursuant to Reg NMS. As opposed to a SLOW QUOTE.

fat finger Trader's slang meaning to make an error in the course of using technology. Errors can range from dialing the wrong phone number to trading a stock on an ECN at a clearly erroneous price. For example, Somebody out there just hit the stock down 10% in ten seconds. Poor guy must have fat fingered it.

fee spitting Partially distributing commissions generated by a particular trade to broker/dealers not directly involved in the trade. See also COMMISSION SHARING AGREEMENT (CSA) and STEP IN/STEP OUT.

fictitious trading See WASH SALE.

Fido Industry slang for Fidelity Investments.

fighting the tape Industry lingo for trading against the prevailing price trend. See also DON’T FIGHT THE TAPE.

figure An abbreviation for big figure. The whole dollar portion of a particular quote or actual price of a stock, minus any fractions or decimals. Also called the full. See also AT THE FIGURE, FIGURE TOP, and FIGURE LOW.

figure low A (sell) limit price of the next whole dollar lower, as in ZVZZT, sell 25,000 with a figure low, I would.

figure top A (buy) limit price of the next whole dollar higher, as in XYZ, buy 50,000 with an ultimate figure top, work.

fill, a A fully executed buy order. Some traders may use this term (less appropriately) when referring to a sell order as well. For example, John just gave me a fill on my XYZ order. Nice job gentlemen. Take another 50,000 to buy best way. See also COMPLETION.

fill, to 1. Specifically, to execute a buy order in its entirety. For example, ZVZZT, you bought 10,000 additional at $25 to fill. Let me know if you have any more to do. 2. More generally (but less precisely), to execute any order in its entirety. See also COMPLETE.

fill or kill order (FOK order) A limit order that must be either executed immediately and completely or not executed at all. If it is not executed, it must be immediately and entirely cancelled. Very rare in practice. See also IMMEDIATE OR CANCEL ORDER.

Financial Industry Regulatory Authority (FINRA) The largest independent regulator of securities firms doing business in the United States. FINRA was created in 2007 through the consolidation of the NASD with the member regulation, enforcement, and arbitration functions of the New York Stock Exchange.

Financial Information Exchange protocol (FIX protocol) A messaging standard developed for the electronic exchange of securities transactions. Originally developed in 1992, FIX has become the industry standard in electronic pre-trade communications and trade execution.

financial instruments Financial assets, derivative contracts, insurance contracts.

financial market An organized and structured environment for trading financial instruments.

FINRA An abbreviation of Financial Industry Regulatory Authority.

fire sale A slang term for the sale of shares at prices that are substantially below “fair value.” For example, It looks like they're having a fire sale in XYZ … get 'em while they're cheap.

firm 1. Unconditional. As opposed to SUBJECT. 2. A synonym for business enterprise. Can be a sole proprietorship, a partnership, or a corporation.

firm bid An unconditional bid from a dealer. As opposed to a SUBJECT BID.

firm bid/offer market A market in which dealers make firm quotes for entire portfolios rather than for individual stocks. Also known as a basket market, a package trading market, or a portfolio trading market.

firm market The prices at which shares can actually be bought or sold in relatively large quantities, as opposed to the inside market which may possess limited liquidity. For example, I see that ZVZZT is $25.11 bid offered at $25.13, but what is the firm market?

firm offer An unconditional offer from a dealer. As opposed to a SUBJECT OFFER.

firm order 1. An order for the proprietary account of a broker/dealer, as in John, let’s start buying 250,000 XYZ for the firm best way, keep me up. 2. A customer order that is not conditional on additional confirmation prior to execution. For example, I've got a firm order to sell 50,000 ZVZZT with a $25 low, so you can offer stock to your buyer here no problem.

firm quote An unconditional quote from a dealer. As opposed to a SUBJECT QUOTE.

first market Industry jargon for the trading of a listed stock on its PRIMARY EXCHANGE. Specifically, refers to trading New York Stock Exchange listed stocks directly on the floor of the NYSE. See also SECOND MARKET, THIRD MARKET, and FOURTH MARKET.

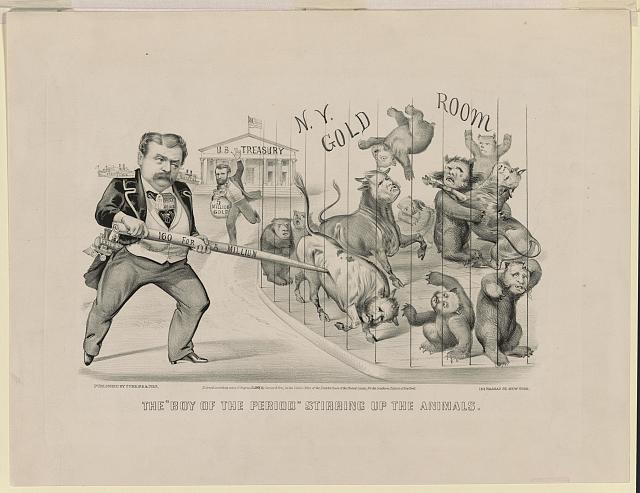

Fisk/Gould Scandal See Black Friday (1869).

Jay Gould and Jim Fisk stirring it up circa 1869

Photo Credit: Library of Congress

fits See IF IT FITS.

Five Percent Rule The NASD Rules of Fair Practice have historically stipulated that it was the responsibility of a member dealer to justify any markup or markdown in excess of 5%.

FIX message Industry slang for an electronic indication of trading interest provided by a dealer to institutional investors. Specifies a precise quantity and price. Similar to a SUPER MESSAGE except it expressly implies that the message represents natural order flow. For example, ZVZZT, I FIXed a $25 bid for 50,000. My guy can probably use more like 100,000 there though. See also FINANCIAL INFORMATION EXCHANGE PROTOCOL.

FIX protocol An abbreviation for Financial Information Exchange protocol.

fixed commissions Commission rates that are standardized and therefore not subject to bargaining between the customer and the broker/dealer. Prior to May 1, 1975 (MAY DAY), U.S. broker/dealers charged a standardized fixed commission rate for securities transactions.

flash crash An extremely rapid and very large loss of value in the stock market.

Flash Crash (of 2:45) On May 6, 2010, the U.S. equity markets experienced a severe disruption. Stocks had traded lower most of the day. By 2:42 p.m., the Dow Jones Industrial Average was down more than three hundred points. At that point, the markets plummeted with the DJIA losing an additional six hundred points in a mere five minutes. However, within twenty minutes, the markets had recovered most of that drop. A debate subsequently ensued as to whether the cause of the Flash Crash was simply abnormal market action surrounding a single large sell algorithm (by Waddell & Reed) or rather systemic structural problems inherent in modern electronic markets.

flat market A market characterized by prices that neither rise nor fall, usually on relatively low volume. For example, If the market continues to stay flat, the mo guys are not going to be happy.

flat position To have no position in a stock. For example, We finally got flat that XYZ we front ended. And it only took me two hours ... and $10,000.

flat, trade 1. To execute an order without charging a commission or a markup/markdown. For example, I know you guys are in a tight spot, so I'll trade this one flat and we can figure things out later. 2. To open and close a position at the same price, without generating a profit or loss. For example, At least we ended up trading XYZ flat. It could have cost us a bundle if we weren't careful.

flatten out To eliminate a position. For example, Joe, just flatten out our ZVZZT position, I'm sick of looking at it.

flier 1. A relatively small and insignificant commitment. 2. A high risk, borderline reckless trade. See also TAKE A FLIER.

flipper One who resells shares received from an initial public offering immediately after secondary market trading begins. For example, Typical … ZVZZT opens up 20%, so the flippers are out in force.

flipping Reselling shares received from an initial public offering immediately after secondary market trading begins. For example, I'd be flipping ZVZZT shares too if Morgan had given me any.

float The shares of a particular corporation that are held by the public. Equals the total shares outstanding minus shares held by officers, directors, or owners of 10% or more.

floating limit order A limit order whose price will automatically change as the value of a specified index changes. Also known as an indexed limit order.

floor 1. Specifically, the physical area of a stock exchange dedicated to active trading, as in I think I'll go down to the floor today to have a face to face with our floor broker. 2. More generally, refers to the totality of trading personnel and activity on an exchange. For example, XYZ is falling out of bed. Check with the floor to see what's going on. See also TRADING FLOOR.

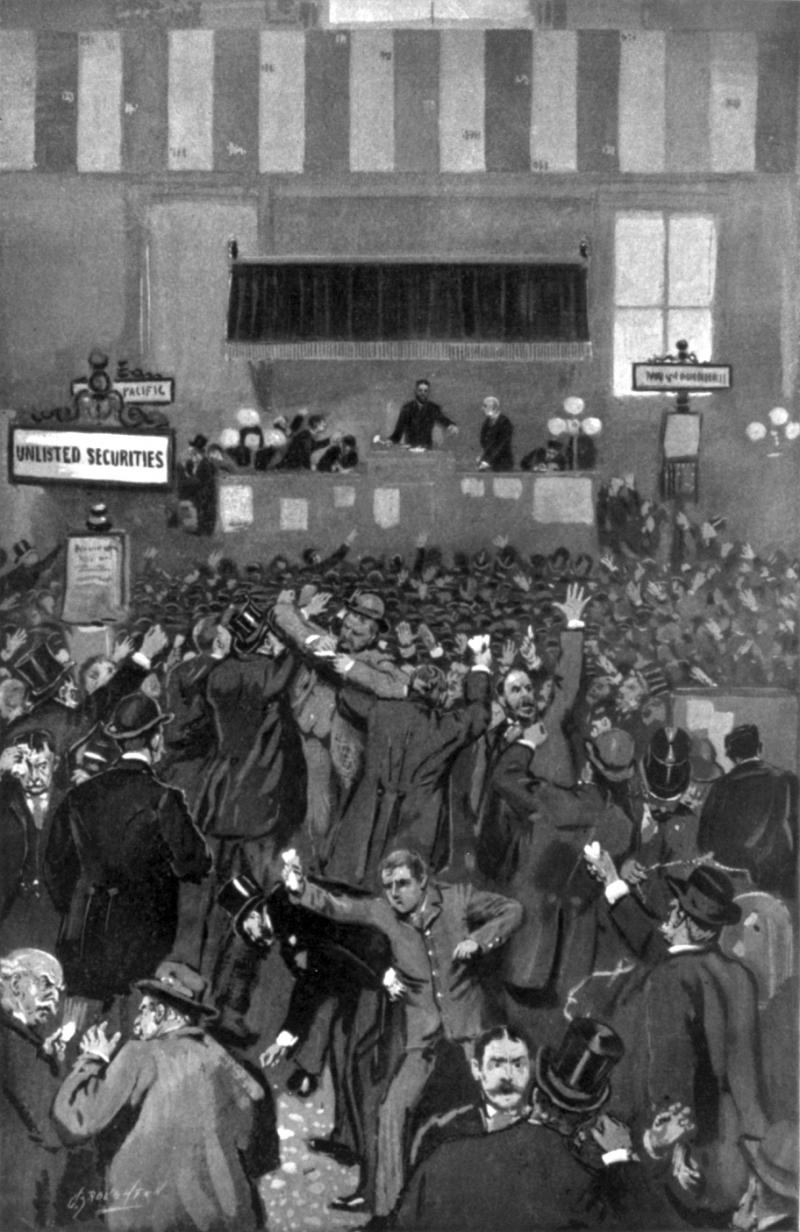

New York Stock Exchange floor 1885

New York Stock Exchange floor 1885

Photo Credit: New York Public Library

floor broker An exchange member who executes orders on the trading floor on behalf of others. A floor broker trades as agent for his customers. A floor broker may be a TWO DOLLAR BROKER or a COMMISSION HOUSE BROKER. See also FLOOR TRADER.

Floor brokers tussle with floor traders during the Panic of 1893

Photo Credit: Library of Congress

floor clerk A floor employee of an exchange member or member firm that is charged with receiving and processing orders from customers and upstairs traders to floor brokers. For example, Call the floor clerk and see if we're due any more partials in XYZ.

floor give up See GIVE UP.

floor look Details provided by a specialist regarding recent trading activity, the current market, and indicated interest. For example, XYZ is $25 1/4 - 3/8, 10k by 20k, Bear on the buy side, Morgan and Monty on the sell side. Also known as a floor picture.

floor official A member or employee of an exchange who supervises and regulates trading activity and resolves disputes between members on the floor of the exchange.

floor partner Historically, the general partner of an exchange member firm who actually trades on the floor for his firm and in whose name the exchange seat is designated.

floor picture Details provided by a specialist regarding recent trading activity, the current market, and indicated interest. For example, XYZ is $25 1/4 - 3/8, 10k by 20k, Bear on the buy side, Morgan and Monty on the sell side. Also known as a floor look.

floor protection Historically, the protection gained by placing an order (or a portion of an order) on a particular exchange in order to guarantee participation in any trading that occurs on that exchange. For example, XYZ, I've got you protected in Chicago as well … we'll see if anything trades there.

floor quote A quote that is obtained directly from a floor broker.

floor report A report transmitted from an exchange trading floor that confirms the execution of an order.

floor reporter Historically, an employee of an exchange who transmitted trade execution information from specialists, floor brokers, and floor traders to the exchange for dissemination.

floor ticket An order ticket created by an upstairs trader in order to transmit execution instructions to the floor of an exchange.

floor time precedence An exchange rule that stipulates that the first order to arrive on the exchange floor at a given price takes precedence over all other orders on the floor at that same price. See also PRECEDENCE.

floor trader An exchange member who operates on the trading floor for his own proprietary account. See also FLOOR BROKER.

flow An abbreviation for order flow. The aggregate of orders processed by a broker/dealer. For example, We've got some nice flow to shop today. Let's get some trades to the tape.

flow derivatives trading desk The upstairs trading operation of a bank or broker/dealer dedicated to trading (and managing a book of) more liquid, plain vanilla derivatives products. Such products will generally be listed on an exchange or traded on an electronic trading platform. Products traded generally include single stock options, index options, variance swaps, correlation swaps, and (sometimes) convertible bonds. See also DELTA ONE TRADING DESK and CASH EQUITY TRADING DESK.

fluctuate To change price.

flurry A significant (but short lived) spike in trading activity, as in There was a flurry in XYZ on the opening, but it’s died down some since then.

for Refers to the bid size in a quote. Bids are quoted as "price for quantity." For example, XYZ, $50 for 100,000. See also AT.

for a number Trader's jargon used to indicate that the size quoted in a bid or offer does not necessarily represent the full trading interest. However, in order to open up the trader, the party making the inquiry must indicate a willingness and ability to trade in substantial size. For example, ZVZZT, right now I'll pay $25 for 50,000 shares for a number. What are you looking to do?

for a turn Trader's lingo for a commitment made in the hope of a small, but quick, profit. For example, I just bought the XYZ for a turn. I actually think it’s going to get hit after the earnings report Thursday.

for cash See CASH SALE/TRADE.

for the long account A somewhat archaic industry term used to describe aggregate margin long purchases.

for the short account A somewhat archaic industry term used to describe aggregate margin short sales.

for valuation only (FVO) Trader's jargon used to indicate that a stated quote is for informational purposes only. It is not a firm quote. Also known as for your information (FYI).

for your information (FYI) Trader's jargon used to indicate that a stated quote is for informational purposes only. It is not a firm quote. Also known as for valuation only (FVO).

forced quotation A quote created solely for the purpose of creating fictitious trading activity.

forced sale The ENFORCED LIQUIDATION of a position due to a failure to maintain sufficient equity in a margin account.

foreign crowd Historically, referred to floor brokers and floor traders who traded foreign bonds on the floor of the New York Stock Exchange.

foreign ordinaries An abbreviation of foreign ordinary shares.

foreign ordinary shares Shares traded in the United States that represent foreign corporations. Foreign ordinaries are the exact same shares that trade in the corporation’s home country. See also AMERICAN DEPOSITORY RECEIPT.

Four Horsemen Slang term for the four boutique investment banks most responsible for banking and trading new technology issues during the 1990s. Included Montgomery Securities, Robertson Stephens, Alex. Brown & Sons, and Hambrecht & Quist. The term is derived from the forces of destruction released on the world in the biblical Book of Revelation.

fourth market Trader's jargon that refers to the practice of trading exchange listed equities in ALTERNATIVE TRADING SYSTEMS. Originally, the term referred specifically to institutional investors trading exchange listed stocks directly with each other on Instinet. See also FIRST MARKET, SECOND MARKET, and THIRD MARKET.

forward contracts Over-the-counter financial instruments that represents a contract between two parties to buy or sell a particular asset at a specified price at some point in the future. The customized nature of such contracts make them particularly suited to hedging.

fractional discretion order A discretionary order that stipulates precisely the amount of price leeway granted to the execution trader, as in Buy 100,000 XYZ at $50 with an eighth discretion. Somewhat dated in the age of decimal trading.

fractional lot A synonym for odd lot.

fractional trading Quoting and trading stocks in dollars and fractions rather than in dollars and cents. Prior to 2001, all NASDAQ and exchange listed equities were quoted in fractions. See also BIT and DECIMAL TRADING.

fragmented market A market in which an identical item can be traded in different market centers. With over ten official U.S. stock exchanges (it varies) and dozens of electronic communications networks and dark pools, the U.S. equities market has become highly fragmented. As opposed to a CONSOLIDATED MARKET.

free delivery A situation in which securities are delivered before payment is made. This involves risk to the seller in that the buyer gains possession of the shares but may never actually pay for them.

free list Historically, a list of inactive securities listed on the New York Stock Exchange that could be called for no fee at the request of any member. Prior to the establishment of continuous trading on the NYSE, active stocks were individually called and traded in order. If a member subsequently requested a stock be recalled, he would have to pay a fee for the privilege. See also CALL MARKET.

free rider A trader that mimics the operations of another trader.

free riding The illegal practice of rapidly and repeatedly trading a stock without supplying the proper funds.

free stock A stock that is fully paid for.

free to trade A stock that is not subject to any unusual trading restrictions, as in XYZ should be free to trade at 11:00am.

fresh look Trader's lingo for an updated FLOOR LOOK. For example, Can you get me a fresh look in XYZ? I may have more to do.

fresh picture Trader's lingo for an updated FLOOR PICTURE. For example, I need a fresh picture in XYZ. My PM is asking.

friction costs The explicit and implicit costs of trading. Also known as transaction costs.

frictionless market A (theoretical) market with no costs or restraints on trading.

frictions The explicit and implicit costs of trading. Also known as transaction costs.

front ending The dealer practice of positioning a portion of a customer block order in a proprietary account in order to work the balance of the order as riskless principal. Basically, the customer transfers a portion of the risk of slippage to the dealer and allows the dealer to generate a risk free commission on the balance as compensation. For example, John, in case the risk management alarm bells went off, we just front ended 100,000 ZVZZT to work 400,000 behind it. We should be okay.

front office The revenue producing portion of a broker/dealer. Specifically includes trading, sales trading, and research sales. See also MIDDLE OFFICE and BACK OFFICE.

front page holder An investor who owns a relatively large percentage of the total float of an issue. In any list of shareholders arranged from largest to smallest, the shareholders on the front page will be the largest. For example, ZVZZT, I've got 100,000 for sale right now. It is a front page holder though, so the order might grow.

front running 1. The illegal practice of trading a stock based on private advance knowledge of an impending order or block trade that will likely affect the market price. 2. The parasitic (but not necessarily illegal) practice of trading in front of and around a relatively large public (but hidden) order that may be uncovered in the marketplace. A GAMING strategy. See also QUOTE MATCHING and PENNY JUMPING.

frothy Describes a market as it rises to levels where prices become detached from value. Taken to an extreme, a frothy market can become a bubble. For example, This market is starting to look a little frothy. I'd be careful if any of the fast guys start looking to get out.

full 1. Describes a trader who has purchased his entire desired position, as in ZVZZT, I'm full, but please keep me up on anything natural you see. 2. An abbreviation of full price, as in XYZ, sell 25,000 up at $51 the full.

full lot The exchange determined standardized number of shares in a single trading unit. Usually 100 shares. Also known as a board lot, an even lot, a regular lot, or a round lot.

full price A synonym for big figure.

full stock A stock with a par value of $100.

fundamental value Of a financial instrument is the price that all market participants would agree upon if each of them possessed all available information about the instrument and were equally able to correctly analyze that information.

fundamental volatility An academic term for volatility that is due to unanticipated changes in value. In contrast to TRANSITORY VOLATILITY.

futile trader A trader who expects to profit from his trading activites but does not on average. May be an inefficient trader or a victimized trader.

futures contracts Standardized FORWARD CONTRACTS in which a clearinghouse guarantees performance of every trade. Used by equity market participats as a hedging vehicle or to leverage exposure.

FVO An abbreviation of for valuation only.

FYI An abbreviation of for your information.

Copyright 2016 by Brian W. Leite. All rights reserved. Reproduction of all or part of this dictionary without explicit permission is prohibited..